Residential Energy Storage VPPs Are Gaining Traction

As the behind-the-meter distributed energy storage market continues to mature, a series of factors have propelled residential energy storage systems (RESSs) to the forefront of industry consciousness. These factors include technological progress, legislative and regulatory tailwinds, and new grid challenges associated with intermittent renewable generation.

RESSs can be a highly flexible and valuable resource, improving efficiencies for system owners and the power grid. While residential battery storage has been a growing market in select geographies for several years, the market was primarily driven by early adopters concerned with supporting clean energy or self-sufficiency more than economic self-interest. RESSs were largely regarded by utilities as a niche product for clean energy connoisseurs.

Many utilities see RESSs as a new avenue to improve their services and relationships with customers at a time when new technologies present a real risk of load defection. Utilities around the world recognize these benefits (particularly the ability to reduce congestion on the network and limit the need for peak capacity resources) and have launched programs to deploy RESSs. Utility involvement, cost declines, government incentives, and increased solar photovoltaic (PV) integration are driving increased RESS deployments.

The global RESS market is gaining momentum, with installation growth rates soaring in geographies including Germany, Japan, Australia, and several U.S. states. However, long-standing uncertainties concerning feasible uses and cost-effectiveness remain. As a result, it is vital to support residential utility customers’ ability to tap into RESS value streams that go beyond traditional solar self-consumption. Such support will likely improve the value proposition and increased adoption of RESSs.

Emerging RESS Virtual Power Plants

For residential utility customers, aggregation through a virtual power plant (VPP) is a foundation for unlocking RESS potential to provide grid services. As energy markets evolve toward a greater dependence on distributed energy resources (DERs), strategies to generate more value from smaller, cleaner, and smarter systems are being designed and implemented — including the use of aggregation and VPPs. VPPs transform previously passive consumers into dynamic prosumers that can deliver services customized to their own needs while delivering services to the grid.

At the same time, utility DER management systems (DERMSs) are being designed, piloted, and closely examined for their potential to provide localized grid services. These systems are employed by utilities to control the same DER assets as prosumers, regardless of whether they own the systems or not. Although demand-side VPPs and supply-side DERMSs are closely related, their integration into a common solution set is yet to be fully realized.

Energy storage systems, including RESSs, are essential to bridging this divide. Once storage is included in a VPP it becomes controllable, dispatchable, and schedulable. Integration enhances the flexibility and underlying value of other generation and load assets gathered in the portfolio. The speed of response time on shifting load up and down is a feature of energy storage systems that enables VPPs to provide ancillary services that are increasingly important to utilities, such as frequency regulation, volt/volt-ampere reactive support, and renewable ramping/smoothing.

As a result, VPPs and the technologies that contribute to their formation will play an important role in how RESSs develop over time, specifically their smart controls and associated software. Although RESS VPPs have already been deployed, many remain in the pilot or measurement and verification stage. Nevertheless, recent programs have shown significant potential — and will drive increased deployment of residential energy storage technologies. This is best evidenced by utility programs around the world that have deployed aggregated RESSs to help manage grid activity.

For example, in July 2019, Sunrun was awarded a contract by the East Bay Community Energy (EBCE) board of directors to replace a retiring fossil fuel power plant with residential solar plus storage systems on low income housing in West Oakland, California. During the 10-year contracted period, Sunrun is set to develop several megawatts of solar and over 2 MWh of grid-connected battery storage on more than 500 low income housing units by 2022.

Sunrun’s project with the EBCE is a prime example of residential solar plus storage system powered VPPs used to support the replacement of a retiring fossil fuel power plant in the United States. This project also demonstrates a potential path for California as it seeks to increase the use of DER to improve grid stability and reliability. According to an analysis by Sunrun, at today’s cost, solar and batteries at homes and businesses have the potential to provide 9 GW of capacity across California. This is the equivalent of 50 large natural gas power plants or four times the size of the Diablo Canyon nuclear power plant set to retire in 2025.

In early 2019, Green Mountain Power (GMP) introduced its Resilient Home program. The program uses a patent-pending approach for customer-sited energy storage, using a Tesla Powerwall as both a backup power supply and a smart meter. This approach will replace the traditional electric power meter and provide customers with a seamless and reliable electric delivery system. The GMP is enrolling customers in the program, offering customers the options to purchase two Tesla Powerwall batteries for a fixed monthly fee or purchase a Powerwall from another provider and enroll it under GMP’s Bring Your Own Device program.

The Role of Residential Energy Storage in Smart Home Energy Solutions

New residential energy solutions are coming to market to address the broader needs to decarbonize the power sector, capitalize on the move toward decentralized renewables, and continue electrifying transport. These new solutions are created based on a strategic shift by utilities and energy suppliers to add new customer service business models to their energy supply offerings.

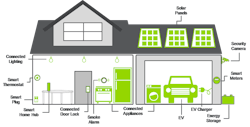

A smart home has the potential to revolutionize the way people interact with their homes. Smart homes can be defined as homes that act intuitively and intelligently through an ecosystem of communicating hardware and software that enrich consumers’ lives by coupling increased comfort, awareness, convenience, safety, and security with lower energy use and energy cost savings. These connected devices, software, and solutions include smart home hubs, digital assistants, smart meters, and RESSs. Figure 1 illustrates a smart home.

Synergies allowing for the integration of smart home and home energy technologies across a single platform are just emerging. The drivers for the deployment of these platforms include:

- Increased customer awareness: Customers are increasingly aware of the concept of a smart home and the benefits offered by connected devices because of the rising popularity of platforms including the Amazon Echo, Google Home, and Apple HomeKit.

- Proliferation of connected devices: The growing number of connected device options and expected expansion of the internet of things (IoT) have increased consumer interest.

- Big data opportunities: Smarter homes are generating new streams of data that offer insight into what is happening in customer residences. Use of this data will increase opportunities for customer engagement and improve customer experience.

Navigant Research expects smart home technology drivers to extend the role of the home in deploying DERs and energy efficient solutions. These solutions will help transition the grid from traditional, centralized generation toward a distributed, digitized, and decentralized system known as the Energy Cloud. This transformation centers on moving from the traditional utility focus of energy asset ownership and commodity electricity sales toward a beyond energy model. The model has integrated services and technology-based business that are often supported by a technical/digital platform. Given RESSs’ ability to serve as generation or load and to produce or absorb both real and reactive power, it is likely RESS software will be the foundation for the development of a single smart home platform.

The Future VPP Model

The future of energy rests on the foundation of cleaner, distributed, and intelligent networks of power. The RESS VPP model presents a compelling vision of the future. Competition will be fierce. Vendors ranging from large multinational corporations to small startups will need to be part of the solution. In the end, however, the success of this VPP model rests on the ability of prosumers to actively participate in grid solutions. This will hinge largely upon the RESS VPP vendor ecosystem’s ability to enable vendors to be part of the solution for grid challenges, and on the creative market designs of regulators and policymakers. In the end, it will be the software’s inherent power that will determine the success of the RESS VPP vision.