The United Kingdom is moving to a decarbonized energy sector and isn’t shying away from experimentation to get there. It became the poster child for utility business model reform when a comprehensive performance-based ratemaking outline, the revenue using incentives to deliver innovation and outputs — known as RIIO, was initiated in 2010. The United Kingdom is now refining its model as it prepares for a second multi-year price period. North American utilities are watching to see how the United Kingdom’s arrangement furthers its social goals while balancing other objectives, such as supply adequacy and affordability.

RIIO: History and Adaptation

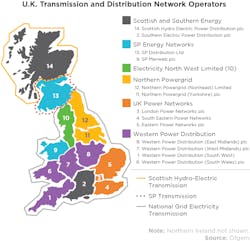

In 2008, the Office of Gas and Electricity Markets (Ofgem) — the United Kingdom’s energy regulator — began a multi-year assessment of the existing regulatory construct. The agency concluded that the then-existing regulatory system would not sufficiently encourage or reward transmission network operators (TNOs) and distribution networks operators (DNOs) for taking a leading role in decarbonization. Further, the assessment found that to build a network capable of addressing climate change the network companies would need to take risks, innovate, and focus on customers.

Ofgem proposed a new model to “drive smarter and more sustainable networks to deliver a secure, low- carbon energy sector and long-term value for money for consumers.” The performance-based regulatory model adopted by Ofgem sets revenue using incentives to deliver innovation and outputs—thus the name “RIIO” was born.

Under the RIIO framework, network companies submit business plans for multi-year price control periods. Ofgem approves the plans and sets cost allowances that can be collected during multi-year price control periods.

This first price control period, known as RIIO-1, was set for eight years in order to encourage long-term planning and investments. It was launched in April 2013 for TNOs and April 2015 for DNOs. During the price control period, network companies may receive reward incentives for delivering on desired outputs and using innovation to manage totex — a combination of capital expenditures (that is, capex) and operating expenditures (that is, opex).

Despite being roughly halfway through RIIO-1, Ofgem has begun planning for RIIO-2. Key design features and methodologies have been established for TNOs and the same elements will be considered for DNOs.

Stakeholders in the United States have long watched the development and implementation of RIIO-1. It is clear that RIIO-2 will be equally instructive as Ofgem makes revisions to the overall framework.

In particular, three key themes have emerged from RIIO-2, as Ofgem works to achieve RIIO’s long-term goal of decarbonization: customer focus, managing uncertainty, and innovation.

Renewing the Consumer Focus

The first key theme that has emerged from RIIO-2 is a renewed focus on the consumer.

The success of network operators in RIIO-1 produced return on equities (ROE) well above benchmarks set at the beginning of the period. As a result, ROE has become a closely watched number in RIIO-2. In May 2019, Ofgem confirmed the methodology that will be used to calculate the allowed ROE in RIIO-2.

Using current economic conditions, Ofgem estimates the baseline allowed ROE would be 4.3% — a figure almost 50% lower than the baseline established in RIIO-1. Ofgem assumes an additional 0.5% will be earned through incentives, thereby providing investors a total ROE of 4.8%. Network companies have expressed concern that the ROE is too low to spur the investment required for decarbonization.

According to Ofgem, the lower ROE coupled with a lower return on debt will reduce consumer costs by £6 billion (US$7.3 billion) compared with RIIO-1. This equates to an average of £25 (US$30.5) per year reduction in domestic consumer bills.

In addition to savings on utility bills, RIIO-2 has revised output targets to be more consumer-facing and has given consumers a stronger voice both in the setting of the price control and in day-to-day operations. The six output categories from RIIO-1 are now consolidated into the following incentives:

- Meeting the needs of consumers and network users

- Maintaining a safe and resilient network

- Delivering an environmentally sustainable network

Ofgem has also established stakeholder groups consisting of expert consumer advocates and network users to challenge proposed business plans and monitor the delivery of approved business plans.

Managing Uncertainty Amid Change

The second key theme emerging from RIIO-2 is a desire to manage uncertainty amid change.

Ofgem’s early assessment of RIIO-1 was that “some cost allowances were set too high in hindsight and some performance targets were set too low.” More importantly, the RIIO-1 framework limits Ofgem’s ability to reset previously approved cost allowances (for example, annual budgets) and output targets.

Looking forward, Ofgem notes that the uncertainty about the future, such as technology costs or consumer demands, makes it difficult to predict the cost allowances necessary for the future. Based on this dynamic, Ofgem decided to reduce the price control period from eight years in RIIO-1 to five years in RIIO-2. The shortened timeframe will allow more regular assessments and course corrections as the industry undergoes a period of intense change.

Other notable changes in RIIO-2 include a move to indexing rather than forecasting for key variables, such as interest rates. Ofgem notes the change will reduce the harm to consumers from forecasting errors.

RIIO-2 will also include an automatic correction mechanism — called a return adjustment mechanism — to protect against the risk of extreme deviations from the start of the price control.

Expecting and Expanding Innovation

A third theme clearly evident in the RIIO-2 framework is the importance of innovation.

In RIIO-1, Ofgem encouraged innovation in business plans and provided innovation stimulus for larger efforts. Because of the success of these early efforts, Ofgem observed the culture of network operators has shifted and they are increasingly willing to finance innovation efforts going forward.

During RIIO-2, network companies will be expected to finance short-term, lower-risk operation and maintenance innovation as a business as usual activity. These innovation investments will be rewarded through the totex innovation mechanism.

Ofgem also plans to restructure the innovation stimulus provided during RIIO-1. Initial plans include reforming an existing fund to focus on the longer-term energy system transition and addressing consumer vulnerability.

In addition, a new fund will focus on strategic challenges while leveraging other public sector innovation funds and increasing third-party involvement in network innovation.

Durable and Successful Over the Long Term?

The United Kingdom and the RIIO framework remain the poster children for utility business reforms. More importantly, the performance-based ratemaking case study now offers an even richer set of lessons learned.

With RIIO-2 taking shape, it is evident which features Ofgem believes require attention, to ensure the regulatory construct remains durable and successful over the long term.

Stakeholders in the United States can continue to learn valuable lessons from the United Kingdom. The latest reforms show long-term success may depend on a strong focus on the customer, a program design that manages uncertainty, and relentless attention on innovation.

Time will tell if the United Kingdom can decarbonize, while balancing the needs of consumers and network companies. TNOs will begin the RIIO-2 price control period in 2021.