The biggest machine in the world — the U.S. electric power grid — will have to become both harder and smarter. After the superstorms of 2012, that thought is pretty much the general consensus, in the industry and among the public, and communications platforms, the central nervous system of the 21st century grid, are already the focus of much of the discussion.

Before Hurricane Sandy, public dialogue about the smart grid was trending the same way as federal stimulus money — downward. Sandy changed everything. In the superstorm's aftermath, Maryland Gov. Martin O'Malley and New Jersey Gov. Chris Christie called for a hardening of the grid. New York Gov. Andrew Cuomo even went so far as to say, it is vital “to immediately invest in new construction, replacement and upgrades to transition the grid” to a “dynamic and flexible network” with enhanced sensors and controls providing real-time information about outages and usage.

While response to natural disasters is a key driver behind modernizing the grid, there is a trend in the electric industry to go even further. The new strategy also is to leverage, expand and integrate smart grid communications both to improve operational efficiency and increase the value of communications networks.

Leveraging the Network

“It began with advanced metering infrastructure (AMI),” said Michelle Rae McLean, director of product marketing at Silver Spring Networks. “But, as an industry, we've reached a tipping point; we're getting beyond AMI. People are realizing that we're not just building networks for the smart meter, rather we're building a smart grid.”

McLean said utilities want to leverage their networks for multiple applications, including distribution automation (DA), demand-side management (DSM) and peak-load management. She cited Oklahoma Gas & Electric, which is running a peak-load management program over its AMI infrastructure: “They could not have involved 42,000 customers as economically with a separate infrastructure. It improves the return on their AMI investment.”

Most experts agree that communications within electric utilities is siloed, and leveraging communications assets between departments is often difficult or impossible. Too often bid specs for, say, AMI, are written without considering any other groups in the utility. That is the case, even though an AMI that blankets the service area with two-way communications, if designed right, also could be used for DA.

Stronger Business Case

“The business case for a multipurpose network would be much stronger if one common communications system would spread the cost over several departments,” noted John McDonald, director of technology strategy and policy development for GE Digital Energy. But, of course, each department would have to “give up some ownership.”

Of course, that can lead to cultural issues, which can be much stronger than the business case, he added. CEOs need to mandate that the communication silos be broken down before any investment is made across the utility, said McDonald. “Where that hasn't happened, we still have the silos and each group doing their own technology procurement.”

Gary Rackliffe, ABB's vice president for smart grid in North America, also sees utilities expanding, leveraging and integrating their networks. “You don't achieve benefits just by putting a smart meter on a house. The next wave of smart grid investment is going to be connecting the dots.” That means digitizing the grid: connecting the AMI to the distribution automation DA and outage management systems (OMS). “Integrating and developing these technologies is one of the keys to developing a comprehensive and effective smart grid,” said Rackliffe.

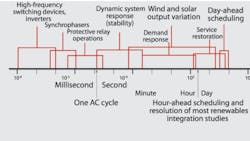

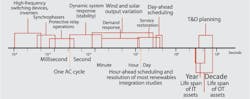

A Need for Speed

Funding aside, utilities are finding this may not be quite as easy as they would like. For instance, smart grid applications such as DA may have response, bandwidth and latency requirements that the AMI specs may not meet. Bandwidth requirements depend on how much information needs to be sent within any given application (that is, are data points or files being sent?). With latency, cyber security is always a major consideration: How much security is desired versus how much latency can be handled?

Matt Olson, senior electrical engineer of telecommunications and network engineering for Burns & McDonnell, concurred. “There is a lot of discussion about whether AMI and distribution automation should be merged on the same network,” he said. “What I'm seeing is it depends on the network and that it is very difficult to do consistent distribution automation on an AMI-speed network,” he said. “If you want to do things with real-time controls, you need things that will get you real-time responses.”

According to Todd Gurela, worldwide operations director of connected energy networks at Cisco, interest in integrated communications is growing. More and more, he noted, “strategic discussions with customers focus on multiservice communications systems that are built with much higher bandwidth” for the simple reason that these systems must not only be able to handle today's communications needs but also the needs of the future.

For instance, he said, “On the transmission level, you are looking at ultralow-latency communications networks to run real-time control systems with teleprotection as well as running all the secondary systems.” That means “you need to have a much higher bandwidth to handle information that comes back from your utility assets,” said Gurela.

As such, he said, the trend is toward IP-based network architecture, which is designed from day one to enable multiple applications while also providing utilities the ability to prioritize traffic over those networks. “You can prioritize so that safety and security protection data always take priority over secondary systems data,” he noted. Furthermore, he added, “They are very flexible networks, because they allow multiple data sources to be engaged over the same investment.”

Utilities will be able to communicate with customers directly through their own infrastructure or via a service provider's network. And, because the technology is so flexible, utilities can bring in new inputs, including more integration with heating, ventilation and air conditioning (HVAC) systems and other energy systems within the customer premises.

Focus on Efficiency

Chattanooga's gigabit-per-second passive optical network (GPON) is a case in point. Last summer, the city showed its very high-speed system could limit outages under extreme circumstances (see “Smart Grid: It's All About Communications” on page 2). But, the city is not done yet. Indeed, it is thinking beyond outages and storm restoration.

In its next stage of smart grid development, the city will focus not only on integrating AMI data into the utility's OMS, as other utilities have done, but also on power quality. “More voltage control, more capacitor banks that help us with voltage stability and power factor — we're expanding our emphasis beyond outages to include efficiency of operation,” Glass said.

That corroborates what some industry observers are seeing. “Between the time federal stimulus money first became available and now, things have changed,” said Cisco's Gurela. Utilities are taking what he calls “a more mature focus on grid modernization” with real return on investment with respect to productivity, reliability, customer satisfaction and overall operational excellence as goals.

A Plug-and-Play Grid

That's certainly true in Massachusetts, where National Grid's smart grid pilot program has just gotten underway.

On the DA side, Chris Kelly, National Grid's utility of the future director, said the utility will be monitoring 11 distribution feeders and five distribution substations in the test area, which has a peak load of about 81 MW. “We'll be putting in four types of advanced distribution applications technology — 70 remote DA switches on the feeders, upgrades to station breakers and the energy management system, an advanced capacitor-control systems, and grid monitoring both on the feeder level and the primary and secondary transformer level,” said Kelly.

The utility also will work with Schweitzer Engineering Labs to test the ability to detect fault locations. “We'll take all the data from the fault indicators and the other new grid equipment back into our control center to pinpoint the exact location of the fault,” said Kelly.

The utility is taking a listen, test and learn approach to the pilot. “You have to set up the architecture end to end and test it under multiple scenarios,” said Kelly. “It's one thing we truly believe in. Every vendor will say they're plug and play, and that it will work, but until you really get it connected to the system end to end, from the grid device to the WiMAX, to the control center, you're finding inconsistencies that need addressing. We are in the process of testing the entire architecture, and it's really going to save us a lot of time during commissioning.”

Kelly does say that one of the reasons they chose the Cisco GridBlocks network is Cisco's philosophy of providing an open-standards-based router to join together the electrical grid with a digital communications network, which provides a platform for developing custom grid modernization applications. “More importantly,” he added, “it is the first true IPv6 environment providing more addressable, configurable capabilities with more robust security.”

Of course, communications standards enable interoperability, which in turn broadens the numbers and types of equipment options available to utilities. While 100% interoperability is probably impossible, there are reasons to be both pleased and frustrated with the current rate of standards development.

Standards and Interoperability

While the potential for truly smart grid communications exists, and the political pressure for the necessary changes is growing, “a convergence of standards is increasing the ability of utilities to realize true benefits of the technology,” said GE's McDonald. “You can make the investment, however, the technology must comply with the communications standard and be tested for interoperability, which are two separate actions. Compliance does not guarantee interoperability.”

“We're always seeing improvements in interoperability, but what interoperability are we after?” asked EnerNex's Houseman. “Are we after all networks operating together in the field, or where the same software handles the messages coming in, or the ability to talk with third-party devices attached to the network?” There are more types of interoperability than can be named, Houseman observed, from the physical to the application layer in the familiar open systems interconnection communications protocol stack.

“I don't think we want or need interoperability at every layer in that stack,” Houseman stated. “Then everybody will be producing one generic product that is completely identical. We need to leave some room for innovation. On the other hand, I'm clearly of the opinion that we need to think about the level of interoperability we need and want for what we do.”

Many smart grid communications systems fall under the IEEE 802 family of standards, which deals with local area and metropolitan area networks. “They were designed with an extensible architecture to create a family of standards with unique capabilities. Their common heritage and architecture gives unprecedented interoperability between the individual IEEE 802 standards,” said the Electric Power Research Institute's Tim Godfrey, the vice chair of the newly formed IEEE 802.24 Technical Advisory Group (TAG), which includes IEEE 802.3 (Ethernet), 802.11 (WiFi), 802.15.4 (ZigBee) and 802.16 (WiMAX), among others.

However, added Godfrey, these 802 standards have a limited scope. “While they focus on lower layers [of the protocol stack] that are essential for interoperability, they are complementary to many other existing standards that specify higher layers,” he explained. The main goal of the 802.24 TAG “is to facilitate coordination and cooperation among all working groups as they develop or amend standards that apply to grid modernization and utility communications,” he said.

After Sandy, that would seem to be good advice. If the governors in the hardest-hit states follow up and, indeed, work with utilities to develop a strategy to make smart grid communications harder and smarter, everyone would benefit from the shorter outages and improved efficiencies a true 21st century smart grid would deliver.