Managing assets is one of the most pressing issues facing the electric power delivery industry. Not too long ago, asset managers used simple spreadsheets to keep track of widgets the utility owned. Things have gotten a lot more complicated. Asset managing technology went digital and the process evolved with features, choices and attributes. Asset management changed for the better, but the learning curve has been steep as utilities move from spreadsheets to sophisticated analytical platforms.

An asset management system is defined as any system that monitors and maintains things of value, but it is not that simple today. When the first computer-based asset software systems came along, they used database programs to list assets and manipulate those lists into simple categorizing reports. The asset management software family tree branched out into several areas related to database programs but with more abilities. The following pages will look at some of the asset managing technology tools as well as the subsequent spin-offs.

As technology developed, so did the names and acronyms the industry used to categorize functions. Of course, acronyms can aid in understanding or they can add confusion. For example, the acronym AMS commonly refers to three different terms: asset management systems, asset management solutions and asset management software. Then there are terms like digital asset management (DAM), asset performance management (APM), asset health management (AHM) and enterprise asset management (EAM). The list grows and changes depending on who is speaking and their area of expertise. Obviously, there are overlaps in defining these applications, but eventually common definitions predominate. In the interest of clarity, acronyms will be kept to a minimum in this discussion.

Maintaining Good Records

Records and record keeping are at the heart of all asset managing systems, and data can come from multiple sources throughout the organization. One of the biggest data resources are paper files such as nameplate ratings, maintenance records, inspection reports and testing histories, which can be scanned into digital files. Supervisory control and data acquisition (SCADA) historians also are another source of digital data needed that can be accessed directly with asset managing software.

Another data source comes from smart grid equipment that has been deployed for up to a decade. It is characterized by intelligent equipment with sensors embedded in them that generate data daily. The trend driving current asset management development is using asset management data to help utilities reduce risk and make faster decisions.

Utilities have recognized they need companywide goals to optimize capital expenditures, run an efficient operation and eliminate unknowns, thereby managing risks. They need to move the utility away from the popular run-to-failure reactive approach to a fix-it-before-it-breaks strategy. Asset management gurus refer to this strategy as a prescriptive method. In simpler terms, it is preventive maintenance with built-in intelligence to predict, prioritize and act on potential failures before they happen.

The downside to this emphasis on data gathering in an asset-intensive environment is the amount of data generated by these systems that the utility must handle. This “big data” is measured in quantities such as petabytes, zettabytes and yottabytes, because terabytes are too small to be meaningful. The sheer size of this data dump has required the development of technologies to handle and store the big data.

Digital Opportunity

Cloud-based storage and computing are showing promise in handling big data, but electric utilities have not widely embraced cloud technology yet. However, independent power producers (IPPs) have been more aggressive in taking advantage of cloud technologies for managing their assets. This may help to settle utilities’ concerns, because IPPs and utilities have so much in common. Recently, utilities have started to embrace knowledge-based asset management, based on analytics (analyzing historical data). These knowledge-based systems use pattern recognition to enable utilities to enhance asset performance and improve health evaluation. At present, most utilities focus on the asset health aspect of managing their assets.

Asset health analytics can be broken down into three basic functions: asset diagnostics, asset prognostics and maintenance. These three functions are essential to understanding the life-cycle branch of the asset management family tree. Life-cycle asset management looks at each component of the utility’s T&D infrastructure. The diagnostics approach establishes the present health of the assets, or baseline. The prognostics method predicts how the health of the T&D asset will change over time. The maintenance scheme keeps the asset healthy or restores the asset’s health to the baseline condition.

When taken together, these three functions are used to understand the asset’s condition and provide decision-supporting information related to maintenance. It is really a health managing system, which some groups are referring to as an asset management and condition monitoring (AMCM) system. A recent Navigant Research study on AMCM systems stated, “Asset management has evolved on many levels alongside the technological and conceptual developments that have characterized the smart grid movement.”

Typically, an AMCM system provides automated alerts when it detects an asset not performing to its expected levels or a device failure. The AMCM system recommends for actionable work to take place on the asset, but there was a problem early on with adopting such a system. A lack of consistency between vendors and service providers resulted in data from one manufacturer not being compatible with other manufacturers and data being stored in incompatible databases. Even the names of data points were not compatible.

The data needed a standardized approach to resolve these issues. Interoperability and interchangeability has been a boon to everyone using smart equipment, but initially it took a great deal of standards work on the part of vendors, suppliers and utilities to make it happen — and asset management technology proved to be no different.

International Standards

Although it seems like managing assets would be a straightforward process, this has not been the case. Initially, utilities took a do-it-yourself approach when they needed something to keep track of their equipment. They started out creating their own asset strategies by relying on the experience of their engineers and maintenance technicians, and then were compounded by the needs of accounting and other business units.

Utilities depended on generalizations from firsthand experiences with suggestions from operating manuals and fixed maintenance schedules from manufacturers. Hindsight shows this utility-by-utility approach was not efficient. Using isolated customized solutions proved a hindrance to enterprise asset managing or for migrating these homegrown systems to digital-based asset management technologies. When vendors began developing condition-based and risk-based AMCM, it was evident that the electric industry needed international standards.

The British Standards Institute was one of the first organizations to accept the challenge. It published the publicly available specification (PAS) 55 in 2004, which focused on management systems for physical assets. This was followed with a revision to PAS 55 in 2008. In 2009, the International Organization for Standardization (ISO) published ISO 31000, Risk Management Principles and Guidelines. Then, in 2014, it published the ISO 55000 series of asset management standards.

The PAS 55, ISO 31000 and ISO 55000 gave the industry internationally recognized processes, terminologies and a framework for systems such as asset health management and asset performance management.

Asset Monitoring

International standards paved the way for health-related AMCM systems becoming the most basic building block of advanced asset health managing systems. Because these schemes generate massive amounts of situational big data, vendors developed powerful computerized maintenance management systems (CMMS) as part of the asset management platform. CMMS collected, stored and analyzed maintenance data to provide usable information from all the data, but some basic maintenance philosophies utilities have been using need to be examined before moving into the asset health analysis.

Although utilities have tried to follow several basic maintenance philosophies to manage assets, there have been issues. The schemes go by many names, but fall into four general categories:

• Corrective maintenance (CM) means run to failure, then fix it.

• Preventive maintenance (PM) involves predetermined tasks and replacing assets according to a schedule.

• Reliability-centered maintenance (RCM) entails careful study of equipment and failures.

• Condition-based predictive maintenance (CBPM) is proactive and situational based.

None of these schemes are suitable to bring a wide range of different asset information needed by a unified cohesive maintenance managing tool, but everything must start somewhere. The CM philosophy has been popular, but it is an extreme scheme that impacts reliability and increases outages. The PM philosophy was the opposite extreme of the CM approach, but as budgets got tight and resources became slimmer, it became economically harder to justify.

The RCM process tried to fill the gap between CM and PM by using the utility’s historic records to determine trends, but the system lacked real-world feedback. The CBPM method took advantage of smart grid data to enable maintenance departments to have more situational awareness of the equipment, but there was no trending.

More About Health

Each of these philosophies contained a part of the puzzle but did not provide a solution. Some components — noncritical assets — are safe to run until failure without causing extensive failures in the network. On the other hand, critical assets must be treated differently because a run-to-failure approach can cause catastrophic results. Utilities wanted to replace the device before failure but not while life was left in the device. This has been referred to as health indexing, which uses asset condition and risk to determine the action to be performed.

As the asset managing systems mature, it is evident enterprisewide holistic asset management platforms will benefit from this approach. They will determine the asset’s health and performance as it relates to all the organization’s business units. Navigant Research calls this application the glue among engineering, operations and capital planning. These systems go by various names, such as ABB’s Asset Health Center, GE’s Asset Performance Management, IBM’s Maximo Asset Management Platform, Oracle’s Work and Asset Management, and Siemens’ Reliability Centered Asset Management.

Primarily, these systems use correlation processing for predictive artificial intelligence (AI) to detect asset degradation. The idea is to analyze real-time operational data from an active T&D grid device and compare the data to a library database of healthy similar devices, identifying any developing changes from normality that could become failures. The correlation process got a big boost when Argonne National Laboratory developed an algorithm called multivariate state estimation technique (MSET), which was developed initially for nuclear power applications.

MSET is a statistical modeling technique that learns from an asset model using normal operating parameters to identify irregularities in the real-time sensor data transmitted by equipment on the grid. This process permits comprehensive diagnostic systems to detect early failure patterns and prevent breakdowns before they happen. It has proven valuable in identifying operating conditions causing long-term performance issues.

Strategic Choices

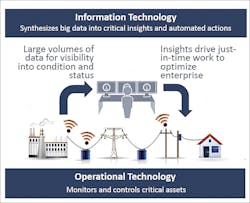

When these diagnostic tools were incorporated into asset managing platforms, they led to improved predictive modeling, which brought about improvements of maintenance tools based on the probability of failure and asset criticality using real-time data interpretation. This approach has been described as a blending of information technology (IT) and operational technology (OT), but it is more than that. The improved asset managing programs are merging IT and OT, changing the individually oriented systems into a balanced platform with business intelligence and operational understanding.

The integrated IT/OT software has added another dimension to modern asset managing solutions. It offers self-diagnostic equipment, condition monitoring and process automation software, which help users to make risk assessments for actions related to asset decisions. Helping utilities to understand risks has led to a better grasp of the consequence of an action. This thinking has steered utilities to make thorough, strategic and fiscally sound choices about which assets should be repaired, refurbished or replaced.

In addition, IT/OT blended platforms assist utility decision makers in making choices concerning when an asset should be scheduled for maintenance or repair. It also calculates the risks that will be associated with the work. This decision assistance is timely with the pressure from regulators and stakeholders. Utilities must reduce costs by optimizing maintenance and capital expenditures by spending resources where they are needed most and at the most opportune time.

Navigant Research reported, “Improving asset management is a key way in which utilities can address these challenges. Asset management is one of the most complex elements of the utility business.”

The general consensus among research organizations found asset performance and health management are the most challenging tasks for the next generation of asset managing technologies. The emphasis will be on expanding enterprise asset managing performance programs to include greater connectivity between work and operation management tools.

Raising the Bar

The art and science of managing assets has come a long way since the early days of accounting ledgers and spreadsheets. The industry has moved from paper-based manual inspections to computer-based asset managing systems that use data from the entire organization. At the same time, digital technology has advanced significantly, resulting in smart grid sensors being integrated into equipment and components used on the T&D network. The disadvantage of this has been the increased volume of data that overwhelmed analysts, but another technology, the Internet of Things (IoT), is addressing the data deluge.

With its big data, analytics, modeling, and cloud-based storage and computing, IoT has been introduced by manufacturers. A few examples include the ABB and Microsoft collaboration of ABB’s Asset Health Center 3.0 and Microsoft’s Azure Cloud Platform, the GE and Oracle collaboration of GE’s Predix and Oracle’s Asset Cloud Platform, and the Siemens and Accenture partnership to provide cloud-based managing applications. These and other vendors’ developments are improving the process, but they also are making the technology more complex while, at the same time, helping the user.

The modern asset management tools tend to identify more risks and require more actions than a utility can resolve with its limited resources, which is where the next emerging technology promises a machine-learning process. Machine learning is also referred to as deep learning and AI, but — whatever it is called — it has given computers the ability to help humans make decisions based on predictive models. AI gained attention in the power industry when the correlation processes driven by algorithms started being used in the nuclear generation industry.

With the deployment of smart grid technology and intelligent equipment, it was only a matter of time until manufacturers started adapting the correlation process to the T&D grid, which is leading the grid to AI. AI promises real-time cognitive understanding to sort through all the risk measures and mitigation activities identified by the enterprise asset managing platforms. This development of AI platforms appears to be the next logical progression for the evolution of the smart grid, because big data is here and humans need help using it.

It is going to be expensive and it will be disruptive, but it is inevitable. Throughout history, technology has not stood still and has only been disruptive to the unprepared. As utilities embrace the new asset management tools and processes, they can better manage their T&D assets, which results in lower costs to customers with better returns to shareholders and a more reliable grid for everyone. ♦