Concern among consumers and the industry about climate implications is prompting companies, advocacy organizations, and governments to meet carbon-free or net-zero emissions targets by 2050. In fact, in the past few months alone, the Biden administration committed to moving its entire automotive fleet to electric, Pacific Gas & Electric announced a move toward large-scale conversion to electric vehicles (EVs), and General Motors announced that, by 2035, it will only manufacture EVs.

These initiatives and more are driving two industries — automotive and utilities — together. Depending on how events unfold over the converging path on which these two sectors appear to be set could result in a match made in heaven. Or a shotgun wedding.

To move forward, utilities and automakers will need to work together to deliver a shared customer experience to consumers who are developing an entirely new relationship with the energy grid. Reconciling these differences will be an important factor in the long-term success — or failure — of this symbiotic relationship.

Strategic partnerships and aligned messaging will bridge culture gaps

Establishing solid partnerships between automakers and utilities is the first necessary step in advancing EV and green initiatives. There will need to be an alignment on the EV ecosystem and an agreement on what roles each sector will play. And while there will be many individual and joint goals along the path toward adoption, a common focus on consumer engagement will be critical to ensuring support for overall EV adoption. Finding a common focus is achievable, but it is not an easy task.

Utilities have a long tradition of viewing customers as ratepayers who have little choice over their providers nor control over how much they pay for energy services. In contrast, the automotive industry has always been hyper-focused on delivering features and functionality to consumers who have lots of options and price entry points. Another big difference that affects attitudes about consumer engagement is:

- Automakers address customers who often purchase or lease new vehicles every three to five years, with regular service interactions; while

- Players in the utility sector interact with ratepayers who experience major changes in rates every 15 to 20 years. Customer interactions are infrequent and typically are billing or outage-related.

To move forward, both industries must address the fact that they share a customer journey for EVs. This is why coordinated customer engagement will be key. If both are not communicating the overall value proposition associated with a broad shift to clean electric sources of energy and personal transportation, the market will be unlikely to see EV sales growth.

Additional players will drive adoption home

Beyond utilities and EVs, there are all kinds of players, including:

- The traditional fossil fuel energy industry with its well-distributed retail distribution infrastructure. We are already beginning to see new green-energy messages come out of this sector in anticipation of EV adoption.

- Parking garage providers and multi-family dwellings in urban settings also have an opportunity to play a big role in adding value to the EV community of interest.

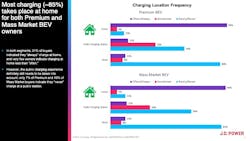

This is because the issue of remote charging is critical. Today, it is unclear to many consumers how charging stations are being deployed to address one of the biggest inhibitors of demand for EVs: range anxiety. If we expect consumers to switch to EVs, all research points to the fact that vehicle charging options are convenient and available.

While there are many challenges and many players to unite, the goal is worthy and achievable. If the stars align and the growing community of interest collaborates effectively to educate consumers on the efficacy of EVs and supporting infrastructure, the promise of all electric-powered travel — including personal, commercial, and public transportation — can be more rapidly fulfilled.

Originally published as an insights brief based on J.D. Power research.