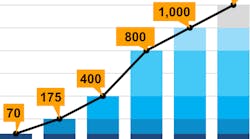

PG&E Corp. plans to underground about 3,600 miles of power lines in California in the next five years, scaling steadily toward that number and topping 1,000 miles annually in both 2025 and 2026.

Speaking to analysts and investors after reporting a fourth-quarter net profit of $472 million – PG&E’s adjusted earnings per share of $1.08 beat analysts’ estimates by 8 cents – CEO Patti Poppe and CFO Chris Foster added numerous details to the broader 10,000-mile undergrounding target the parent of Pacific Gas & Electric rolled out last summer as part of its work to lower fire risk. Among them are:

- PG&E completed 70 miles of undergrounding projects in 2021 and has so far this year wrapped up work on another 14 miles. The goal for 2022 is 175 miles and that target will roughly double in both 2023 and 2024, when the plan calls for 800 miles worth of work.

- The company’s target cost per mile this year is $3.75 million but is expected to fall steadily to $2.5 million in 2026. Poppe said the various projects for which PG&E has contracted range quite considerably in cost – some are already as low as about $2 million per mile – but that window will narrow as the utility scales its work and works with contractors to refine workflows and use new technologies.

“It's pretty exciting stuff which gives us confidence as we ramp up and scale this program – with the right equipment, with the right partners, with the right work process – we can dramatically reduce our costs every year.”

- More than half of the nearly 600 miles the company expects to complete by the end of next year is either already scoped, ready for construction or under construction.

- Poppe said the massive investment project – at an average cost of $3 million per mile, work through 2026 would cost nearly $11 billion – will have a “minimal” additional impact on customers. PG&E will late this month file its 2022 wildfire mitigation plan and an update to its 2023 general rate case that will reflect undergrounding plans in more detail.

On their conference call, Poppe and Foster also said they are looking to trim PG&E’s non-fuel operations and management costs by 2% annually to help account for capital spending plans estimated to total $53 billion by the end of 2026. Foster said the plan, which is a tack from the company’s approach of targeting $1 billion annually in productivity savings, will look to improve the efficacy of field operations as well as secure better pricing on supplier and contractor deals.

Shares of PG&E (Ticker: PCG) fell more than 7% Feb. 10, closing at $11.39. They are, however, still up 20% over the past six months.