Refreshing the Outlook for P&C Investments Specifically and for Grid Modernization

The Newton-Evans study of protective relays that was completed several months ago was based on a 2019 multimonth survey-based study of protection and control (P&C) engineering department heads and senior staff members at key electric power utilities in 30 countries. A total of 97 utility P&C managers and staff discussed their usage patterns and plans for relay applications, protocols, and telecommunications architectures as well as their investment plans for P&C activities during the field collection phase of the study. In addition to utility surveys, more than 30 industry officials from several protective relay manufacturing firms around the world also participated in the study.

The report series provides updated information on a variety of "universally-applied" protective relay types, including generator, transmission line, distribution feeder, transformer, and motor protection units.

Estimates and forecasts contained in the 2019 to 2022 report were premised on five sources of information:

- In-depth utility surveys and interviews of 98 utility P&C officials located in 30 countries, conducted in 2019.

- Relay manufacturer surveys and channel member interviews together with available financial information from suppliers.

- P&C consulting firms in six countries.

- Excerpts from related multiclient and commissioned studies undertaken and completed by Newton-Evans Research Co.

- Economic and financial global market outlook information developed by a number of respected public and private sources, for example, World Bank, UNDP, IMF, Bloomberg, and others (World and Regional Economic Outlook: Implications and Viewpoints for the Protective Relay Market).

In order to develop a successful market outlook for any industrial or utility infrastructure equipment or product, Newton-Evans found it to be a good practice to include reliable external references such as the IMF/WB research conducted in world regional economies — especially the organization's World Economic Outlook Database. The IMF had published its then-latest outlook series in April 2019 and this database served as a basis for our outlook published shortly thereafter. Now with the global emergence and spread of the COVID-19 virus, the impact of the global market sell-off, and the oil industry in disarray, it is time to reevaluate the outlook.

Assessing the then-current IMF findings in light of the multinational relay manufacturer survey, the multinational utility survey, and the multinational consultant survey one could, during 2019 at least, view the overall outlook for protective relay shipments through 2022 with a clearer lens than may now be the case.

In spring 2019, I wrote, "Albeit that a single unforeseen international development — whether good or bad, whether economic, political, financial, or military — can change the outlook drastically for many product or service categories. For example, on June 16, 2019, a significant portion of the entire power grid of Argentina and Uruguay, along with some portions of the Brazilian and Paraguayan grids suffered a major outage event of several hours. Early findings indicated prolonged use of old equipment and too little investment in replacement and upgrading of electric power infrastructure, including protective relays. As a result, Newton-Evans staff believes that there will be a significant increase in near-term budgeted expenditures for new and upgraded power infrastructure, including replacement of older relays lasting through 2021."

Nonetheless, now only several months later, we need to take a fresh look with what we do know today. Together with some reliance once more on the probability-based outlooks of the IMF, World Bank, and other economics and econometrics professionals in the field of forecasting, we now make an effort at redeveloping a mid-range market outlook for protective relays and for related grid modernization efforts.

The 2019 IMF report on the world economic outlook had viewed global GDP growing through 2022 in the range of 3.3% to 3.6% each year. However, the global number necessarily should be reviewed based on its constituent parts. This is especially important when one notes that the GDP growth rate outlook for G7 countries (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States) is less than one half of the total world rate of change outlook, hovering in the 1.4% to 2.1% range. Even within the G7 nations, however, there was a wide range of GDP growth (or lack thereof), separating the countries. The United States, for example, grew at better than a 2.2% level, while Canada remained a bit below a 2% rate of growth.

Looking at the large IMF grouping of 155 emerging nations, one subgroup, the ASEAN-5 (comprising Indonesia, Malaysia, the Philippines, Thailand, and Vietnam) had been expected to continue growing at better than 5% per year through 2022. Other emerging market areas (Latin America, Middle East, North Africa) were not faring as well as was sub-Saharan Africa — which is likely to continue growing at 3.5% to 4% over the forecast years. Emerging Asia countries were projected to do even better, with multiyear growth likely to be in the 6% range through 2022.

On an average, the survey sample thought the 2018 protective relay market size was slightly lower than the 2017 market. However, these same marketing/business executives saw a more positive outlook for 2019; an average of all responses suggests the 2019 market likely saw a 3% to 5% increase over 2018.

The 30 executives surveyed in 2019 indicated that the North American and Asia Pacific regions had the largest markets for protective relays in 2018. In total, these estimates would place the 2018 world market value of all protective relay shipments at about US$3 billion (US$3.041 billion). This estimate aligned rather well with the results of the combined North American and international surveys conducted by Newton-Evans Research and the use of appropriate multipliers (used for sample-to-universe calculations). The total Newton-Evans estimate amounted to a somewhat lower US$2.861 billion, or about 6% below the manufacturers' estimates.

The manufacturers themselves provided more detail for Europe (western and central/eastern sub-regions) and for Asian nations (Asia Pacific and South Asian sub-regions) as shown in the following chart.

What About 2020 and 2021?

Now the hard part — attempting to determine what the effect will be, if any, of the likely economic consequences to grid modernization plans and budgets now in place, caused by the COVID-19 epidemic now creating disruptions and even havoc in a significant number of the world's industrialized and developing nations.

Preliminary indications suggest the IMF and World Bank believe that the COVID-19 outbreak and possible pandemic will negatively affect economic growth this year and perhaps have ramifications for a longer time horizon. When coupled with the first quarter 2020 fall-off in energy pricing, the number of world troublespots bubbling up while the world's attention is diverted to care for citizens and to combat the spread of the virus, the dampening effect on the global economy will likely become more significant through the second quarter of the year. If the virus can be contained over the next 60 to 90 days, the world economy may well make a moderate-to-strong comeback in the second half of 2020.

Even before the emergence of the coronavirus epidemic, the World Bank — as recently as January 2020 — was voicing caution in its 2020 outlook indicating, "Nevertheless, downside risks predominate, including the possibility of a reescalation of global trade tensions, sharp downturns in major economies, and financial disruptions. Emerging market and developing economies need to rebuild macroeconomic policy space to enhance resilience to adverse shocks and pursue decisive reforms to bolster long-term growth."

As recently as mid-January, the World Bank had anticipated some real economic growth in 2020 as stated here: "Global growth is expected to recover to 2.5% in 2020— up slightly from the post-crisis low of 2.4% registered last year amid weakening trade and investment."

As of March 9, 2020, it appears that while the stock markets around the world continue to suffer sharp declines, the utilities industry may not see a dramatic drop-off in electricity demand, unlike the probability of such happening with other components of the energy industry, especially vehicle fuels. However, with less business and holiday travel taking place at this time (March 2020), and with some international tourist destinations now under quarantine, there will be less demand for all forms of energy among businesses catering to travelers, including airlines, cruise ships, hotels, and rental vehicles, while the concern for personal health may defer many from attending large public events, going to theaters or for dining out at restaurants. Manufacturing industries will suffer in the near-term because of supply channel disruptions and decreased demand for hard goods over the coming few months.

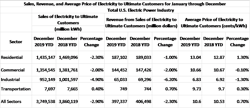

Newton-Evans believes that the potential fall-off in electricity demand for commercial and industrial customers will be made up in large part by the increased consumption of electricity among residential customers as more people stay home, telecommuting, spending more time on their computers, watching TV for longer periods and preparing more meals at home. If we look at the recent EIA data for electricity consumption in the accompanying chart among the three major usage sectors (residential, commercial, and industrial) and assume a 10% increase in residential usage during 2020, compared with a 10% drop in both commercial and industrial usage, further assuming price stability, the total industry change in anticipated revenue would amount to a loss of less than 1% (US$3 billion) from 2019 revenues of US$397.3 billion.

In this evermore complex 21st century global economy, with its multinational supply chains — including some weak links in those chains — nations need to work together to find common solutions through development of a comprehensive set of economic policies that will benefit the international community, whether such developments occur within the G7, the G20 within the UN, or another body of cross-border central banking organizations and market intervention officials. We are well beyond time for a single nation response to be effective. What are we waiting for?

Once the virus fear has passed, COVID-19 has been relegated to history, and an end to this global scourge is within sight, the resurgence in energy demand for the production of goods and provision of services will likely rebound rather quickly, as long as people can retain their jobs in the intervening months.

After going through this exercise, I believe that the diversion of potential investment in P&C equipment as well as other grid modernization equipment, systems, and services will be minor (less than 5% lower shipment values in 2020 from 2019 levels) unless the current COVID-19 situation continues to affect manufacturing supply chains and if the "oil wars" heat up further.

More reports from Newton Evans Research Company can be found here.