Medium voltage (MV) switchgear, operating within the 1 kV to 42 kV range, plays a crucial role in controlling, protecting, and isolating electrical equipment. The US MV switchgear market, valued at around $2 billion, is projected to maintain a robust compound annual growth rate (CAGR) of 10.5% until 2030 (Source: PTR). This substantial growth is propelled by key factors such as grid modernization and the Biden-Harris administration's ambitious clean energy targets, aiming for 100% clean electricity by 2035 and a 50% reduction in greenhouse gas emissions by 2030.

The Rise of Data Centers

Offshore wind projects and the expansion of Electric Vehicle (EV) charging loads also increase the demand for MV switchgear, but the expansion of data centers is significantly propelling the growth of the MV switchgear market. With advancements in artificial intelligence (AI) and the increasing reliance on cloud computing, the number of data centers in the US is booming. Data centers require reliable power supply systems to ensure continuous operation and MV switchgear plays a vital role in this infrastructure. According to PTR estimates, the MV switchgear market in the data center segment is expected to grow at a CAGR of 16% from 2023 to 2030 in terms of investments. This growth is driven by the need for high-performance and reliable electrical systems to support the data-intensive operations of modern AI applications.

As the deployment and use of artificial intelligence (AI) technologies expand, power density per rack in data centers is expected to increase significantly. Currently, the average power density per rack ranges from 6 kW to 8 kW. However, in large hyperscale data centers, this figure can reach nearly 20 kW and has the potential to rise to between 50 kW and 75 kW per rack.

Data center operators adopt parallel supply paths from utility connections to efficiently manage this increasing power density. This approach necessitates the deployment of multiple units of MV switchgear. By implementing this design scheme, the data center can significantly drive demand for MV switchgear. Furthermore, this strategy enables data centers to achieve 99.99% uptime in a cost-effective manner without fully transitioning to Tier 3 or Tier 4 configurations.

Underground Switchgear

Our research is showing the US MV underground switchgear market revenue to experience a CAGR of 7.2% between 2023 and 2030, with the annual market for underground switchgear units expected to be nearly twice as large in 2030 compared to 2023. Currently, pad-mounted switchgear dominates the market with a substantial 75% share. However, this dominance is anticipated to decrease as utilities shift towards underground switchgear due to urban expansion, infrastructure development, the aesthetics factor and the need for reliable power distribution in densely populated areas.

Electric utilities must enhance grid resilience and reliability, and undergrounding is gaining momentum as a viable solution, especially in high-risk areas prone to natural hazards such as wildfires and flooding.

- The Dominion Energy Strategic Underground Program aims to shift outage-prone lines underground in Virginia.

- In California, Pacific Gas and Electric (PG&E) has plans to shift 10,000 miles of powerlines underground in high wildfire-risk areas across the state.

- In Florida, Florida Light and Power Company’s (FPL) undergrounding program states that 45% of their total distribution system has shifted to underground lines, and 90% of new lines are underground.

- In Iowa, RTO PJM has greenlit a 550km pilot undergrounding project for the MISO grid.

Transition to Gas-Insulated and Solid Insulated Switchgear

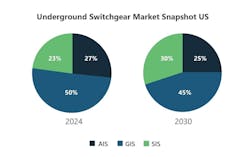

Changes in switchgear technology also impact the demand for MV switchgear. Historically, the US market has predominantly used Air-Insulated Switchgear (AIS). In contrast, Europe has favored Gas-Insulated Switchgear (GIS) due to its compact design and suitability for urban environments. However, with the increasing trend towards undergrounding in the US, there is a growing shift towards GIS and Solid Insulated Switchgear (SIS) for underground installations. GIS and SIS are more suitable for underground applications due to their compact size and better insulation properties. PTR research indicates that SIS market shares will increase from 23% in 2024 to 30% in 2030 in the underground switchgear market compared to GIS, which drops from 27% in 2024 to 25% in 2030. This technology shift is attributed to SIS's superior reliability compared to the GIS for underground installations, and hence, SIS will surpass GIS for these installations. Additionally, the rise in wind power installations, which typically utilize GIS, further drives this shift. As a result, the demand for GIS is expected to grow in the US market.

Adoption of SF6-Free Technology

- What is SF6?

- SF6 is a man-made, non-flammable, and comlpetely non-toxic, gas widely used as an insulating and breaking medium. SF6 is popular for its insulating and current breaking properties, thermal capacity, and stability.

Another significant trend in the MV switchgear market is the move towards SF6-free technology. Due to environmental concerns, Europe has already started phasing out SF6 and plans a complete ban on SF6 MV switchgear by 2026. Although the US has no country-wide regulations banning SF6, many global manufacturers are transitioning to SF6-free alternatives. This shift is also anticipated to influence the US market, as it would be inefficient for manufacturers to maintain separate production lines for SF6 and SF6-free switchgear. A few major manufacturers plan to phase out SF6 globally across their operations, and hence, their US operations will also undergo the phase. As such, other manufacturers are expected to adopt SF6-free technologies over the next decade, driven by the global shift towards environment-friendly technologies and SF6’s high insulating property, which make it possible to significantly reduce the size of switchgear for tight spaces such as underground vaults.

Lead Time Challenges

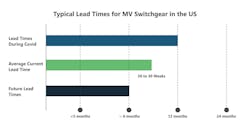

Our research has found the supply side of the MV switchgear market has faced significant challenges, particularly lead times. Pre-COVID-19, lead times for MV switchgear were around 12-16 weeks. However, the pandemic disrupted supply chains and manufacturing processes, resulting in extended lead times and delays. This hampered distributor sales and hindered the performance of other manufacturers whose products could not be installed until switchgear was available for a project. The lead times then increased to roughly 52 weeks in the COVID period.

The pandemic highlighted supply chain issues, inducing transportation delays and factory shutdowns. While many of these issues have since been resolved in the post-pandemic era, the industry is now facing an increased uptake in computing applications, which requires more data centers, and the rise of AI, which demands even more power and data infrastructure. Additionally, utilities are investing billions into infrastructure, which must be spent within a short timeframe, focusing on electrification, industrial reshoring, and utility grid enhancements.

In response, switchgear manufacturers are expected to invest in new factories and expand the capacity of existing facilities. However, building these facilities takes time, and they must hire and train staff, leading to inevitable delays.

Post-pandemic lead times have improved, yet they remain above pre-COVID levels, averaging between 26 and 32 weeks. While not as severe as the lead times for transformers, which have faced even more significant delays (and price escalation), the extended lead times for MV switchgear pose challenges for utilities and infrastructure projects. Efforts to streamline supply chains and increase production capacity are expected to gradually reduce lead times, reaching nearly 24 weeks by 2027. However, the ongoing demand surge will continue to pressure the supply side.

In response to the growing demand for switchgear, manufacturers have expanded their manufacturing facilities to alleviate supply chain issues and cater to the existing and forecasted demand.

- In 2024, Vertiv expects to double its global manufacturing capacity for switchgear, busway, and integrated modular solutions to support the increased demand.

- Similarly, Schneider Electric unveiled plans to invest $140 million in 2024 to expand its US manufacturing presence, explicitly targeting critical infrastructure equipment, including MV switchgear.

The demand for MV switchgear in the US is expected to increase, driven by the increasing need for grid resilience, the expansion of data centers, underground projects and technological advancements, but manufacturers are expanding their manufacturing facilities. While the market has historically favored AIS, the shift towards GIS, driven by undergrounding trends and wind power installations, is set to enhance the landscape. The transition to SF6-free technologies and the adoption of underground and digital switchgear further highlight the market's evolution towards more sustainable and advanced solutions. Despite supply-side challenges, the availability of the US MV switchgear remains promising, with continued investments in infrastructure and technology driving its growth.

Saqib Saeed is Chief Product Officer United States/Germany-based at PTR Inc, which has evolved from a core market research firm into a Strategic Growth Partner, particularly within the electrical infrastructure manufacturing space. Saeed’s expertise lies in the power grid and e-mobility equipment sectors. He has overseen numerous global market research studies throughout his career and provided valuable insights to key decision-makers at various Fortune 500 companies.

Abdullah Kamran is a Market Analyst at PTR Inc. He specializes in energy storage and battery energy storage systems and researching the global energy storage market. Kamran covers areas such as market sizing of different markets, policy landscapes, market developments, pipelines of projects, installations of these projects and the development of new battery technologies.