Once viewed as an isolated market with limited lessons to offer global markets, Australia and Alaska have emerged as leading voices in articulating how best to accelerate the transition to a net zero energy economy. While strong differences separate Australia from Alaska, the two jurisdictions share a lot when it comes to the provisions of vital electricity services to remote and isolated communities.

When I engaged on my first investigation of the global microgrid market in 2009, much of the available data on the types of resources deployed in microgrids came from Alaska and Australia.

The source of my data was the Commonwealth Scientific and Industrial Research Organization (CSIRO), an R&D lab that has long been involved in developing cutting-edge solutions to energy challenges. Since then data provided by the Alaska Center for Energy and Power (ACEP) shows that Alaska has more microgrid capacity installed today than any other US state.

An estimate from Guidehouse Insights showed Alaska with close to 3,000 MW compared to Australia’s 1,300 MW of microgrids that include some portion of renewable energy and/or energy storage. Australia does include some regional grids in the west that could be considered microgrids, but were not included in the Guidehouse tally.

Likewise, Australia is a market leader in remote microgrids in the Asia-Pacific, particularly on the western side of the country which, like Alaska, lacks traditional grid infrastructure that is common throughout industrialized markets such as the US and Europe. Knowledge sharing between Alaska and Australia to resolve common integration challenges for increasing amounts of renewable energy with isolated power systems that traditionally featured diesel generators has been ongoing. Both regions initially focused on wind and diesel hybrid power systems, but today are turning to solar photovoltaics (PV) and new kinds of battery storage to enable the transition to a lower carbon energy system.

Despite these similarities between Alaska and Australia, there are also some major differences. These differences go beyond climate, with Alaska’s ongoing operational challenges for its remote microgrids focused on cold-weather impacts on technology choices and operational constraints. In contrast, Australia has to deal with extreme hot weather impacts.

New Market Structures

The primary distinctions between Alaska and Australia revolves around market reforms to better integrate distributed energy resources (DERs). Rather than viewing DERs as problems, new market structures can transform them into solutions for grid reliability.

A report by Commonwealth Scientific and Industrial Research Organization, Australian Government (CSIRO) forecasts that by 2050 almost 2/3 of all customers in Australia will feature some form of distributed energy resources (DER).1 Once a country whose primary contribution to energy innovation was the build out of remote microgrids in its western states and territories, Australia is now a hotspot for grid connected virtual power plants (VPPs) in the southeast. The deregulation of energy markets there has accelerated reforms that now make VPPs – the temporary aggregation and optimization of diverse DERs including residential and commercial and industrial (C&I) loads – a virtual necessity for intelligent grid management. Consider the following:

- Australian consumers boast one of the highest per capita electricity consumption rates in the world. These consumption levels translate into flexible load that can serve as the basis for demand response (DR) programs and, ultimately, VPPs.

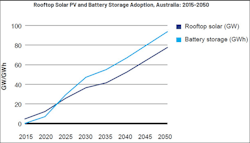

- Australia also lays claim to having the highest per capita rooftop solar PV penetrations in the world. Adoption is expected to accelerate over time (Fig 1). Curtailment of solar production is a related challenge with companies such as Synergy seeking solutions.

- Like U.S. markets in New Mexico, California, Colorado and Oregon, Australia has also been wracked by wildfires and corresponding power outages, building the business case for grid- connected microgrids too.

- As coal plants are retired and replaced by large-scale solar and wind farms, the Australian Energy Market Operator (AEMO) requires greater visibility into the assets used to balance the grid and integration of behind-the-meter with front-of-the-meter assets to maintain grid reliability.

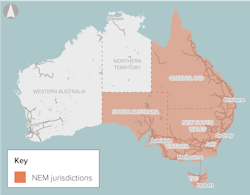

The five-minute market results in a hyper competitive bidding process that sets the stage for deregulated energy retailers and other market participants to fully embrace the VPP market optimization opportunity. The NEM market (see diagram below) is an energy only market lacking a capacity or day ahead market, so trading activity can be frenzied. Bidders can sell into six frequency services market products as well as eight other grid service markets. There are almost 20 different ways a battery can be allocated with compensation spanning almost a dozen different pricing bands.

Australia’s National Energy Market Footprint

The National Electricity Market (NEM) in Australia is centered in the southern and eastern portions of the country, where the majority of Australians live. It operates on one of the world’s longest interconnected power systems - from Port Douglas in Queensland to Port Lincoln in South Australia - a distance of around 5,000 kilometres

In Australia, however, the VPP use-case that has risen to the top of the agenda for energy retailers is frequency regulation, especially in South Australia and New South Wales. A report released by Cornwall Insight Australia claims that the majority of utility scale battery assets currently operating in the NEM derive 75-80% of their market revenue from supplying Frequency Control Ancillary Services (FCAS.) The market operator buys these services when it needs them from power generators, big electricity users, and other organizations. The study shows that the location of batteries really does matter.

While FCAS figures to be a market revenue bonanza throughout NEM, South Australia is particularly attractive for a couple of reasons. Despite having a portfolio of large-scale batteries, the region has a significant shortfall in regional suppliers of FCAS due to the proliferation of both behind the meter and in front of the meter variable renewables and corresponding lack of spinning synchronous generation typically used to bolster grid reliability.

Alaska’s Railbelt Transmission System

Like Australia, Alaska does not have an interconnected electric grid network covering the state such as the lower 48 or Europe. Instead, Alaskan communities are all served by some form of a microgrid, some of which are then interconnected via a transmission network to form larger regional grids. The largest of these regional grids is called the Railbelt grid. It is called the “Railbelt Grid” because it runs along the general route of Alaska’s Railroad. It extends for over 600 miles and links three distinct service areas that are each capable of islanding via a transmission backbone, including (from north to south): the greater Fairbanks area, the Matanuska-Susitna Valley and Anchorage metropolitan area, and the Kenai Peninsula.

Alaska’s Railbelt Grid system evolved from some of the first utility companies in Alaska. Over time, utility companies - many of them cooperatives - served the most basic needs for electricity and energy throughout Alaska. As these cooperatives grew, they started to bump into each other, and borders were created to distinguish the control area each utility covered. The six electric utilities along the Railbelt Grid do interconnect with each other but maintain their independence with their own generation sources.

The Railbelt Grid operates on 75% natural gas, 10% hydropower, and the rest coal power. From one perspective, Alaska has a relatively clean grid, since natural gas produces less air pollutants, chiefly CO2, than both coal and oil. But natural gas is still not a totally “clean” energy source as it is not renewable. Ironically, the carbon footprint of the Railbelt Grid is much larger than that of many remote microgrids that have transitioned away from a sole reliance upon diesel to integrate hydro, wind and solar resources, among them utilities serving Kotzebue, Kodiak Island and Cordova.

In addition, the Railbelt Grid, which represents approximately 2,000 MW of total peak generating capacity, is comprised of nested microgrids such as the University of Alaska Fairbanks campus and several military bases. These microgrids bump up against each other but interaction is limited as there is no independent system operator for the transmission system. While resilient, these microgrids are hampered by the lack of interactive DR that could lead to more efficient operations. A lack of transparency on supply and demand across the grid also limits the kind of real-time system wide optimization of DERs and other resources that is taking place today in NEM, which is much larger in size both geographically and in terms of peak demand of over 35,600 MW.As noted in a blog published by the Alaska Microgrid Group last year, ACEP developed three different scenarios to decarbonize the Railbelt Grid, which are summed up briefly below:

Scenario 1: This scenario is built on decentralized, customer-driven decarbonization and the maximum plausible use of aggregated DERs and requires greater integration between today’s existing microgrids.

Scenario 2: This scenario aims to provide electricity through utility-scale carbon-free energy resources such as hydro, wind, solar, geothermal, tidal, biomass, and perhaps nuclear and relies upon carbon capture and sequestration (CCS) to remove any residual carbon emissions.

Scenario 3: The third scenario for Railbelt decarbonization relies on a large-scale export project revolving around large-scale hydrogen production to take advantage of Alaska’s position on world shipping routes to export low-carbon fuel constituents for Pacific marine transportation and energy production in the Asian markets.

Phase 1 of the analysis is nearing completion. Future work on decarbonization will likely examine a blend of all three of these scenarios, but the scope of the Phase 2 analysis has not yet been decided upon.

Regulatory Comparison

Most microgrids in Alaska are operated by local utilities Over 100 certificated utilities are active in the state. The non-integrated nature of Alaska’s electric infrastructure permits this large number of certificated utilities to serve such small populations. Cooperative utilities are the predominant model in Alaska, but municipal and private utilities also have a significant footprint. The cooperative model has been particularly effective in aligning customer needs and desires with utility programs to increase renewable energy portfolios.

In contrast to Alaskan decentralized utility-led approach, consider the regulatory environment of Australia. Horizon Power, a government-owned utility which serves Western Australia, boasts the largest utility service territory in the world: five times the size of California. Its other claim to fame is that it has the lowest customer per square kilometer ratio of any utility service territory (one for every 53.5 km2;). Given how sparse its customer base is, Horizon Power is currently disconnecting some isolated customers from its grid networks and instead supplying them with standalone power systems. All told, Horizon Power serves only 47,000 customers.

Many of the microgrids that Horizon Power operates historically relied on a centralized diesel generation power system. Horizon Power’s poster child for more advanced microgrids integrating DERs and renewables is a microgrid serving the coastal town of Onslow with a population of 850. Integrated into this microgrid are DERs owned by customers, reflecting disaggregated ownership trends that are sweeping through global markets. Before recent upgrades, the microgrid was designed to meet a 4 MW peak load with an 8 MW natural gas generator, 1 MW diesel generators and a 1 MW lead acid battery.

Today, Horizon Power’s microgrid includes the following resources:

- 1 MW utility-owned solar PV array with two 1 MWh batteries connected at the utility substation

- 260 customer owned solar PV installations, representing over half of the microgrid’s customers, totaling 2.1 MW of clean energy capacity

- 500 kWh of customer-owned distributed battery systems

- Plans to add another 200 kW of customer-owned DER assets in the future

This mix of both utility-owned and customer-owned assets can serve as a model for the Railbelt Grid microgrids. Since these Alaska grid-connected microgrids have the theoretical capability of sharing resources across microgrid boundaries, the key barrier to decarbonization for the Railbelt is less about technology choices – though those will clearly play a role - and more about regulatory reforms.

For example, the only way a significant reliance upon DERs would be viable in the Railbelt Grid would be to restructure the market allowing for dynamic pricing, a common carrier model for transmission access and the ability to access resources across the entire grid to balance overall supply in the most cost-effective manner possible. Though a five-minute market settlement structure might not make sense for the Railbelt Grid, a dynamic trading regime of some sort is one of the primary lessons Alaska regulators and utilities could learn from Australia. The same jurisdiction can accommodate both remote microgrids managed by utilities as well as a deregulated energy market that leverages the economic efficiency of new retailers, aggregators and other market players infusing power grids with new dynamic sustainable energy solutions.

Conclusion

Both Alaska and Australia share much in common, especially when it comes to a reliance upon microgrids to serve isolated communities. But when it comes to market reforms for the respective regions connected to traditional transmission infrastructure, they couldn’t be more different. Alaska’s Railbelt Grid wins high marks for the resiliency-nested microgrids can provide but lacks the ability to leverage demand response and other tools to shrink reliance upon fossil fuels. The lack of a dynamic market structure and common carrier model for transmission access may need to be revisited if Alaska is to find the most cost-effective way to reduce climate change risk.

The hyper-dynamic market structure of Australia probably would not work in Alaska as utilities still remain in the driver’s seat when it comes to ownership and control, but the current system is inefficient and does not take advantage of major advances in control technologies that render past assumptions on grid balancing obsolete.

Peter Asmus is Executive Director of the Alaska Microgrid Group an affiliate of the Alaska Center for Energy and Power (ACEP), part of the University of Alaska, Fairbanks. Alaska has one of the most diverse renewable energy-based microgrid project portfolios in the world. Asmus is a leading global authority on microgrid markets and other emerging trends in sustainable and resilient energy systems. Author of four books, Asmus has been writing about and analyzing emerging trends in energy policy, technology and applications since 1986. Most recently, he was Research Director with Guidehouse Insights where he started up the world’s first global data set on microgrids and developed a forecast methodology to estimate future growth. He has served as a global thought leader on microgrids and other DER platforms such as virtual power plants. Among his past clients are ABB, ATCO, AutoGrid, Bank of Tokyo, EDF, Enbala (now Generac Grid Services), Engie, GE, Hitachi Energy, Horizon Power, Power Ledger, Schneider Electric, Siemens and many others.

About the Author

Peter Asmus

Research Director

Peter Asmus is a research director contributing to Navigant Research’s Energy Technologies program. In one of his most recent reports, he analyzes the global market for DC distribution networks.