A Changing Distribution Planning Environment

Technology innovations and learning curve effects have steadily and gradually reduced the cost of distributed energy resources (DERs), including rooftop photovoltaic solar units and energy storage. Availability of and interest in those resources have been increasing.

This, in turn, has had an effect on how transmission and, especially, distribution organizations approach planning. Traditional distribution planning has historically assumed one-way power flows from centralized generation to customers. Increasing DER penetration challenges, or at least modifies, that general planning approach. Planners now need to consider bi-directional flows, more variable and new demand profiles (such as electric vehicle charging), and growing amounts of digital technologies, including controls.

Stakeholders, including regulators, are also interested in alternatives to capital intensive distribution expansion projects. Indeed, some regulators believe that distribution utilities are unduly biased toward wires-oriented solutions to distribution problems, given the traditional financial incentives to grow their rate base. For their part, wires utilities are trying to balance a growing number of investment priorities, and they are considering (as well as being encouraged by some regulators) alternative, customer-side solutions.

Non-Wires Alternatives: What Are They? Why Are They of Interest?

In some jurisdictions, utilities are considering alternatives to traditional wires solutions, such as substations, feeders, and distribution lines. These alternatives are referred to as non-wires alternatives (NWAs). NWAs leverage energy efficiency, demand response, DERs, and other distributed solutions to remedy constraints on the distribution grid. They may be employed individually (e.g., energy storage at a substation) or in combination (e.g., energy efficiency, demand response, and energy storage), depending upon the system’s needs.

Possible benefits from NWAs include deferred capital requirements, integration of non-carbon-emitting resources, additional flexibility, and decreased energy and capacity costs for the distribution utility. Deferral of capital for infrastructure is seen as a key economic benefit, with avoided or deferred upgrades and replacements of feeders, substations, and transformers. Some constructs, while valued from a state policy perspective, may include difficult to quantify benefits, such as reduction in carbon emissions.

What Has Been the Early History of NWAs?

To date, NWAs have been encouraged by regulators. New York is a jurisdiction leading the promotion of NWAs. Its Reforming the Energy Vision (REV) dockets have been an early driver of potential solutions, as the Public Service Commission (NYPSC) has required New York utilities to propose NWA solutions as part of their mandated distribution system implementation plans.

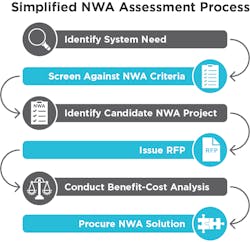

Depending upon the jurisdiction, one feature of NWAs is the ability to solicit NWA options from third parties. Competition is seen by some as encouraging alternatives at potentially lower cost, although the jury is still out on that. These pilot programs are in the early stages and have yet to produce enough evidence over time of cost savings.

In New York, the NYPSC has worked with utilities to formulate benefit-cost analysis methodologies for consideration of NWA projects. Benefits and costs are grouped into large categories, such as a bulk power system, distribution, reliability/resiliency, and externality benefits vs. program administration, as well as utility, participant, and societal costs. Benefit-cost framework elements include avoided energy, capacity, outage, O&M costs, and avoided losses on the benefits side, as well as program administration expenses, lost-utility revenue, and participant DER charges on the costs side.

To date, only a handful of projects have gone from a system need identification to solicitation to implementation, but more are expected. One early program, widely touted as a successful NWA, is Con Edison’s Brooklyn-Queens Demand Management program (BQDM). BQDM was implemented before consideration of NWAs was formally mandated, but it used NWA evaluation elements, which were ultimately adopted by the NYPSC. BQDM used primarily energy efficiency, as well as customer-sited distributed generation (combined heat and power, fuel cells, and rooftop solar), distribution voltage optimization, and utility-sited storage, to achieve more than 50 MWs of peak demand reduction at a total projected program cost of about $200 million, versus adding a substation and transmission feeders at the cost of more than $1 billion.

Other states are looking into requiring their utilities to consider NWAs in resource planning as well. In New Hampshire, for example, regulators have required Liberty Utilities to include evaluation of NWAs as part of its least-cost integrated resource-planning process. In Washington, DC, the city council has proposed a new, independent body that would plan and evaluate NWAs. A handful of other states and utilities are also looking at NWAs.

Does NWA Ownership Matter?

One aspect in which NWAs differ from traditional wires solutions is potential ownership models. With integrated utilities having both wires and generation businesses, utilities might own NWAs, and their planning, operation, and maintenance may simply be a matter of extending current processes. This provides the incumbent with some level of confidence in system performance.

For wires-only utilities, depending upon the jurisdiction, the incumbent might not own the NWA. It may then have to contract with the NWA solutions provider for operation, maintenance, and management of the facility. Compensation for these services and performance of the assets would also be addressed as part of the contracting process.

What Challenges Have Been Presented by NWAs?

Challenges presented by NWAs arise from their novelty and limited track record. While third parties are participating in NWA provision, distribution utilities are ultimately looking for reliability and system performance, and they are reasonably concerned that third-party solutions will not perform as expected.

A second challenge is solutions selection. Evaluating projects is difficult, since the operating characteristics (and cost elements) of different NWAs may differ significantly. Given that, a wires utility may lack the ability to do an apples-to-apples comparison and have to rely upon its engineering and economic judgment.

Finally, planning processes and organizations may need to be adapted, as more parts of the utility organization are involved than in the traditional distribution-planning processes. Additional organizational coordination may be required as operations, capital planning, supply chain, and regulatory organizations, among others, may need to assist in evaluating potential solutions. In addition, processes that consider NWAs may also need to accommodate planning for backstop solutions in the event that the NWA is not available in the timeframe needed.

What’s Next?

The industry must wait for early returns and learnings from those currently pursuing NWAs to see how the solutions perform, both from a cost and an operational standpoint. There will be important lessons in NWA procurement and administration as well.

For now, NWAs are not going away and utilities—particularly in jurisdictions promoting DERs and/or alternative regulatory models (versus traditional rate base models)—would be wise to watch and learn.