Since the global electricity market adopted an alternating current (ac) system rather than a direct current (dc) system for power transmission and distribution (T&D), switchgear has been the backbone of electricity grids. Switching equipment became a requirement to connect power generation sources and loads to a single electricity line, which resulted in a complex yet effective meshed topology that is today’s electricity grid. Electrical switchgear is a centralized assortment of circuit protection devices that serve to protect, control, and isolate electrical equipment in case of faults in the power system and includes the following main components:

- Switching devices such as circuit breakers, switches, and fuses

- Measuring devices such as current and voltage transformers

- Protection and control devices such as relays

- Conductors such as buses and connections to carry the power from one point to another

Medium voltage (MV) switchgear, defined as 1 kV to 40 kV for this article, is installed throughout the sub-T&D sectors in addition to generation and in industry. Broadly speaking, switchgear can be classified as indoor type or outdoor type and then further segmented by technology types; that is, air-insulated switchgear (AIS) or gas-insulated switchgear (GIS), outdoor circuit breakers (OCB), and so forth.

Switchgear in USA’s Grid Modernization:

Substation automation and switchgear

Automation is a tool which enables a utility to remotely operate and manage the components installed in a substation including switchgear. Evidently, such a process involves communication between remote devices and control centers. With advancements in communication intelligent electronic devices (IEDs), utilities are now able to perform real-time control and protection operations. With the introduction of powerful micro-processing tools and multi-functional relays (IEDs), the power systems industry entered the digital age which made the automation process extremely fast and efficient. A substation (SS) acts as a strategic node in a T&D network. Most substations operating at high voltage (HV) or extra-high voltage (EHV) perform switching and routing of ac power. So, the operation of switchgear which is aimed at the routing/switching of power (operation of switchgear and so forth) is termed as the “primary process.” A substation is called digitally enabled in which the data related to protection, control, and monitoring of the primary processes is digitized immediately after the measurement.

Grid automation — IEC61850 components

In 1997, both IEC and IEEE partnered together to develop a common standard for substation communication which is now popularly known as IEC61850. Naturally, the standardization process involved all the major stakeholders including system manufacturers and key utilities. Automation in a switchgear occurs when the traditional control and protection function of a switchgear is combined with IEDs communication through IEC61850. Traditionally, switchgear was connected to bay-level devices through copper wiring. With the introduction of IEC-61850 process bus, the switchgear is connected to the rest of the system (IEDs) through a digital interface. Two crucial parts of IEC-61850 series of standards, IEC-61850-8-1 and IEC 61850-9-2 are defined as Generic Object-Oriented System Event (GOOSE) and Sampled Measured Values (SMVs).

- Sampled Measured Values (SMVs): Analog signals (waveforms) from sensing equipment (instrument transformers) are converted into a stream of sampled values. SMVs are broadcasted over the communication network and can be accessed by any IED which needs the information. Sampled values are time stamped so that the receiver can correlate the samples coming from different sources.

- Generic Object-Oriented System Event (GOOSE): GOOSE messages contain information in the form of a dataset which contains status indication in binary form. Just like SMVs, GOOSE messages are also available for any IED connected to the system. A typical example of GOOSE dataset would be the status indication of all the switches in one bay to all the other bays level devices in the substation. Information packed in one single dataset and broadcasted over the communication network means removal of several hardwire connection which existed in traditional substation design (one network cable replacing several hundred meters of copper wiring).

Interoperability and enhanced grid protection schemes

Flexibility achieved through IEC 61850 process bus in terms of information exchange plays a crucial role in providing enhanced protection coordination among the bay level IEDs. Trip, blocking, status or any logical signals are transferred through the same network using GOOSE and can support peer-to peer applications in a substation. In addition to that, it presents other opportunities, such as failure of any current transformer or merging unit can be easily compensated by estimating lost signal from other merging units and installing centralized back-up protection system instead of providing individual duplication of each bay level protection IED.

Impact of switchgear advancements on USA’s grid

According to the U.S. Department of Energy (DOE), automation in switchgears (circuit breakers) and reclosers is categorized under the concept of distribution automation. PTR believes that with more than 60,000 distribution substations, 205,000 distribution circuits and six million miles of distribution lines in operation, the United States has an enormous potential for automation in its distribution network. Applications of switchgear automation in the United States go well beyond the traditional fault isolation and interoperability. Automation in the U.S. grid provides resilience to high-impact, low-frequency (HILF) events, such as extreme weather conditions. Given the fact that the U.S. market is driven by the replacements in the grid, it provides an excellent opportunity to the utilities to introduces automation-equipped switchgear in the network leading to a highly modern and automated grid. The overall opportunity for manufacturers is summarized in the following market analysis.

The MV Switchgear Market in USA:

Market Segments

Switchgear is used in various application verticals in the United States, which can be categorized into three parent categories: utility distribution, power generation and industry. Given the entities involved in these three verticals, the United States is a highly fragmented market. Indoor cabinets are preferred in all three major sectors; however, there are some specific applications such as in the mining industry, wind generation plants as well as substations, which have a high use of outdoor circuit breakers.

Utility distribution

The United States has some of the largest electric utilities in the world but with over 3500 distribution utilities, it is also a heavily fragmented market segment. The MV switchgear market in the utility segment is driven by the long-term equipment replacement plans by large utilities which are initiated either because of the high percentage of equipment operating beyond end-of-life or to enhance the grid resilience to withstand ‘high-impact low-probability’ events such as storms. The distribution grid sector accounts for the largest volume of MV switchgear cabinets followed by the power generation sector.

Power generation

The United States has more than 1 TW of installed capacity with over 80% coming from conventional energy resources such as hydroelectric power, coal, oil, natural gas, and nuclear. However, the dynamics of the generation sector is changing, and renewable energy resources from solar and wind will increase, possibly doubling by 2030. This shift in generation will dictate which switchgear technology will become more widespread in the United States in the future. Indoor switchgear will expand because of its use in wind and solar power.

Industry

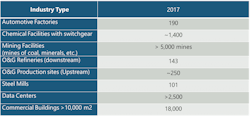

Across many industries, the U.S. market ranks among the largest in the world. It is a major manufacturer of chemicals as well as a key player in the automotive and data centers. In addition, the United States has a significant number of oil and gas refineries (O&G) and a large number of commercial buildings that exceed an area of 10,000 m2. These buildings require a connection to their local utility using MV switchgear. The following table shows the top industrial applications in the U.S. by number of facilities.

Market Size

Indoor systems

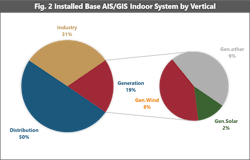

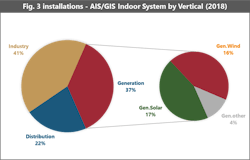

For AIS/GIS indoor systems, the distribution segment accounts for 50% of the installed base, followed by the industrial and generation segments (Fig. 2). However, the annual market for AIS/GIS indoor systems (Fig. 3), shows that the contribution from the distribution segment has gone down to about 22% while the number of units of AIS/GIS indoor systems sold for industrial uses and generation have gone up to 41% and 37% respectively.

This shift in the usage of MV switchgear equipment can be directly attributed to the change in the United States from conventional energy resources to wind and solar. Solar accounts for a mere 2% of generation in the installed base, but in 2018 solar has become the most widely used renewable energy resource and is now a whopping 17% of new generation. This percentage is a little higher than wind power whose annual market share is 16%. It is also worth noting both wind and solar require considerably more MV switchgear equipment compared with conventional generation requiring MV Switchgear mostly for medium voltage motors at 6 kV or 10/11 kV.

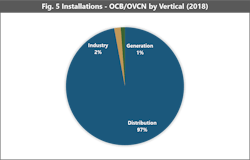

OCB/OVCB market

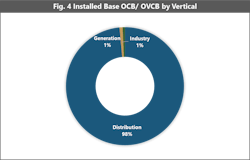

The installed base for outdoor switchgear (both OCB and OVCB) is shown in Figure 4 and the annual market is shown in Figure 5. In both figures, the use of outdoor switchgear in the distribution segment overshadows the generation and industrial sectors completely, with the latter two segments collectively amounting for just 2% installed base and 3% of the 2018 market share.

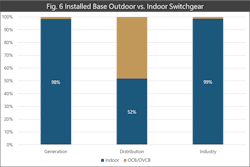

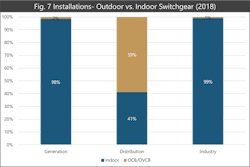

Outdoor versus indoor switchgear

For both the generation and the industrial sector, indoor systems are the clearly preferred MV switchgear type while in the distribution sector, the installed base for indoor switchgear is about 52% (Fig.6). The use of outdoor switchgear is increasing in the distribution sector and based on the 2018 annual installations (Fig.7) indoor switchgear is decreasing to 41% of the market share.

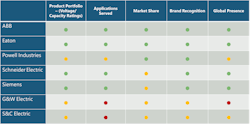

Top Suppliers

To be a successful supplier of MV switchgear in the United States, a presence in all the 50 states is preferred as well as the capability to offer both outdoor and indoor switchgear. As seen in the chart below, ABB, Eaton, Schneider Electric, and Siemens have a large portfolio of products that cover the U.S. MV switchgear market. Moreover, these four companies can use their products for various applications and have the brand recognition and geographic presence that is desired. Even so, MV market share in the United States, is not equal for all and Powell Industries, a company with a smaller product portfolio, has a higher market share in than globally known Schneider Electric and Siemens. In addition, G&W Electric and S&C Electric, two American companies with smaller geographic presence have a piece of this market.

Given the large size of the U.S. market and the opportunity of replacing old switchgear with new digitally connected switchgear, switchgear can play a vital role in grid modernization of the United States. Of course, the process will be long, and the overall grid will shift toward higher degree of automation slowly. Increasing pressure on the grid from distributed energy resources (DERs) and integration of electric vehicles (EVs) in some states is speeding up this process, with utilities in these states opting more and more for automated solutions over conventional switchgear. The question now is how the rest of the market would react to these changes and adopt these technologies leading to a highly modern and sustainable U.S. electricity grid.