Utility Wish List: Planning for the Distributed Grid

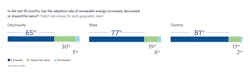

The annual Black & Veatch 2019 Strategic Directions: Electric Report survey found that much of renewable energy is customer-owned or decentralized, meaning utilities are left managing distribution systems packed with generation resources the utility may not see or be able to control. That’s a problem when you consider that all electric utilities embrace one ubiquitous goal: providing safe and reliable power. Now, they’re doing it while their distribution systems are impacted by unpredictable consumption and generation assets owned and operated by third parties.

These conditions serve as the catalyst that has prompted today’s electric utility wish list. Increased visibility, greater flexibility and dynamic regulatory support top the list of things that will help the power sector navigate our changing industry landscape.

See it coming…and going

We’ve all considered the scenario where a feeder has a high penetration of distributed solar, but the utility secures power and plans their system in such a way that they’re providing power to those circuits anyway. They need to do this for times when the sun isn’t shining or clouds impede that distributed solar generation quickly, so the utility must respond with a fast ramp rate. If there’s a power outage, the utility has to do some creative switching around that feeder too. Every step of the way, utilities must take that distributed generation (DG) into account even though they don’t own it.

Between 2010 and the first half of 2015, U.S. Department of Energy (DOE) research shows photovoltaic (PV) capacity connected to the U.S. distribution system jumped from 1.8 GW to more than 11 GW, which was about a six-fold increase. Distributed solar accounted for more than half of the country’s 20 GW of solar installations and according to a 2016 report from the National Renewable Energy Lab (NREL), it will continue to comprise as much as 60% of solar capacity through at least 2020.

That’s a lot of uncertainty and volatility many utilities are grappling with. This is why visibility into these distributed energy assets could very well be the top item on the utility wish list.

Managing a power system chock-full of DG will require more sensors on distribution circuits, as well as more intelligent systems, such as advanced distribution management systems (ADMS), plus integration of data with operations and control systems at the grid edge. That’s something many utility staffers understand, as evidenced by results from the survey.

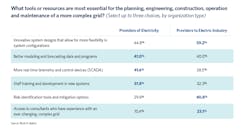

When asked what tools or resources are most essential for the planning, engineering, construction, operation and maintenance of a more complex grid, nearly half — 47%— named better modeling and forecasting data and programs, while 42% cited more real-time telemetry and control devices among their top picks.

Add flexibility

In the same survey question — what tools are most essential for a more complex grid — 45% of utility respondents cited innovative system designs that allow for more flexibility in system configurations. One such change could be mandating advanced smart inverters, as California has done.

The previously mentioned NREL report found that because advanced inverters could automatically help utilities manage the voltage excursions that come with high penetrations of distributed solar, adding these inverters could double distribution-level hosting capacity, moving the number from 170 GW to 350 GW. In California, such inverters also must have communications capability, making them controllable by utilities and even more valuable as a grid-support tool.

The NREL’s research also maintains that distribution hosting capacity could grow even further with careful siting of distributed PV, minor changes in utility operations and coordination of DG through distributed energy management systems (DERMS), which would likely coordinate a full range of distributed energy resources (DERs), including smart inverters and storage.

Right now, however, utilities are in that uncomfortable transition period between the traditional grid and the grid that’s ahead. More than 70% of the survey respondents named the coming generation mix — one with fewer traditional base-load units and more renewables — as the biggest concern ahead regarding grid operations and maintenance.

Is the regulatory community adapting quickly enough to keep utilities and the grid strong? Sometimes, and sometimes not.

Partner with regulators

For investor-owned utilities and even some of the municipal ones, regulation of our evolving industry landscape could stymie the market or move it forward. The utility industry is traditionally conservative and, often, so are regulators. Still, technology responds to what the market wants and the market reflects consumer interests, not utility needs.

Given the dynamic nature of the power sector’s marketplace today, regulators and utilities both will likely scramble to keep up and they’ll need to support each other.

A few years back, utility staffers worried about the death spiral of shrinking revenues from load reduction and increasing investment needs because of the proliferation of DERs. Now, along with DG, utilities are facing electrification of transportation, something that will boost load, but do so unpredictably for a while.

Consider the electric vehicle (EV): seven years ago, only a couple of model choices were available for EV owners. Now, there are more than 50, plus medium- and heavy-duty trucks are coming to market too. Bloomberg New Energy Finance expects 57% of global passenger cars sold by 2040 to be EVs.

At this scale, many compare EV loads with what happened to the power market 50 years ago, when air conditioning started to take hold. EV loads will impact the grid in many ways, but utilities still don’t know how. Are people going to charge vehicles at night, or are they going to charge at the workplace? What impact will autonomous vehicles have? Will we see 10-MW charging hubs with 100 autonomous vehicles coming and going at different times of the day? Will charging infrastructure itself continue to draw increasingly more energy? Already, the size of the chargers is getting bigger; instead of 20kW to 100 kW, we’re now talking about 350-kW to 500-kW chargers coming online.

Utilities are studying the impacts and some are finding surprises. As an example, Black & Veatch did a study for a mid-size municipality that expected a negative net load growth in the future driven by the increase in customer self-generation. Utility managers anticipated declining capital infrastructure requirements. But when they evaluated the demographics of EV buyers, solar installations, and the geographic and socioeconomic parts of the city where these were starting to proliferate, they realized they were going to need to increase their spending on substations and transmission lines. The quantity, timing, and location of energy consumption were changing so significantly that this municipality didn’t have substation capacity in the right places because daily load curves were shifting.

All of this is occurring while utilities are seeing increases in DG that make the grid increasingly complex and hard-to-manage. Will regulators open up distribution markets for DERs? When asked if their utility anticipates the introduction of such markets, 37% of respondents to the Black & Veatch 2019 Strategic Directions: Electric Report survey replied affirmatively. An additional 47% answered that they weren’t sure, but we’re at a pivotal point in the industry. Chances are, many who replied “don’t know” to this year’s survey may say “yes” in a year or two.

Some 40% of survey respondents said the primary driver for distribution markets was that they’d serve as a “strategy for accelerating the transition to a more distributed grid model.” More than half — 55% — of survey respondents believed that DERs will dominate utility service offerings in the next 15 years.

Like it or not, DERs are here to stay, and utilities will keep trying to deliver safe, reliable power via a grid increasingly impacted by third parties. Support from regulators will be crucial, as will the utility’s increased visibility and flexibility in the grid.

Maybe “wish list” is the wrong thing to call these three items. They’re actually imperatives for operating and maintaining the grid of the future.

Part 2, 3, and 4 of this four-part series will address: “The Balancing Act: IoT and Cybersecurity”, “DER Marketplaces: How Utilities Can Find Their Place?”, and “Big Customer, Big Losses? Why Utilities Need More Customer Focus.”