Part I of this article made clear that utility customers, especially homeowners, are very willing to consider their utility as their smart home solution retailer. In fact, these customers would prefer to purchase these products from their utility, versus the large national retailers. A significant finding indeed! This article follows up with more detail on what the utility customer would expect from its utility in this role.

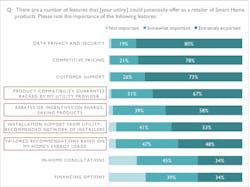

To answer this question, turn once again to the customer survey data. Figure 1 provides a summary of the data collected from customers across the United States. The survey identifies the driving purchase considerations that utility customers think about when purchasing from a utility.

First, some context on this survey: typically, for retailers, the top two purchase considerations are product price and breadth of product catalog. This is followed by secondary considerations, such as experience with the retailer, service offering, and overall convenience of retailer interaction.

The very top item from the survey was NOT one of the typical purchase considerations. Rather, it was data privacy and security, followed quickly by pricing.

Utility executives are closely following the current debate about digital security — and watching with interest the broad society-wide concerns about data privacy and security. Privacy issues have surfaced across industry segments and now include much more than Facebook and other social media applications. Security issues are front and center, as reflected in the seemingly continuous notifications from major companies about their data base breaches, with the resultant disclosures of personal data. This has become the number one customer expectation and it is clearly a cry for help. There is an implicit expectation that the customer’s local utility, which should be the trusted utility, can and must do better.

With this not-so-surprising expectation regarding privacy and security, are four significant purchase considerations, that are unique expectations of utilities (each one is highlighted in red in the table above). Considering each one of these four in turn provides guidance on how each utility can show up as a differentiated retailer, delivering on customer expectations differently than those big players (Amazon, Best Buy, Walmart, Home Depot, and others) which were included in the survey.

- Product compatibility guarantee: Another surprising finding speaks to customer confusion and frustration. They believe that many solutions which they are purchasing often don’t work well together. Homeowners clearly expect their utility to ensure that all utility recommendations do indeed work well together. Similar to the survey results about privacy/security expectations, this is yet another reflection of the fact that “my utility” should be trusted to provide logical recommendations for what’s purchased for “my home.”

- Rebates and incentives: This is a unique utility offering and another reflection of customers’ focus on price. This ability positions the utility to provide exceptional pricing to its customers, even if only on some of the products offered.

- Installation support from utility recommended installers: This consideration is another reflection of trust. The utility supports my home now, why not expend this support to include installation and support of these complex smart home solutions?

- Recommendations based on “my home energy usage”: Yet another unique capability of the utility is making customized solution recommendations. As a trusted energy provider, the utility is in the position to know, with precision, much about the customer’s home. The product compatibility guarantee, together with this solution recommendation, enables each utility customer to ask whether the different solution recommendations will work well together and be optimized for their own home. Each customer wants to ensure that the personal information on which these recommendations are based, will be kept strictly confidential and secure.

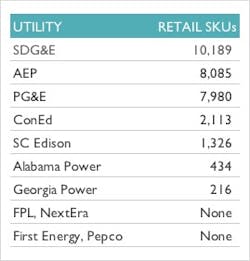

Given this information on how utilities can show up differently and valuably to consumers, you might expect utilities to have evolved to develop similar retail strategies, supporting this consumer demand. To explore this expectation, we pulled the number of retail smart home SKUs that many utilities are selling publicly as proxy. The aim was to provide directional insight on their smart home strategies.

Figure 2 shows a sample of SKU counts for a short list of utilities. While the SKU counts change month to month, the key insight is that utility smart home assortments, as sold online, are highly varied, ranging from more than 10,000 to zero. This variability reflects a remarkably broad range of underpinning strategy decisions. As such, it seems clear that the utility industry as a whole has not landed on similar strategies, internalizing the consumer demand discussed here.

Taken together, these “voice of customer” considerations make a strong case that the utility can and should provide smart home solutions to its customers. Utility customers seem to expect their utility to present itself as a new kind of retailer, one that delivers solutions that work and make a difference. All of this should happen while reinforcing customer privacy considerations and maintaining consumer data security.

This is a call to action for utilities. How will the executives who run utilities respond to this call?