Breakthrough Batteries, Part 2: Potential Grid-Tied Applications for Non-Li-ion Batteries

Advanced battery technologies are poised to disrupt long-term resource planning for grid applications sooner than many market actors realize. In Breakthrough Batteries, Part 1: Investment Is Accelerating the Era of Clean Electrification, we explored how rapid improvements in lithium-ion (Li-ion) battery costs and performance, coupled with growing demand for electric vehicles (EVs) and renewable energy generation, have unleashed massive investments in the advanced battery technology ecosystem. In this second installment of a three-part series based on Rocky Mountain Institute (RMI) research, we consider key alternatives to Li-ion batteries that may be well suited to grid-tied use cases.

Looking beyond 2025, RMI research shows that the transformational potential of next-generation battery technologies will have a tremendous impact on the grid. In the near term, an increasingly electrified, Li-ion battery-dominated world will open significant new market opportunities for other emerging battery technologies that are nearing commercial readiness.

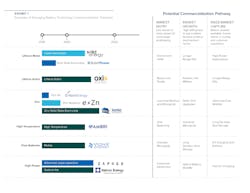

The RMI's analysis of emerging battery technologies identified six categories, in addition to advanced Li-ion, with significant potential for achieving commercial production by 2025. (Company commercialization timelines in Exhibit 1 are examples, not endorsements, for each of the larger categories.) This article highlights a few of these technologies with significant grid-tied application potential.

The Promise of Solid-State Technology

Solid-state technology (in which a liquid electrolyte is replaced by a solid or semisolid one) in particular is poised to unlock dramatic cost reductions and step changes in performance for cheap, safe, and high-performing batteries, including non-Li-ion batteries. Following are three key indicators of the game-changing potential of solid-state technology:

1. Solid state will be adopted first by manufacturers that are currently pursuing advanced Li-ion for its safety and temperature characteristics. Current Li-ion batteries have flammable liquid electrolytes. Thermal runaway (when the rate of internal heat generation exceeds the rate at which the heat can be expelled) is a persistent risk across all applications, and Li-ion will face increased scrutiny as the market continues its exponential growth. Solid-state batteries, however, are nonflammable, and could reduce dendrite growth, improve battery life, and improve performance in both cold and hot climates.

2. Solid state will enable higher energy density, opening additional market opportunities. Solid-state research has been driven by the desire for more energy-dense batteries, with the potential to quadruple specific energy. It also has the potential to make materials like Li-metal rechargeable. Li-air has been long sought after but will depend on significant cathode improvements. Heavy research and development (R&D) investments and continued improvements in zinc-air and Li-plating will make beneficial contributions.

3. Solid state will enable the use of much cheaper materials. Solid state could help researchers overcome rechargeability challenges in less expensive materials like zinc, aluminum, and sulfur, which could enable US$30–US$40/kWh batteries. Some solid-state materials, such as ionic organic polymer, could be commercialized in Li-ion but then subsequently enable very inexpensive rechargeable alkaline batteries.

Note that manufacturing integration is crucial to the long-term success of solid-state technology. Some companies and research initiatives are focused on how to integrate solid state into existing Li-ion battery manufacturing processes, but other solid-state gigafactories are being planned that use different processes. Li-metal investment must focus on low-Li and thin film Li-foil manufacturing. Several solid-state companies are targeting 2024 to 2025 for initial EV commercial lines, but demonstrations are likely to happen earlier.

Emerging Market Opportunities in Long-Duration Storage

Batteries will play a foundational role in scaling EV and related markets over the next decade. The large-scale investments in renewable energy and Li-ion batteries that support this ecosystem will also open up entirely new markets, including long-duration energy storage systems.

The long-duration stationary energy storage market will be large enough to commercialize new technologies. Global demand for stationary storage reached 20 GWh in 2018 and is projected to almost double every year in the next decade. This will play a large role in integrating renewable energy penetrations of 16% to 20% by 2025. Balancing the grid and replacing fossil fuels are expected to increase grid-connected battery support to 750 GWh over the next decade, with China and the United States projected to be the largest market segments. However, meeting electricity goals to keep global temperature increase to below 2°C may require deploying batteries much faster than Li-ion price decreases are predicted to enable, unless demand flexibility can be significantly increased.

BNEF modeled the estimated amount of batteries needed to integrate the renewable energy generation required for a below 2°C warming scenario and found that Germany, California, and North Central China would require between 4 to 13 times more energy storage than is currently expected based on Li-ion cost decreases. Aggregating this estimate would require 270 GW of additional storage by 2040 just for these three regions, on top of the 900 GW already expected globally based on price curves. A large portion of this capacity is expected to consist of storage duration in excess of four hours.

A simplified top-down analysis provides a complementary perspective. High renewable penetration modeling scenarios generally assume that 3% to 7% of the total installed renewable capacity is required as additional inter-day energy storage to account for forecast and demand uncertainty. Meeting 60% of the 6500 GW of current global electricity generation capacity with variable renewable energy would require between 120 GW and 280 GW of long-duration storage, or enough capacity to power France plus Germany.

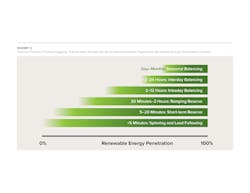

Longer duration storage needs will be best addressed with low-cost batteries that are less exposed to degradation and duty-cycle limitations. As renewable energy penetration increases, batteries will need to discharge over longer periods of time at extremely low-cost points. Short-duration, high-priced storage applications like peak-demand shaving and ancillary services are well suited to the performance and cost characteristics of Li-ion batteries. Grid economics for longer duration storage, however, require that storage technologies compete favorably on a levelized cost basis with least-cost generation alternatives.

As storage requirements move beyond the four-hour threshold, technologies with lower duty-cycle degradation at full depth of discharge, lower material costs, and longer lifetimes will be better suited to provide those lower costs than what most analysts believe Li-ion can achieve. Market designs for specific battery duration, such as four hours, often have unintended consequences, and can act as a disincentive for long-duration storage technologies.

Yet, long-duration technologies continue to improve with research, demonstration, and deployment. Of the six emerging categories of non-Li-ion batteries listed earlier in this article, three are best positioned to support long-duration storage goals: zinc-based, flow, and high-temperature batteries.

Potential Commercialization Pathways for Non-Li-ion Batteries with Grid-Tied Applications

Low-cost and long-duration batteries like zinc, flow, and high-temperature will be well positioned to provide grid balancing in a high-renewable and EV future. Following are high-level overviews and potential commercialization pathways for each:

1. Zinc-based batteries could be a better performing, inexpensive, and non-toxic alternative to lead-acid batteries. Zinc coupled with low-cost cathodes (like air) can create an inexpensive battery with improved cycle life. Zinc batteries are already cheaper than Li-ion and will continue to decrease in cost. These could also include zinc alkaline batteries in the future, enabled by solid-state electrolytes.

2. Flow batteries have reached a point of maturity and can outcompete Li-ion for long-duration storage (for example, more than six hours). They use externally stored fluid to generate energy as they flow past each other. While not an energy-dense battery, a flow battery provides large-scale and long-term reliable energy storage. They have also reached a point of maturity and some can outcompete Li-ion for energy-focused, long lifetime use cases.

3. High-temperature batteries could provide energy shifting or peaking capacity based on safety and long life cycle. New high-temperature chemistries using liquid metal components could outcompete Li-ion for long-duration grid applications greater than four hours. They can deliver continuous cycling up to 100% depth of discharge without capacity fade degradation. And, emerging cells are safer because of low toxicity, low flammability, and lack of internal membranes. Cell materials are inactive at low temperature and are tolerant of overcharge, overdischarge, and short circuits.

These and other emerging storage technologies illustrate both the nascent market opportunity and some likely technology solutions that utility leaders and other market actors should follow closely as they consider future plans, policy, manufacturing, and investment strategies.

For more detail on the battery technologies poised to revolutionize how we power our world, please refer to the RMI's Breakthrough Batteries report. Also, stay tuned for the third and final installment of this series, where we'll discuss implications for grid-tied storage in the United States and recommendations for utility sector leaders.