Here’s a Bit of Irony

The key drivers of the investments that utilities are making in distribution system modernization stem from assets that utilities often don’t own, according to the 2019 Black & Veatch Smart Utilities Strategic Directions (SDR) survey and report. Examples of these assets include such things as rooftop solar arrays, electric vehicles and battery energy storage systems.

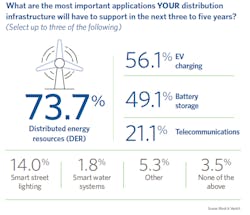

Distributed Energy Resources (DER) is by far a top focus area that utilities are planning to support in the next three to five years, according to our most recent survey. DER will shape the industry’s infrastructure, which will require it to support such things as electric vehicle (EV) charging and battery storage. In the not so distant future, DER could be controlled and dispatched to support the overall power system.

What’s Going On

Planning is one of the biggest challenges that DER presents to utilities as they work to accommodate various resources and assets that customers want to add to the electric system.

“Decentralization mandates a different kind of planning than what utilities have done in the past, and they will likely want to bring analytics into the process. With analytics, power providers will be able to look at the grid through multiple lenses, including what-if scenarios for DER growth, which assets to tap to achieve optimal economics, and where to place asset management devices like sensors, volt/VAR equipment and more,” said Paul McRoberts, president of Atonix Digital, a software subsidiary of Black & Veatch.

Most utilities already are studying how behind-the-meter resources impact the grid. Many also are looking at how they can use customer assets to aid in things such as volt/VAR management or whether the resource could come into play as some sort of additional capacity in an emergency. Some utilities also are starting to question the optimal place for customers to add generation resources, particularly big ones like megawatt-scale storage or microgrids. One utility recently offered to subsidize a local university for putting in DER to take load off a substation. The project would spare the utility expensive substation upgrades in the coming years.

What Counts

Along with delivering valuable data, AMI facilitates grid-supportive initiatives like time-based rates and targeted load shedding that can deliver a non-wires means of deferring grid upgrades and investments. Survey respondents of our Smart Utilities SDR picked AMI as the top distribution automation solution planned for their utility. In fact, it was selected by more than three out four respondents. Advanced distribution management (ADM) also received high marks as a priority with nearly one in three respondents choosing it. Analytics was not far behind with more than half the respondents saying it was a priority.

Eighty-four percent of survey takers said they were modernizing their distribution system to increase monitoring, control and automation capabilities. AMI meters can deliver power quality data. They can be strategically placed around the distribution system to serve as bellwethers to voltage sags and spikes and/or frequency excursions.

From Here to There

As in previous surveys, one of the biggest opportunities for utilities to move forward with implementing smart infrastructure and related solutions is securing investment. Competing priorities were cited by two-third of the Smart Utility SDR respondents as a top barrier to overall modernization. Regulatory hurdles were right behind.

Even with budget challenges, more than a quarter of the survey respondents are looking at spending between US$100 million and US$200 million over the next three years. Roughly one in five respondents expects to top the US$200 million price tag.

“Both investment and prioritizing decisions can be aided by analytics. On the regulatory side, concerns are likely tied to the uncertainty of the utility model itself. I see the downward trend in solar and storage costs making these options more attractive than ever, particularly in areas where power prices are high. That’s decreasing the rate base for utilities to maintain infrastructure,” Heather Donaldson, managing director at Black & Veatch Management Consulting, said.

Utilities are embracing cross-functional teams to get grid modernization done. More than half of survey respondents have the CIO, transmission, security, IT/communications and operations working together toward the smarter grid. Pull out the CIO’s involvement, and you still have a strong IT/OT team on the job.

Getting us from here to there will take an industry that is willing to embrace the opportunities that transformation brings to the future of energy. This transformation will require us to listen to customers, embrace the opportunities of renewable energy as well as learn how to utilize technology to bring it all together. The complete 2019 Smart Utilities Strategic Directions Report can be downloaded at bv.com/reports.