The European Union Ecodesign Directive, effective July 2015, provides consistent EU-wide rules for improving the environmental performance of energy-related products. A transformer is one such product and the directive requires all transformers placed on the market to comply with strict new design specifications that explicitly address transformer losses. This trend toward the regulation of transformer losses is making owners and developers of solar plants pay closer attention to the overall costs of transformers – especially the fact that while the capital costs of the lower-loss transformers that are required to meet new efficiency directives may be slightly higher than those of “standard” transformers, the lifetime costs are lower. The lifetime cost should take into consideration not only the purchase price, installation costs, maintenance costs, etc. but also the future revenue not realized because of losses – a revenue loss that will be greater than the initial purchase price.

Transformer losses

Transformer efficiency is impacted by the inverter output: As the load increases, so does the transformer load loss. However, losses also arise when there is no load as energy is consumed when voltage is applied to magnetize the iron core. These losses are independent of the load and will be present as long as the transformer remains energized.

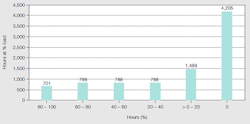

The collector network of a utility-scale solar plant, which includes transformers, is sized to the peak inverter output. But, averaged over a year, outputs usually do not exceed 20 to 30 percent of the peak value ➔ 1. Geographical location and the technology employed – eg, tracking systems – cause production variation from site to site, therefore it is important to know what the average of the inverter output is so that transformer manufacturers can customize their designs to minimize whichever loss component has the greatest impact. In the case of solar plants, no-load losses become a significant proportion of total losses because of the lower average output.

Comparing the cost of losses

Solar farm owners seek to maximize their return on investment by operating as close to capacity as possible, while minimizing losses across the collector network. Capital investment aimed at lowering losses and increasing efficiency is decided upon depending on the calculated return. As an example of such an evaluation, two liquid-filled transformers can be compared: One using a grain oriented steel that exhibits “standard” losses and a low-loss unit, using a high quality, high-permeability steel that conforms to the new EU directive. The cost of future losses based on the loading profile shown earlier can be calculated for these two, assuming:

- The average price of energy sold is $130/MWh.

- The average price of the (nighttime) energy purchased is 50 percent of average selling price.

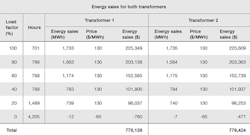

➔ 2 – 3 compare the net energy sales for these two transformer types. Transformer 1 is the standard unit and has a cumulative total of 5,960 MWh available to sell, which would yield a revenue of $778,128. Transformer 2, which has lower losses and uses Hi-B core steel, has 5,992 MWh available to sell, resulting in a revenue of $779,424. Therefore, the lower-loss transformer increases revenue by $1,296 per year. This illustration is for a 2.5 MW installation, however the saving can be scaled up linearly for larger installations.

Note the negative energy sales during times of zero inverter output, indicating the solar site is purchasing power from the grid to energize the transformer and collector network ➔ 3. This represents the no-load or core losses that are always present when the transformer is energized.

After the revenue calculation, the next step is to calculate if the additional purchase price for the lower-loss transformer is worth the investment. The calculation incorporates the initial purchase cost of the transformers and the increased annual revenue that can be achieved with the increased efficiency of the lower-loss transformer over its lifetime (assumed to be 20 years).

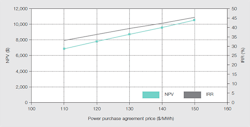

The financial argument for using lower loss transformers can be examined more closely by calculating the NPV (net present value) and the IRR (internal rate of return), using an interest rate of 8 percent. The power purchase agreement (PPA) price sensitivity graph in ➔ 4 shows an IRR and NPV of the additional investment at varying PPA prices. A $130/MWh PPA would yield an IRR of 39 percent and an NPV of $8,726. This means the additional cost for the lower loss transformer is indeed a good investment.

Switching out to save

Depending on the site’s geographic location and the price paid for nighttime energy, it can also be worthwhile to consider switching the transformer out of the circuit altogether to save the nighttime energy cost. This can be done with the help of medium-voltage (MV) switchgear.

ABB has a wide selection of switchgear suitable for application in solar installations – for example, SafeRing/SafePlus or UniSec secondary switchgear. ABB’s green policy ensures a focus on environmental factors during the manufacture and over the life span of the switchgears.

In utility-scale solar plants, there is switchgear on the MV side of each of the transformers to protect them and the MV network from harm. The switchgear is either directly beside the transformer or further away in a collection station or grid connection substation, depending on the size and the design of the power plant. In order to break the current, the switchgear is equipped either with a fuse switch or a circuit breaker. While motorized fuse switches can be operated up to 1,000 times, the circuit breaker can be operated several thousand times.

Equipping switchgear with motorized circuit breakers and remotely controlled protection relays allows automatic, or remotely operated, opening and closing schemes to de-energize the transformers. The additional investment required depends on the plant design and can involve simply changing fuses to circuit breakers, motorizing existing circuit breakers or adding motorized circuit breakers. The protection relays may also need to be changed or have communication equipment added to enable remote control of the circuit breaker.

The savings achieved by doing this depends on the length of time each day the panels are not producing electricity and how many mechanical operations the circuit breakers can withstand. Obviously, in solar power plants, no electricity is produced at nighttime and to de-energize a transformer every night and reenergize it every morning over a 20-year life time, each circuit breaker would have to be operated 14,600 times. This poses a challenge because the circuit breakers in secondary switchgear are usually limited to a maximum of 10,000 mechanical operations.

In smaller power plants (under 10 MW), the solution is to either replace the circuit breaker after 10,000 operations or simply limit the number of operations to this figure over the transformer lifetime. In larger solar power plants, which utilize primary switchgear either in the collection stations or in the grid connection substation, it may be viable to invest in motor-operated circuit breakers that are capable of 30,000 mechanical operations. While more expensive, the number of circuit breakers required would be fewer because the primary switchgear in collection substations and grid connection substations is connected to several MV stations within the facility.

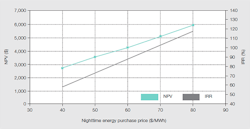

For example, ABB’s UniSec secondary switchgear can be fitted with a circuit breaker capable of 10,000 operations at up to a 24 kV voltage level. A UniSec switchgear with a motorized vacuum circuit breaker could cost the site developer as little as $ 600 more than a non-motorized option. However, the savings from de-energizing the transformers overnight would generate an additional $580 per year of energy savings, assuming energy costs of 65 $/MWh and that the transformer was de-energized during winter when the nights are longest and solar irradiation lowest. This adds up to 3,226 hours and 9 MWh energy savings annually in the case of Transformer 1 (compare with ➔ 3). The return on the additional investment would be a 97 percent IRR and $4,750 NPV. Therefore, the additional investment in motorized circuit breakers would be worthwhile ➔ 5.

Savings are heavily dependent on plant design: If circuit breakers were already planned for, simply motorizing them would enable the operator to de-energize the transformers. In installations with smaller transformers in which the fuse-switch option is viable, changing them to motorized circuit breakers may also be a good investment – depending on the energy costs.

ABB can offer support in both the internal power plant network design and the selection of the appropriate products to reach the most optimal solution from both the original investment and total cost of ownership point of view.

------

Patrick Rohan

ABB Power Products, Transformers

Waterford, Ireland

[email protected]

Tero Kalliomaa

ABB Power Products, Medium Voltage Products

Vaasa, Finland

[email protected]