Con Edison Projects Explore the Potential of Energy Storage

Rapid improvements in battery technology have given storage great potential as a tool to help energy companies manage peak demand, lower investments in new infrastructure, and meet environmental goals.

Some experts hail storage as the “holy grail” for the energy industry. The ability to store energy at periods of low demand and provide it to customers when demand is high makes storage a flexible, unique and valuable resource to meet a wide variety of reliability and resiliency needs.

Yet, the deployment of storage in the United States has been limited. Costs, performance uncertainty, regulatory requirements and market realities have hindered the adoption. Although 77 MW of new utility-scale energy storage were announced in the United States in the first half of 2017, more than 75 percent was in California. Lacking California’s mandates and subsidies, most energy companies struggle to overcome the financial and regulatory barriers to energy storage deployment.

At Con Edison, we believe we can overcome those barriers and that storage will play a particularly integral role in New York City’s unique environment, where demand peaks are extreme, reliability standards are high, and city and state carbon reduction goals are aggressive. Our company is running a portfolio of storage demonstration projects under New York State’s Reforming the Energy Vision (REV) proceeding. With these projects, the company is testing new business models and trying to establish storage as a resource to help Con Edison maintain our industry-leading reliability and defer investment in traditional utility solutions. Two projects in our portfolio look to overcome financial barriers through stacking value across the customer, utility, and wholesale markets.

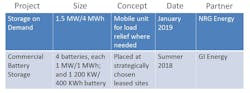

The first, Commercial Battery Storage, is a 4.2 MW/4.4 MWh system that aims to reinvent the traditional behind-the-meter model by simplifying the customer value proposition to provide value across all stakeholder groups. Our second project, Storage On Demand, is a 1.5 MW/4 MWh mobile storage solution that utilizes trailers to stack value for wholesale markets and multiple transmission and distribution needs.

Commercial Battery Storage

Our “Commercial Battery Storage” project explores an alternative to more traditional “behind-the-meter” batteries, which are owned by customers to reduce their own peak demand and associated charges. But this business model significantly limits the market for storage because it is only economic for a small number of customers and provides nominal benefit to the utility.

The value of demand charge reduction can vary significantly, which narrows the pool of customers who can profitably install a behind-the-meter battery. This business model only works for customers with a specific “peaky” load shape -- high, short duration peaks. For example, a 2-MW/1-MWh battery system could theoretically reduce a customer’s monthly demand charge by 2 MW over 30 minutes, yielding approximately $568,800 in savings in a year. But another customer with a flatter and longer peak may get only a 200-kW demand charge reduction from the same battery system, worth only $56,900 in a year which would not be enough to offset the cost of installing a battery system.

The limited market size raises the developer’s customer acquisition costs as they embark on a virtual scavenger hunt to find viable customer sites, further inhibiting project economics. They must also sell prospective customers on a complex value proposition that includes savings on demand charges, backup power, and the potential demand response program participation.

The project economics are further restricted by the limited value a behind-the-meter battery provides to a utility. This is due to issues with location, size and dispatch timing. The utility must build the networks and system to meet the peak hour of the year. A reduction in peak demand for a customer with behind-the-meter storage is not necessarily coincident with the network or system peak, which means the utility still has to manage to the same peak.

Additionally, a customer battery is sized to manage customer peak, which is much smaller. Therefore even if a customer peak is coincident with system need, the reduction is rarely enough to offset the required transmission and distribution upgrade. Finally, the utility distribution deferral value stream depends on location. If a customer reduces demand on a network with excess capacity, the battery system provides minimal distribution value.

Our project offers a simpler value proposition – a lease payment in exchange for customer space to locate a battery ahead-of-the customer meter. By disconnecting the project economics from the customer load, the battery can be used primarily for utility need, sized larger and strategically located.

Con Edison has provided GI Energy with a list of geographic areas in networks that will experience a capacity constraint in the next five years. GI Energy is using this information to find four customers with the outdoor space for a battery storage system.

Con Edison will pay GI Energy a quarterly fee in exchange for the dispatch rights under a five-year contract. This ensures the storage dispatch will be coincident with utility demand and located in an area of need. When Con Edison is not using the assets for grid support, GI Energy will dispatch the batteries into NYISO markets to capture additional revenue. GI Energy and Con Edison will split the revenue, offsetting the costs of the battery system for Con Edison’s customers. Full system commissioning is scheduled for summer 2018.

Storage On Demand

Con Edison has partnered with NRG Energy for the “Storage On Demand” project, which aims to maximize the value of the batteries by deferring multiple transmission and distribution investments in addition to enabling wholesale market participation over the 10-year asset life. The greatest value stream for batteries is providing transmission and distribution investment deferral, but this application is typically a 3-year need before additional investment is required to meet grid demands. The mobility of the “Storage On Demand” units allows Con Edison to defer multiple investments in multiple areas of our system during the system’s asset life, while also earning revenues from the wholesale market.

Con Edison is trying to unlock a significant amount of value that usually goes to waste. According to the Rocky Mountain Institute report “The Economics of Battery Energy Storage,’ most battery systems are unused or not utilized to their potential for more than half their lifetime. For instance, a storage system dispatched only for demand charge reduction is used for only 5 to 50 percent of its useful life.

NRG Energy has designed three 500 kW/1.34 MWh tractor trailers measuring 30 feet in length and outputting at either 120 volts or 480 volts. At these voltages, Con Edison can deploy the assets on the majority of our secondary distribution networks in New York City and Westchester County, NY, the area we serve. We will be able to deploy the units individually or in aggregate to support distribution needs.

NRG and Con Edison will split the revenue from the wholesale market, with Con Edison using its share to offset the costs of the system. Con Edison, as the owner of the batteries, will call the assets when needed for deployment onto the system. We anticipate the initial uses will be full deployment for peak shaving on constrained networks or partial deployment (one or two trailers) to support low-voltage incidents.

The first few deployments of the mobile units will provide many lessons on disconnecting from Astoria, interconnection once deployed, permitting, and transportation. Con Edison will use this demonstration period to streamline the deployment process and reduce deployment time from the current estimate of 2.5 days. Reducing the deployment time will let us use the assets for more emergency response needs in the future, similar to a mobile generator, but cleaner and quieter than a traditional diesel generator.

Con Edison will test additional use cases to extract additional value from the mobile assets. These uses could include serving temporary load needs such as new construction or electric cranes. As we continue to identify use cases, the values will stack with wholesale revenues to offset the cost of the units. We envision a versatile, low-cost distribution asset for Con Edison and our customers. The system is expected to begin operation in January 2019.

Consistent with REV Goals

Con Edison is leading New York in the transition toward the REV goals of a cleaner, more resilient and affordable energy system and easier access for customers to distributed energy resources. We are particularly interested in storage’s potential to help the state meet its environmental goals through managing renewable intermittency and managing peak demand.

The 2015 State Energy Plan sets a goal that 50 percent of all electricity used in New York should be generated from renewable sources by 2030. The Plan also seeks to reduce greenhouse gas emissions by 40 percent in the same timeframe. The Department of Public Service estimates the state will need an additional 30,000 gigawatt hours of renewable energy, along with significant energy efficiency, to achieve these targets.

As the economics of battery storage improve, the technology can also play a crucial role in managing the peak demand in constrained networks. Con Edison’s system experiences an extreme peak that presents an opportunity for energy storage; about 2 percent of peak demand occurs for less than 24 hours a year. By charging the batteries at night and discharging during peak, we can prevent more expensive, less clean peaking plants from dispatching.

The final market driver for storage in New York is non-wires solutions, a REV initiative which encourages utilities to invest in innovative alternatives. Con Edison can earn financial incentives by using distributed resources to defer or even avoid traditional transmission and distribution investment to the economic benefit of customers. In our first non-wires solution, the Brooklyn-Queens Neighborhood Program, customer-sited storage is part of a portfolio deferring a $1.2 billion substation.

We filed our demonstration projects with our regulator earlier this year and have made tremendous progress in the development of our business plans, but challenges remain. Con Edison is ready to meet those challenges and harness the value of storage on behalf of our 3.4 million customers.

About the Author

Adrienne Lalle

Project Specialist in Distributed Resource Integration

Adrienne Lalle is a project specialist in Distributed Resource Integration for Con Edison of New York and is managing the company’s storage demonstration projects.