Resilience on the Docket

The utility industry has always had to deal with floods, hurricanes, droughts, wildfires, and similar natural disasters. However, greater attention is being paid to these events, as their costs and, in many cases, their intensity increase.

Moreover, as digitization increases, particularly in operational technology, the potential impacts of cyberattacks increase. The role of the energy sector as the lifeblood of an advanced economy and its interconnectedness with other critical infrastructure, like water and transportation, makes it a uniquely attractive target for malefactors, both individuals and nation-states, and advances in technology are making these risks more challenging to defend against.

Finally, physical threats to the grid remain. In a recent report, the North American Electric Reliability Corp. (NERC) reported 207 physical security incidents impacting the bulk power system, including 13 vandalism incidents and 41 gunfire incidents, most commonly involving transmission lines and solar photovoltaic (PV) generation sites.

Pacific Gas & Electric Co.(PG&E) is one example of the potential devastating financial consequences of these rising risks, seeking bankruptcy protection as its potential liabilities for wildfires in 2017 and 2018 exceeded US$30 billion. Similarly, back-to-back winter storms early in 2018 led to lengthy outages in the greater New York area. These and other earlier events, like Superstorm Sandy in 2012, have put resilience front and center in policy and planning forums.

At the same time, the president’s National Infrastructure Advisory Council (NIAC) looked at the United States’ ability to withstand a catastrophic power outage with consequences that are severe, widespread, and long-lasting (months or years). In a December 2018 report, NIAC found, among other things, that there was no common agreement on the level of redundancy or resiliency that should be built into critical utilities to lessen the risks and impacts of a long-term catastrophic power outage.

While the electric industry has always been focused on reliability, resiliency is emerging as a separate and different, but important, priority. Reliability has focused on reasonably expected outages and sudden disturbances, while resiliency focuses on the ability to withstand and reduce the magnitude and/or duration of an extreme, disruptive event. The response to a resilience event typically requires a process and capability well above normal operations.

Federal Regulatory Energy Commission (FERC) initiated a resilience docket in January 2018, but after a comment period, that docket has been relatively dormant, although the commissioners have expressed their interest in the topic. Recently, FERC’s Chairman, Neil Chatterjee, has floated the idea of a FERC-state task force as a next logical step.

Generation Adequacy is an Issue in Selected Markets

With the shift in the U.S. generation mix to more gas-fired resources, away from other fuels, one area that has been identified as a resilience risk is the dependency of the power grid on gas deliverability. Extreme weather, such as extended cold snaps, can elevate this risk. Recent studies by the PJM Interconnection, ISO-New England, NERC, and the Department of Energy, among others, show that different regions have different resilience issues, depending upon the fuel mix, delivery reliability (such as heating season gas pipeline capacity availability), and anticipated generation additions. Early assessments from NERC show a few sub-regions — two in the West, one in the Southeast, and Texas ― could fall below target reserve margins if a large volume of existing coal and nuclear-generating units retired quickly. NERC had several recommendations, including enhanced resource planning that includes fuel assurance analysis and more regulatory flexibility, specifically expedited processes to permit transmission upgrades and energy infrastructure.

PJM and ISO-New England have focused particularly on resilience issues during extreme winter cold snaps. A recent PJM report concluded that even with accelerated retirements the grid would be reliable except under extreme circumstances, that is, a long-duration cold snap with extreme winter load, the unavailability of non-firm gas services, a severe pipeline disruption, and the inability to replenish oil supplies (for reserve and dual-fuel generators). As with the NERC study, grid operator analyses focused on fuel security and flexibility in implementing market rules to achieve enhanced resilience.

Can the United States Deal with a Worst-Case Scenario?

Generator retirements are relatively predictable or at least occur over a timeframe that permits adaptation of energy infrastructure and operations. But even without generation retirements, other risks, such as weather (hurricanes, extended extreme cold), cybersecurity events, and geo-magnetic or man-made electromagnetic pulses, continue to threaten grid resilience. Rapid recovery from these events is what both government officials and utilities are interested in.

While the government and utility industry continue to improve their response to natural disasters, cybersecurity threats, and other events, concern remains over “black swan” events that could impact the grid. NIAC recently examined the nation’s ability to respond to a catastrophic power outage of a magnitude beyond modern experience. This event was characterized by long duration, a wide geographic area, severe cascading impacts into other infrastructure sectors (for example, water, gas, communications), and potentially exacerbated by a cyber or physical attack.

NIAC recommended: (i) development of a national approach to such power outages, including clarification of authorities and guidance between federal, state, community, and infrastructure providers and (ii) improving understanding and mitigating cross-sector impacts and cascading failures. One practical step is to conduct regional catastrophic power outage exercises that look at second- and third-level dependencies, identify lessons, and implement improvements in available resources and processes to respond to this type of event.

Industry’s Approach to Shoring Up Resilience Capabilities

So, what should the electric industry do about resilience risks? As noted earlier, FERC has taken some steps to look at this issue, as a separate docket item and as part of its regular reliability oversight. As the nation’s electric reliability organization, NERC has been active as well.

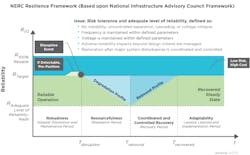

As noted previously, NERC has conducted special studies of resilience issues and socialized results with the industry. It has also developed a resilience framework, aligned with NIAC’s resilience framework. This framework is focused on four pillars: robustness (prevention), resourcefulness (resistance to degradation), rapid recovery (coordinated and controlled), and adaptability (learning lessons from events). NERC is incorporating this framework into its assessment activities as a reliability organization.

Utilities are also learning from past events and incorporating those lessons into operating and capital plans. In Florida, Florida Power & Light (FPL) made investments in its system that allowed for restoration within two days after Category 5 Hurricane Irma hit the state, as compared with 5.4 days for restoration after Hurricane Wilma in 2005. Likewise, in California, PG&E has implemented more pro-active de-energization plans after wildfires, some sparked by power lines, devastated parts of that state.

The Bottom Line

Resilience will continue to be an area of focus for transmission and distribution utilities and grid operators. It will, however, compete with other priorities, such as system flexibility, renewables integration, and grid modernization, for attention and funding. But utilities can make investments that have multiple benefits, including resilience, and they can make a more compelling case to regulators that customers are getting more “bang for the buck” as system benefits are aligned. For example, distribution automation can provide flexibility, but it can also be configured to harden the grid. Utilities must proactively develop risk management, grid-hardening, and disaster recovery and resilience plans in anticipation of extreme weather events. Close coordination with regulators and other stakeholders is needed to ensure public acceptance and timely and adequate cost recovery.