Over the past five to seven years, bulk electric system companies outside of the U.S. have increased their use of unmanned aerial vehicles (UAVs) in pursuit of increasing safety, improving efficiency and reducing cost. By using aerial robots, crews not only can perform the work they do safer and quicker, but the onboard data-capture payloads allow for additional benefits long after the initial inspection effort is complete.

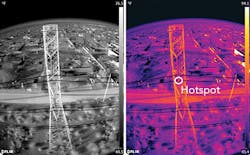

Instead of deploying a bucket truck or climbing a pole, crews are able to use UAVs to quickly put eyes on assets to make decisions on how to proceed. In addition, real-time images and video can be relayed to utility operation centers for additional perspectives or concurrence on a plan of action. Data can then be stored and used for comparison analysis against previous or future images, and also be shared with planning and preventative maintenance groups.

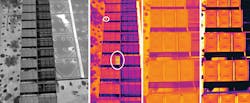

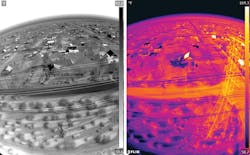

UAV applications include solar farm inspections, substation inspection and mapping, right-of-way planning including vegetation management, and fire and storm assessments. Ian Hatfield, a senior predictive maintenance technician for Arizona Public Service (APS), realized the value of using UAVs for utility inspections four years ago and started pushing for approval.

“It was clear early on that making existing thermal imaging inspections using an airborne platform would have huge benefits in both cost savings and an increased level of safety,” said Hatfield.

While the use of UAVs undoubtedly presents a large opportunity, the real question in a cost-conscious industry is does it actually deliver bottom-line savings and improve safety?

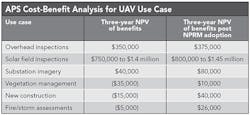

To answer this, a team at APS analyzed current Federal Aviation Administration (FAA) guidelines and the expected applications and costs of using UAVs in six separate use cases. The team found that safety improvements and significant cost savings are possible in the near term on three of the six use cases. Future expected amendments to FAA regulations (as early as 2017) are expected to make all six use cases cost-effective and safety-enhancing

Regulatory Analysis

The heavy adoption of UAV use overseas indicates there is a benefit to UAV use in other countries. A key contributor to the lack of UAV use in the U.S. is a lack of maturity in specific UAV FAA regulations, which is making the use of UAVs a slow and expensive endeavor. However, in the third quarter of 2014, the FAA started granting exemptions for the commercial use of UAVs with relatively few restrictions. And in the first quarter of 2015, the FAA released a Notice of Proposed Rulemaking (NPRM), detailing its plans for official commercial use rules for UAVs; these rules are expected to be adopted in the spring of 2017. Nevertheless, until those rules are adopted as law, commercial use must follow the FAA Section 333 exemption process for legal business use of UAVs.

In general, the FAA Section 333 process is straightforward and has few restrictions that would prohibit UAV use in utility applications. Vehicles must stay within 400 ft (122 m) of ground level, and they have to be registered with the FAA. The only detrimental restriction is that all commercial UAV operators must be certificated FAA pilots.

This restriction is expected to be removed as a requirement in the 2017 NPRM, allowing current line workers to operate UAVs after taking an approved (still to be developed) ground-based training course. This gives utilities two options for use of UAVs. First, they can obtain an FAA Section 333 Exemption, purchase UAVs and employ an experienced FAA pilot/UAV operator to pilot the UAVs from within the electric utility. The other option is to source a qualified FAA Section 333 approved third-party UAV (Drone as a Service [DAS]) provider to provide the electrical inspections.

While the first option of establishing an entity’s own in-house UAV organization may serve it better in the long run, the training, risk and speed to become operational are factors to consider. The DAS option will provide the quickest route to actual UAV use for a company, but it has a potential adverse impact on the utility in that it could result in less preparation for 2017, when less-restrictive regulations are expected to allow utilities to operate UAVs with non-FAA pilots.

Specific Use Cases

APS identified 16 initial use cases that ranged from power line damage inspections to construction and maintenance yard inventory using RFID technology. Some of the use cases will require Beyond Visual Line of Sight (BVLOS) approval. It should be noted that even with the pending FAA rules, BVLOS is not expected until 2021. However, a recent joint venture with FAA and BNSF Railway Co. gives some indication that this date may be pulled forward. Of the remaining specific use cases, APS reduced the list to six for initial investigation:

• Overhead inspections (including tower/pole/line/transformer)

• Solar field inspections

• Substation imagery

• Vegetation management

• New construction (right-of-way path)

• Fire/storm assessments.

Cost Analysis

APS conducted multiple interviews and table-top working sessions to quantify and categorize the current costs of performing for the six use cases in a traditional manner. The utility gathered manpower costs, human resource loads and travel expenses along with vehicle costs, including purchase, depreciation, maintenance and insurance. APS also researched and included tools of the trade such as ATVs, special repelling gear and the like. The team then reapplied the cost framework as if the work had been accomplished using UAVs.

“This was an extremely valuable exercise because it gave a very granular comparison between the two work methods,” commented Hilary Waterman, an engineer in technology assessment for APS.

Cost analysis results focused on the differences between doing business both ways. Ancillary benefits were considered on a qualitative basis but not included as a line item in the financial analysis. These included safety benefits, reduced potential for OSHA recordable events, and the addition of image/video analytic capabilities to be used and shared throughout the company. APS reached out to one of the few U.S. DAS consultants/providers, Industrial Aerobotics, for help in assessing, scoping and costing each of the six scenarios.

Following the assessment, three of the six scenarios showed a positive net present value (NPV) under the three-year time horizon using a nominal discount rate of approximately 7%. The UAV operations cost is generally the same in a pre- and post-NPRM world. The NPV difference is mainly the result of travel expenses for DAS personnel. APS wanted their personnel present during the inspections so the travel cost for each operation is doubled. In a post-NPRM world, the APS traveling crew would be trained to perform the aerial work as part of their other planned activities at the site.

Next Steps

The APS task force determined that in the three use cases that show a cost savings to using UAVs now, APS will use a hybrid approach. The current estimate for the FAA NPRM to be modified based on submitted comments and made into law in early 2017. Until the new FAA rules are adopted in 2017, APS will use a third-party DAS provider to manage all of the UAV specifics, UAS regulation compliance and federal paperwork for all UAS flight operations. This will allow them to immediately gain the benefits of UAV inspections until such a time when it becomes cost-effective to manage flight operations with APS personnel.

At the time flight operations commence, APS intends to partner on a separate engagement with a DAS provider to continue to monitor and assess rapidly changing regulations and to establish an in-house UAV program with special emphasis on operator training, BVLOS R&D and data integration. Operator training will allow APS to proactively train and ready its field crews to be competent UAV operators, thus enabling in-house UAV inspections as soon as the FAA regulations lifting the UAV certified pilot requirement are made into law.

BVLOS R&D will allow APS to refine its requirements for future BVLOS scenarios. The NPV figures are based on current regulations where UAVs must remain in the line of sight of the pilot in command and the visual observer at all times. NPVs are expected to double or triple when BVLOS flights are allowed. When UAV flight operations are allowed to take advantage of data and video transmission technology to allow for safe and controlled missions out of the visual range of the flight crew, the true value of autonomous aerial inspections will be realized. BVLOS flights will open vehicle selection into the fixed wing arena where extended flight durations further lower costs by reducing the amount of time spent managing battery changes and charging operations.

The APS in-house UAV program also will be tasked with integrating UAVs with existing data systems. As with most utility companies, APS has a heavy investment in geographical information systems (GIS). To fully leverage the benefits of UAVs for asset inspections, there needs to be a tight integration between existing GIS data and the new geographical data intended to be captured from UAV operations. Existing GIS data will be used in flight planning activities to reduce the time to plan an inspection as well as to increase the accuracy of the flight routes to enable high-quality imaging results.

Georeferenced asset locations already exist in APS’s GIS and can be made available to the DAS provider to ensure the correct assets are inspected. Once inspected, the captured georeferenced data can be fed back into GIS as well as other systems to allow for better visualization of assets.

Once fully integrated, inspection results would be fed into the APS network model updating systems with freshly captured, high-resolution images. This UAV data injection would also look up assets in the APS work management system based on the georeferenced images to trigger work order to schedule repair or replacement of underperforming or inoperable assets.

APS has a small subset of flight operations underway for overhead inspections, solar field inspections and substation. Going forward, if the expected positive results of these operations are realized, full implementation of the UAV inspection program will commence.

Scott Bordenkircher ([email protected]) is director of transmission and distribution technology innovation and integration at Arizona Public Service. He has 15 years of experience in the electric utility industry.

Erik Ellis ([email protected]) is manager of technology assessment at Arizona Public Service. He has 15 years of experience in power and electric utility industry.