Energy markets are undergoing some massive transitions. Growing demand for electricity, when combined with the need to limit carbon emissions, drives a huge increase in renewables. This growth is accelerated by the falling cost of renewables, and is further encouraged by polices to decarbonize the energy sector.

DNV GL’s new "Energy Transition Outlook" is a key report which aims to forecast such growth in electricity consumption. It predicts that the growth will increase rapidly, more than doubling its share of energy demand to 45% in 2050. This growth in electricity production will be dominated by renewables, including solar photovoltaic (PV), onshore wind, hydropower, and offshore wind, which will account for 80% of global electricity production in 2050.

But how will this high proportion of solar and wind generation impact our power systems?

In the electric power system, electricity supply always needs to be balanced with electricity demand and network losses to maintain safe, dependable, and stable system operation.

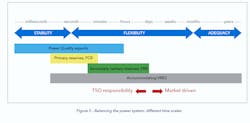

There are three broad challenges when it comes to a power system with a high penetration of renewable energy: stability, flexibility, and adequacy. These three concepts refer to different timescales that the electricity system needs to adapt within. Stability is mostly the domain of power quality and fast response to load variation and is about seconds and even microseconds, flexibility ranges from seconds to months and is required to compensate for variability in supply and demand and maintain its balance. Adequacy is defined as the ability to supply the aggregate electrical demand and energy requirements of end-use customers at all times, taking into account scheduled and reasonably expected unscheduled outages of system elements which can range from months to years.

The figure below sums up DNV GL’s view on stability, flexibility, and adequacy:

When it comes to power system stability, a high percentage of variable renewable energy sources (VRES) will have a significant impact. This is because of the nature of VRES: the lack of kinetic inertia and the electrical, high frequency characteristics of the converter that connects VRES to the grid. Traditionally, power system stability relied on grid-coupled rotating generating units. The inertia of the grid (the resistance toward frequency changes) was provided literally by the physical inertia of the rotating parts of large generating units.

DNV GL’s research shows that, with an increased share of VRES in the energy mix, grid stability will be an issue on a much shorter timescale (microseconds to seconds) than the timescale of the current frequency containment reserves (FCR, seconds to hours). Furthermore, VRES will push conventional generation out of the market, reducing the physical inertia of the grid provided by the rotating mass of synchronous generators. High shares of renewables in the future power system will therefore certainly tighten the FCR requirement in terms of ramp-up time and the bid time interval (because of reduced inertia and higher volatility in the system frequency).

Continued development in weather forecasting and VRES generation changes will be important to have the best possible information for system operators. With an increasing share of VRES in European continental systems, the automated frequency restoration reserves (aFRR) demand will be linked to the forecast error for VRES generation.

The digitalization and use of advanced metering infrastructure (AMI) gives growing access to (close to) real-time data from electricity use and distributed generation, allowing for an increase of demand participating in aFRR. Digitalization also helps the development of new close-to-real-time market places. The German development over the last decade illustrates how market design is important. Despite the increasing energy supply of variable renewable energy sources, the demand for balancing power in Germany has been declining. This is linked to TSO cooperation (connected) in balancing, increased flexibility in intraday, and shorter bid periods in day-ahead markets.

DNV GL expects some adaptions to the current market for ancillary services:

- FCR participation and inertia emulation from bulk renewable generation plants is expected in the future as the system inertia and the number of synchronous generators continues to decrease.

- A reactive power market can be expected since the increase of renewables will significantly reduce the local connection point voltage regulation capability. This is because of the converter overload capability and reactive power control capability.

These are additional ancillary services that can be contracted by TSOs, just like the current FCR. In addition, DNV GL sees more international cooperation on imbalance settlement.

For system adequacy, DNV GL identified two issues resulting from a large penetration of VRES:

- Can conventional, dispatchable generation survive in a market with high VRES penetration where operating hours will decrease, making it more difficult to realize sufficient producer surplus to cover for investments?

- Can fossil-fueled peaking units that are sporadically used recover their investments (missing money problem)?

In the case study, with no changes in demand flexibility or changes in market design, the load duration curves show a decline in operating hours for central dispatchable generation from the current situation and the situation in 2050. In the case study for 2050, given the surplus of renewable energy, central generation can realize 6000 full load hours at the most. Whether this erodes the business case of central generation under the given assumptions, depends on the central generation mix.

- A mix with a high amount of low-CAPEX, high-OPEX peaking generation will lead to higher market prices and the business case for central generation (represented by relative attractiveness) on the average does not deteriorate.

- If the generation mix contains only few peaking units, as is currently the case, the relative attractiveness shows, on the average, a deterioration.

A problem with peaking generation for rarely occurring peaks is the unstable annual cash flows caused by large variation in peak load demand. Good and bad years cannot be predicted. Mitigating this risk by socializing the cost of this peaking capacity (for example, through a capacity market) is an option that is implemented in several European countries.

A side effect of covering the investment costs of peak capacity by capacity fees is that electricity prices in peak periods will be lower than would be the case if these prices would need to cover these investments, thus affecting the profitability of other generation (including VRES that is producing at peak times) as well.

The full report, "Future Proof Renewables," can be downloaded here.