5G: Opportunities and Challenges for Electric Distribution Companies

The advent of newer telecommunications technologies, such as 5G, is bringing to realization many new capabilities including wireless broadband services, low latency connectivity, and the ability to bring millions of internet connected devices — all of which will have a direct and indirect impact on electric distribution utilities.

There are realistic and practical opportunities for electric utilities to be both users and participants in this new world of communications. Utilities, regardless of their governance structure, business structure, or size, will have an opportunity to engage with these technologies. The level of participation will range from passive users to active partners, from pure infrastructure agents to collaborative contributors, and from pay-for-services rendered to possible owners of these capabilities.

The level of engagement utilities will have depends on a number of factors that will impact the relationship between utilities and communications providers. These generally include regulatory constraints, which may dictate the level of participation or ability to enter into commercial enterprise, corporate governance structure, the franchise or operating structure that sets the boundaries of what services can be offered to customers.

Additionally, there is the willingness that utilities will have to invest time, dedicate resources, and allocate capital — all of which translates to the potential financial, reputational, and service risk, as well as the opportunity to reap rewards that would be associated with the varying depth and breadth of the commercial arrangements.

The Promise of 5G

The fifth-generation wireless communications generation (5G) is based on the standards adopted by the International Telecommunications Council (ITC) and their third-generation partnership program (3GPP). It is an open, interoperable standard used by virtually all carriers. The major changes that this technology promises are improvements in the following requirements: speed, reduction in latency, higher bandwidth, greater capacity for connected devices, a targeted 99.999% uptime, the goal of 100% coverage, reduction in network energy usage, and up to 10-year battery life.

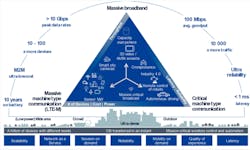

In terms of numbers, 5G speed will be up to 10Gbps peak data rate (a 10x to 100x improvement over 4G networks), latency will approach less than 1 msec (compared to 50 msec to 100 msec in 4G), there will be 1000x bandwidth increase per unit, and the network will support up to 100x the number of simultaneously connected devices.

The 5G map of functionality visually shows these areas that have been classified as massive internet of things (IoT) or machine type communications (mMTC), ultra-reliable and low-latency communications (URLLC), and enhanced mobile broadband (eMBB).

Operational Opportunities for Utilities to Leverage Carrier-Based 5G

While the primary focus for this new technology from a common carrier’s perspective seems to center around broadband services, the most likely areas that will be important to electric utilities will be the increased capacity to support field area network needs for connected grid devices. The "Grid of Things" will greatly benefit from the connectedness afforded by the larger IoT.

"We plan to leverage our AMI network for connectivity needs, but that may change as we deploy more 'grid-edge' devices," said an executive of a mid-sized mid-Atlantic utility.

Low-latency services potentially offer the opportunity to leverage this technology to support mission critical applications, such as protective relay management, SCADA, and substation communications.

"Use of 5G can potentially provide SCADA and other system data over a cellular network versus a hard-wired solution through fiber or copper," said a general manager of a Connecticut public utility.

The high data rate mmWave wireless broadband services may be applied to augmented/virtual reality (AR/VR), an area where some utilities like Duke Energy and EPRI are actively leveraging, and unmanned aerial vehicles (UAVs) that will improve asset management and visualization.

Utility-Owned/Private LTE

As technologies continue to provide improved performance capabilities, the industry demand for hardware, software, and services is driving the cost of these components further down the price curve. In many cases, utilities may already own frequency spectrums where these assets can operate and are exploring and deploying private LTE (PLTE). In the past few months, new frequency auctions in the 3550 MHz to 3700 MHz band were held in an area known as Citizens Broadband Radio Services (CBRS). Approximately 400 licenses were obtained by 11 electric utilities (6 IOUs, 4 co-ops, and one Muni).

Challenges 5G Creates for Electric Utilities

There are key foundational elements for this new communications infrastructure that include the use of existing and higher frequency spectra. These are the low band (less than 1 GHz) and the mid band (1 GHz to 10 GHz). These are where most of the 4G and LTE systems currently operate, but 5G involves the introduction of the high-band (15 GHz to 95 GHz) spectrum or mmWave.

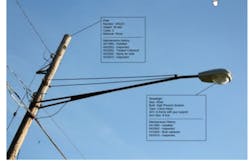

Because of the physics of propagation, the high-band network will require a dense array of communications elements, known as small cells. In general, 'small cells' are defined by both their range — that is, how far the signals they transmit and receive can travel — and in many cases, the number of simultaneous users they can support.

Given the proliferation of microcells and the drive for carriers and infrastructure firms, like American Tower, Crown Castle, and SBA Communications, to leverage existing structures like electric distribution poles there is an increasing need for greater standardization of issues such as regulatory requirements, policies, safety concerns, and aesthetics.

Regulatory Requirements

The Federal Communications Commission (FCC) has established key requirements through various orders: "Pole access also is essential to the race for 5G because mobile and fixed wireless providers are increasingly deploying innovative small cells on poles and because these wireless services depend on wireline backhaul. Indeed, an estimated 100,000 to 150,000 small cells will be constructed by the end of 2018, and these numbers are projected to reach 455,000 by 2020 and 800,000 by 2026."

To facilitate the deployment of small cells, the FCC adopted a streamlined process for the rollout of these assets including setting governance over shot clocks and guidance over local governance regarding spacing, equipment design, and aesthetic concerns. It also established a new pole attachment process that includes "one touch make-ready" (OTMR), in which the new attacher performs all make-ready work.

OTMR speeds up and reduces the cost of broadband deployment by allowing the party with the strongest incentive — the new attacher — to prepare the pole quickly by performing all of the work itself, rather than spreading the work across multiple parties. This also covers areas such as overlashing.

In the United States, approximately 25 state legislators have enacted small cell legislation that streamlines the facilitation of these assets. These include applications to access public right of ways, caps on costs, and fees and shot clocks for consideration and processing.

Policies

Utilities like CPS Energy (CPSE) have put in place a set of policies that addresses best practices. They have established an Energy Pole Attachment Program to facilitate constructive dialog with attaching entities and ensure transparency: "CPSE standards provide for a non-discriminatory, consistent, and streamlined approach for the access and use of CPS Energy Poles in a manner that will facilitate the delivery of the variety of communication services offered today, as well as assist with speed-to-market processes for future technologies in a manner that is consistent with the safe and reliable operation of CPS Energy Facilities."

CPSE has a website for access to its pole attachment standard to facilitate this process.

Summary and Call to Action

The use of electric poles for placement of 5G mmWave small cells will happen. Electric utilities need to investigate, evaluate, and execute the following actions:

- Fully understand the regulatory and legislative orders as they relate to OTMR requirements, shot clock, and reduction of barriers.

- Follow the local governance guides that may apply in states where there is a policy or rule.

- Develop internal policies and practices that comply with these regulations.

- Establish collaborative relationships with carriers and tower installation companies.

- Maintain equality and transparency.

- Seek ways to collaborate on needs and services (that is, powering, access, and possible use of existing communications backhaul).

Acknowledgments

This article is a summation of work performed by EnerNex under a contract with Distribution Systems Testing, Application, and Research (DSTAR), which is a consortium of electric utilities, facilitated by GE's Energy Consulting business (General Electric International, Inc.), sharing the results of distribution research.

Throughout its more than 30-year history, DSTAR has provided its member utilities with results that are directly applicable to everyday distribution design, planning, engineering, operations, and maintenance. The DSTAR model offers utilities a cost-effective and responsive way to address complex distributed energy challenges that require unique and innovative solutions. The members cooperatively fund research, enabling each utility to get significant research and development (R&D) value out of their individual contributions.

For more information on DSTAR, visit www.dstar.org or www.geenergyconsulting.com.