Estimating the Pace of Low-Carbon Technology Adoption

Keeping global warming well below 2°C to avert the worst impacts of climate change will require a dramatic transformation of the global energy economy. To a large extent, this means scaling up entirely new, low-carbon technologies and industries, but just how fast can the world make that happen?

In a recent study that I and my colleagues at the MIT Joint Program on the Science and Policy of Global Change published on assessing the pace of new technology expansion, we developed an approach for estimating and incorporating into the model a process to replicate the challenges of scaling new technology up very rapidly. We estimated the relationship based on some historical precedents.

Drawing upon a rich set of concepts and theories going back decades, we asked: how fast and under what conditions can the world scale up a new technology?

Learning from History

"It is useful to learn from history to help us gauge what is possible and to calibrate our expectations about the future," said Steven Rose, senior research economist at the Electric Power Research Institute (EPRI), a nonprofit, nonadvocacy research organization. "Creating 'favorable economics' for transition is important, but doing so will take favorable developments in research and development (R&D), policy design, and regulatory processes, as well as social acceptance. Also, electricity transformation and technology portfolios are further complicated by the need to balance affordability, reliability, environment, and safety. Overall, favorable conditions and investment signals will be important to new investments as well as utilizing and repurposing existing investments."

A basic empirical observation is that often new technology adoption proceeds in an S-shaped fashion: slow at the start, speeding up rapidly, and then slowing toward the end with some of the older technology hanging on for quite a while.

A key observation in our study is that the cost of a new technology often falls over time as it spreads. Some have posited that this is a process of learning-by-doing — as we gain experience at building and using the technology, we find ways to cut costs. A second explanation is that as we scale up a new industry, per-unit costs drop. And a third explanation centers on adjustment costs. At first, there are only a few people with the skills to build the new technology. When it becomes suddenly popular, and demand increases dramatically, it creates strong price pressure on resources, drawing less qualified people into the field (at least until they gain the skills needed). As the industry scales up, develops more production capacity, and trains a larger workforce, it no longer faces these adjustment costs, so overall costs fall.

Another contributing factor to the slow spread of technology initially is that there may be a lot of old technology around where costs are sunk. For example, existing power plants may continue to operate at less than full marginal cost, slowing the adoption of a new technology until the old plants age out. There is a lot of investment in the production and use of fossil fuels, and so unless the new technology is such a radical improvement, all these sunk investments will not be suddenly abandoned but rather gradually replaced as they wear out or fail.

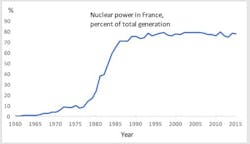

One of our best examples was the development of nuclear power in the United States and France, largely in the 1970s. During that period, there was increased demand for electricity and rapid expansion of nuclear from around 1970 to 1990 (20 years), when it went from 1.4 to about 20% of the U.S. electricity supply, reaching about 100 GW. We argue that expansion of nuclear was more limited by capacity to build these plants than by demand, at least through the early 1980s before the Three Mile Island accident took the shine out of nuclear power. Without that incident, nuclear might have expanded much more than it did in the United States. France went from about 1.5% nuclear in 1966 to 77% by 1986 (20 years).

We also considered the more recent, rapid spread of fracking for shale gas in the United States, where it contributed around 1.5% in 1999 but was supplying 40% of U.S. gas by 2011 (12 years). In addition, we evaluated the deployment of wind turbines and solar photovoltaics (PVs) in several markets around the world where it had penetrated the furthest, such as Germany, China, and the United States. But as far as our data went, any of these markets were only at 4% to 6% of power from these sources. That makes the wind and solar examples not quite as instructive, because they haven't yet spread very far, so we don't have a good estimate of what it would take to get them to 20%, 30%, or 40% of the market. We reestimated some of our data series for nuclear, pretending we only had data up to 5% or 6% penetration, and comparing that with our estimates for solar PVs and wind turbines.

Estimating the Pace of Technology Expansion

The surprising result was that we arrived at a very similar estimate across all of these technologies. We found that once we set up the model to represent expansion based on estimates of historical technology penetration, a given technology would take off rapidly and any adjustment costs would disappear largely within 20 years. So, at that point the industry could expand with demand. Of course, it's critical that the costs of the new technology be considerably lower than those of the existing technology to provide a sufficient incentive to expand at all.

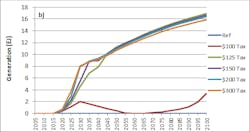

For instance, we modeled the expansion of an advanced fleet of nuclear power plants. We found that with a significant carbon tax, the cost of nuclear generation was less than that of gas or coal, so that provided a strong economic incentive to expand. We also tested a case with a lower carbon price where nuclear power was only marginally cost-competitive; in that case nuclear expanded for a while and then contracted as advances in fossil technology made nuclear less competitive. We observed a similar pattern for wind power. We used a carbon tax to make these technologies more competitive — and it may take that in reality — but if their cost simply drops, that can also create the economic incentive for rapid adoption.

While our research focused largely on utility-scale adoption of technology — our historical examples involved utilities or other large industries — we recognize that there is also growing interest in distributed energy resources (DERs). To the extent we have looked at the adoption of hybrid vehicles in other work, the behavior appears similar. New vehicle technology adoption may be a better model for DERs because they similarly involve decisions by many more people with a wide variety of interests and in a range of circumstances.

What Does All This Mean for Low-Carbon Technologies?

Our estimate — and history — shows that a new energy technology can capture 20%, 40%, even nearly 80% of the market in 12 to 20 years. Thus, significant progress toward an energy transformation is possible within 20 to 25 years, if the economics are favorable.

That may be a big IF without a supporting policy such as a carbon price, but we shouldn't be worried about the ability of these industries to scale up if the economics is there. Such a rapid scale-up may seem impossible to many observers, most likely because even though adjustment and scaling costs are not prohibitive for these technologies, their current economic advantages are marginal.