The transportation sector is the largest source of greenhouse gas emissions in the U.S., accounting for 29% of all emissions in 2019. While much attention has been given to the electrification of light-duty passenger vehicles, the electrification of larger medium- and heavy-duty vehicles (MHDVs) presents a promising decarbonization opportunity. Medium- and heavy-duty trucks account for almost one-quarter of all greenhouse gas emissions from transportation in the U.S. These include fleets operated by private companies, such as logistics operators managing freight trucks and last-mile delivery vans, or public fleet operators, such as municipal transit authorities offering public bus service. Beyond carbon, MHDVs are much more intensive polluters in the areas they operate, with significantly higher amounts of other pollutants such as particulate matter.

Analysis by Bloomberg New Energy Finance (BNEF) demonstrates the scale of the electric fleet transition: In the net-zero scenario of BNEF’s 2021 Electric Vehicle Outlook, about 90% of all MHDVs globally will be electric vehicles (EVs), with the remainder being hydrogen fuel cell and other zero-emissions technologies. This transition will create a substantial increase in electric demand, requiring not only a large build-out of renewables and other zero-emission generation to fuel these EV fleets but also T&D infrastructure to deliver the clean electricity to fleet depots and on-route charging plazas, where chargers will need to be installed in sufficient supply.

How can the electric grid support a fully electric future for MHDV fleets? To understand this, it is necessary to first understand the scope of potential impacts on the grid — how much demand could be added and where?

Fully Electric Fleets

National Grid and Hitachi Energy Ltd. recently teamed up to study the impacts of fully electric fleets on the power grid. This joint study, “The Road to Transportation Decarbonization: Understanding Grid Impacts of Electric Fleets,” analyzed potential impacts from fully electric fleets in a specific area of National Grid’s electric service territory in the Northeast U.S. The case study identified actual fleets, estimated the potential demand associated with full electrification (taking into account different vehicle classes, operation requirements and charger types) and mapped those demand requirements to National Grid’s existing distribution system to identify future constraints. It revealed electric fleets could have significant loads that would impact distribution systems and proposed several actions to support the transition to EVs.

The analysis provided a bottom-up view of electrification needs. The process involved the following:

- Identifying over 50 individual fleets in the study area, including the largest and most impactful vehicle fleets that were identifiable (many other smaller commercial operators were not included)

- Estimating fleet sizes and vehicle classes and then assessing vehicle charging needs, in both summer and winter, at each fleet depot to fully charge vehicles overnight

- Mapping each fleet location to the nearest electric distribution feeder (the circuit extending from the substation to the local neighborhood)

- Aggregating electricity demands at the distribution feeder and comparing this demand estimate to the feeders’ load ratings and available load capacities in summer and winter.

Case Study Takeaways

A striking takeaway of the case study was the scale of potential load: One distribution feeder sees a tenfold increase of its peak load under a full EV scenario, triple the available capacity on the line. This is because of the cluster of fleets on the line — 10 sites and over 400 electric MHDVs. These fleets likely cluster as a result of the access to transportation infrastructure (such as highway corridors), commercial zoning (such as distribution centers) and other factors.

The analysis identified more than two-thirds of the distribution feeders studied could eventually need to be upgraded when nearby fleets fully electrify. This was only for the studied fleets, which were some of the largest and easiest ones to identify. Other smaller fleet operators would add their load on top of this, as would residential and public vehicle charging and other electrification load, such as electric heat pumps.

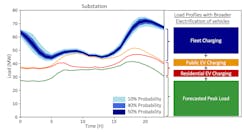

The case study also revealed these impacts would not be limited to the feeder level, and the magnitude of impacts of fleet electrification in cluster areas would be large even compared to other electrification-driven increases. One substation that supports several fleet-heavy feeders could see a 60% increase in peak load from fully electric fleets, compared to an additional 20% load increase from the full electrification of residential and public charging. While not all feeders would support fleets, planning must incorporate potential impacts for those that do.

This analysis was National Grid and Hitachi Energy’s first step to understanding the impacts electric fleets will have on the electric grid and establishing proper frameworks to enable the transition to electric transportation. Proper planning and coordination can have significant value and help to ensure infrastructure is built economically and on time to support these needs. Further analysis is underway examining infrastructure needs and, later, policy needs. Already, though, several recommendations stand out to encourage electric fleets.

Critical Next Steps

It is clear the electrification of large fleets around the U.S. will have a major impact on power grid performance, and the effects will be felt well before full fleet electrification. It is important utilities start planning for this inevitability now with a full, end-to-end approach to bolstering the grid. Fleet electrification needs should be addressed in tandem with other needs, and this will require collaboration across multiple stakeholders, including utilities, regulators, policymakers, fleet operators, suppliers and communities.

How can this coalition accelerate fleet electrification? The study suggested several critical next steps:

1. Act now to plan for fleet needs promptly. The clustering effect of fleets emphasizes how important it is to understand where fleets are located and the number and type of vehicles transitioning to electric operation. Right now, utilities largely lack that level of visibility.

To plan for a fully electric future, this needs to change. Utilities, fleet operators, logistics operators, and other stakeholders should work together to identify where fleets are or are likely to be located and expected timelines. Utilities should work with system operators and regulators to begin forecasting and planning for the medium- and long-term impacts of fleet electrification in their service territories. Only by proactively understanding where impacts will be felt can utilities determine where grid infrastructure and other solutions must be implemented to enable fleet charging needs in a timely manner.

2. Develop end-to-end solutions. Solutions that should take this approach include transmission, distribution and distributed energy resources (DERs) in addition to charging programs. Different charging strategies can reduce the magnitude and duration of peak loads associated with fleet charging, suggesting that managed charging will play a role in supporting EV adoption, reducing system-wide costs and improving overall system reliability.

Considering long-term needs and timelines could lead to new thinking about solution requirements, more efficient solution development and the more rapid achievement of a net-zero future. Today, fleet operators are at the start of their decarbonization journeys and addressing issues individually. Soon, the impacts of fleets could scale up and lead to broader, system-wide issues requiring more comprehensive solutions. Working with fleet customers (as utilities already do through fleet advisory services) and planning further into the future would lead to holistic plans and projects that could meet long-term fleet needs and accelerate electrification. Hitachi Energy and National Grid already are considering how to achieve this.

3. Address multiple needs at once. When it comes to grids, nothing happens in a vacuum. Every event, every charge and every outage has an impact on operations across the system; adding millions of EVs to the grid is no small event. National Grid and other utilities continuously invest in their electric networks. Today, those investments largely address asset condition issues, but they are increasingly geared toward supporting the integration of clean energy into the grid — through grid-enhancing technologies, EV make-ready programs, transmission upgrades and more. In New York state, for example, utilities have proposed transmission investment plans to address bottlenecks and constraints for renewable energy in tandem with projects for reliability, safety and other purposes. Fleet electrification should be addressed in tandem with these other needs to increase efficiency, identify opportunities for synergies and reduce costs.

Further, many large commercial MHDV fleet operators have regional and national coverage across multiple states and utilities. Collaborative regional planning is needed to accelerate interstate MHDV electrification requests.

4. Collaborate and share learnings. Wide-scale fleet electrification will require collaboration across many parties, including utilities, regulators, policymakers, fleet operators, suppliers and communities. Electrifying fleets will have economic, climate and public health benefits, especially in areas where large numbers of MHDVs operate. Infrastructure to support fleet electrification is an investment in these communities, which means they need to have collective buy-in to both the process and end goal. This should include public education campaigns, public commenting, government interactions, public-private partnerships and other activities designed to get everyone rowing in the same direction.

Building Momentum

The recent US$1.2 trillion U.S. Infrastructure Investment and Jobs Act, which provides billions of dollars for EV charging infrastructure and fleet decarbonization, could provide a springboard for investment to deliver electric fleets of the future. To make the investment count, a plan is needed for how to deliver the clean and reliable electricity that will fuel those fleets.

The case study from National Grid and Hitachi Energy provides one critical piece of that road map by showing how substantial grid impacts could be and how they will be highly location specific. The electric industry can ready the grid for fleet electrification, but it needs to start planning now and collaborate closely.

Much is already happening to drive the shift toward electric MHDVs. Policymakers are issuing directives to procure EVs and phase out combustion engines; vehicle economics are approaching, if not already at, cost parity; and vehicle manufacturers are expanding their lineups, including increasing the number of MHDVs. The recently passed infrastructure bill will lead to significant investments to support EV adoption and charging needs. The grid will be ready to support these vehicles, and a framework to proactively plan for and integrate them into the system will help this to happen faster and more economically.

Editor’s note: To learn more, download the joint study from Hitachi Energy and National Grid at www.nationalgridus.com/media/pdfs/microsites/ev-fleet-program/understandinggridimpactsofelectricfleets.pdf.

Jonathan Hou is a Consulting Director in the Power Consulting business at Hitachi Energy. He has more than 25 years of experience in innovative technologies, advanced system solutions, and business strategies in the utility industry. In his current role, he is focused on grid modernization and electric vehicle system planning.

Gideon Katsh is Principal Analyst in Clean Energy Development at National Grid. He has over a decade of experience in the utility industry, including regulatory, strategy, and system considerations for transitioning to clean energy technologies. In his current role, he is particularly focused on opportunities to support large-scale electric vehicle charging through National Grid’s networks. He has been with National Grid since 2008.

For More Information

Hitachi Energy | www.hitachienergy.com

National Grid | www.nationalgrid.com