1 Renewable generation is not generally run at peak capacity. A low no-load loss design can keep operating costs low as no-load losses are a greater percentage of total transformer losses

In a renewable application ➔ 1, distribution transformers are used to step up the voltage to 35 kV within the collector network. At the end of the collector network, a power transformer steps up the voltage to supply power to the transmission grid. Most renewable sites are owned and operated by independent power producers (IPP), whose interest is to maximize the return on their investment.

As there is either a dry-type or liquid-filled distribution transformer per turbine and many turbines per site, a large proportion of collector losses are the result of transformer losses. To improve on today's collector network efficiency of 97–98 percent, the losses in these transformers need to be reduced. And since the load factor of these transformers is far below nameplate, reducing the no-load losses is the priority.

To quantify the financial benefits of AM core technology, a study was conducted on a renewable site in North America. The site has 70 wind turbines rated at 2.3 MW, and an equal number of 2,600 kVA RGO (regular grain oriented) electrical steel liquid-filled distribution transformers, along with associated cabling, switchgear and power transformers. A load flow study was done on the collector network, studying its present situation with RGO and comparing it with replacement by AM distribution transformers.

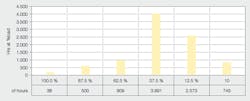

2 Annual turbine output % rating (2.3 MW)

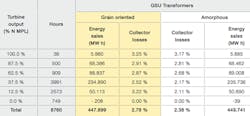

3 Energy savings with amorphous transformers

Collector losses were calculated using the turbine output for an entire year. For this site, the turbine output was less than 38 percent of nameplate for more than 80 percent of the hours in a year (7,313 hours) ➔ 2. The load flow comparison resulted in the AM core transformers being more efficient by 0.42 percent, resulting in an additional 1,842 MWh that could have been sold to the grid each year ➔ 3. This may not sound like much, but over 20 years, it is a considerable amount of revenue improving the rate of return of the site investment ➔ 4.

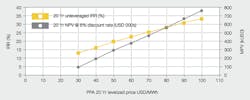

4 PPA Price sensitivity GSU Amorphous transformer investment

AM transformers would have cost the site developer another $ 450,000 on top of the $ 250,000,000 original investment – less than one percent. But the higher efficiency of the collector network would have generated an additional $ 129,000 per year of energy sales, assuming a PPA (power purchase agreement) of $ 70/MWh. Classifying it as a good investment would require a positive net present value (NPV) and double digit internal rate return (IRR). On calculating the returns, a 30 percent income tax credit was assumed and an unleveraged investment or zero financing cost. The return on the additional $ 450,000 using a $ 70/MWh PPA was a 25 percent IRR and $ 467,000 NPV. For a $ 50/MWh PPA, the return is still an acceptable 20 percent IRR and $ 300,000 NPV. So the additional investment in lower loss AM transformers would be a good investment.

The necessary financial and site specific details may not be available at the time of tendering the transformer. But without these details, the transformer manufacturers will have difficulty designing to the most optimal design relative to Total Ownership Cost (TOC). TOC being the purchase price plus cost of operating the transformer over its useful life. So ABB worked with a financial modeling company to develop an on-line tool for capitalizing the no-load (A) and load losses (B) for individual renewable sites. These factors would then be given to the transformer manufacturer at the time of transformer tender for optimizing a design to the lowest TOC. This tool is available by going to www.abb.com/transformers and selecting transformer calculators.

Douglas Getson

ABB Power Products, Transformers

Jefferson City, MO, United States

[email protected]

Peter Rehnström

ABB Power Products, Transformers

Ludvika, Sweden

[email protected]

Gal Brandes

ABB Power Products, Transformers

Genève, Switzerland

[email protected]

Egil Stryken

ABB Power Products, Transformers

Drammen, Norway

[email protected]