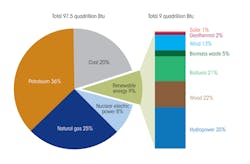

Globally, the total installed renewable generation capacity has exceeded 1,470 GW. That mark was hit in 2012, the latest available figures. By all indications and reports, 2013 continued to be a great year for green energy installations. Not only that, but 23% of all the electricity generated globally came from renewable energy resources in 2012. These are amazing figures considering there were roughly 18 GW of solar generation installed worldwide in 2000.

Equally amazing is what has taken place with photovoltaic (PV) solar technology. In 2007, a little less than 10 GW of PV systems had been installed in the entire world. In the five years from 2007 to 2012, PV grew to more than 100 GW of capacity. Incredibly, it was not huge installations making up this base; small-scale solar generation was responsible for the growth.

Rooftop PV panels have been the leading solar technology. According to Navigant Research, rooftop PV (less than 1 MW) accounted for 69% of all PV solar installed in 2012. Tens of thousands of homeowners and small business owners have installed hundreds of megawatts worth of power-producing arrays made of semiconducting wafers that convert the sunlight into electric power.

Disruptive Generation

The rush to rooftop PV may possibly be one of the biggest game changers to hit the electric industry. Every building has a roof that can be adapted to some form of PV panel installation. Rooftop solar was made for distributed generation (DG), but some pundits say DG really stands for disruptive generation.

The jury is still out on that because the technology offers both advantages and disadvantages. Technologically, PV offers benefits in the form of clean energy with no noise pollution, power produced right at the point of consumption and aiding utilities in avoiding massive infrastructure-addition costs.

There is a dark side, too, unfortunately. The installation of large amounts of these small-scale PV systems presents utilities with some risky operating problems, such as fluctuating voltages along the feeder, reversal of power flow direction on those feeders and possible impacts to power quality.

This form of DG has become a rooftop rebellion on the part of the consumer. There are times during the day PV panels produce more power than consumed. Regulators have put in place incentives for the PV owner to sell excess power back to the utility, which is referred to as net metering.

That seemingly simple concept has led to some complex ramifications concerning the basic utility business model. As customers cut their electric bills, utilities are losing revenue, but it’s more than that. The utilities are still responsible for providing a reliable electric grid for everyone connected to it. The rooftop PV owners are taking power from the grid when the sun is not meeting their needs.

As higher concentrations of rooftop PV are installed along the distribution feeders, utilities are being forced to rethink their business. Last year, National Geographic reported that David Owens, executive vice president of business operations for the Edison Electric Institute (EEI), addressed a major utility concern. Owens said, “It’s not about lost revenue… We want to make sure the grid is maintained, that it can be maintained and that cost shifting does not occur.”

Disruptive Challenges

EEI delved further into the technological issues facing utilities in an early 2014 report, “Disruptive Challenges: Financial Implications and Strategic Responses to a Changing Retail Electric Business.” This report outlines a variety of potentially disruptive technologies emerging onto the power grid, such as battery storage, fuel cells, wind generation and micro turbines.

Rooftop PV, however, has become an embraceable technology for the customer. It is simple to understand, has no moving parts — reducing maintenance to a minimum — and is readily available. However, economics have proven to be the major consumer benefit. The price of PV panels has been dropping while electric rates have been increasing. According to a Bloomberg BusinessWeek report, PV panel pricing dropped significantly from 2008 through 2012.

Bloomberg pointed out that a PV panel cost US$3.80/W in 2008; today, it costs around $0.86/W. It is not surprising sales of PV panels are projected to grow by 22% annually through 2020. A report published by the Energy Information Agency (EIA) found PV systems have reached what it calls “grid parity” in several areas of the U.S. such as California and Hawaii.

Disruptive Economics

In its simplest definition, grid parity takes place when PV-produced electricity costs at or below retail electricity prices. EIA found this has happened for approximately 16% of the U.S. retail electricity marketplace.

According to the EIA report, electric consumers can justify investing in solar panels wherever the utility rates are at or above $0.15/kWh. When this is combined with EIA projections of the cost of solar power at $0.13/kWh by 2018, it is easy to see why the growth is taking place.

The growth is not just taking place in the U.S.; Schneider Electric’s Smart Grid website quotes a 2013 study released by the Deutsche Bank that estimates the European solar market will transition from being subsidized to being sustainable by sometime in 2014, which is a key step in grid parity.

Disrupted Grid

Recent news stories back up these reports. One article reported that, during 2013, a new rooftop solar system was installed every four minutes in the U.S. Bloomberg estimates in the last two years, 2012 and 2013, about 200,000 U.S. homes and businesses added rooftop solar.

To give these figures some perspective, California leads the U.S. with its installed rooftop solar capacity, which was about 2 GW at the close of 2013. California’s Pacific Gas & Electric (PG&E) has more distributed solar customers than any other utility in the U.S. PG&E has about 25% of all the rooftop PV installations, which equates to something like 95,000 customers.

An interesting side note, it took California roughly 30 years to install its first gigawatt of rooftop PV, but the second gigawatt was installed in just one year, 2013. The experts are saying in the next five years, California will continue to set records for these types of installations of distributive generation.

A Changing Environment

In addition to the societal forces powering the rooftop revolution, there are business opportunities fueled by tax credits from local, state and federal levels. In a recent report, the National Renewable Energy Laboratory (NREL) investigated various options driving the deployment of PV rooftop systems.

NREL found a very interesting driver that does not cost the homeowner anything. The homeowner contracts with an equipment provider such as SunEdison, Sungevity, SunRun and Vivint. In turn, they install and maintain the solar equipment on the homeowner’s roof.

The homeowner pays a set rate for the electricity, and the provider gets additional funding from the utility for any power feed into the grid. The provider also gets tax credits, subsidy programs and other incentives from the various governmental departments.

It is a program gaining a great deal of momentum that has added tens of thousands of PV systems to the grid. Even Google has gotten into the act by participating in rooftop power ventures with these urban-scale PV developers. Google has invested hundreds of millions of dollars in programs such as SunPower’s fund that leases solar panel systems to homeowners and building owners. It also has invested in SolarCity’s fund to finance solar systems for homeowners.

With funding options like these, rooftop PV is no longer the realm of the wealthy. It has become available across all income levels. As a result, the transmission and distribution infrastructure is facing major modification to mitigate this unpredictable behavior brought about by bidirectional power flows.

Electricity follows the laws of physics where current flows from higher voltage levels to lower voltage levels. So, when the power generated by the rooftop PV exceeds the energy consumed at the point of use, the excess electricity reverses flow.

The power goes back toward the grid and the voltage level on the feeder rises. If clouds pass over the PV panels, the output drops, power flows in the other direction and the voltage level on the feeder drops. Utilities with high levels of rooftop solar have feeder voltage fluctuations ranging between 20% and 30%. All these variations can result in problems for both the utility and the consumer.

Both overvoltage and undervoltage are harmful to the customer’s electronics and the utility’s equipment. The Institute of Electrical and Electronic Engineers (IEEE) recommends not exceeding a 15% PV penetration, but this recommendation has become a point of contention from both sides of the issue.

What to Do?

As penetrations of PV increase, voltage impacts are being addressed by mechanically switched devices such as capacitor banks, voltage regulators, load-tap changers and bucking transformers located on the distribution system. Being mechanical, however, their response is slow and cannot keep up with fast voltage fluctuations because of the intermittency of the large numbers of rooftop solar installations on the feeders.

Utilities have been installing additional capacitors and voltage regulators on the distribution feeders. In some cases, they are investigating reconductoring those feeders. Many utilities have been petitioning regulators to place moratoriums on the installation of more rooftop solar. They say studies need to be performed to determine what is taking place on the system. Regulators agree, which is causing a lot of discussion from experts on both sides of the issue.

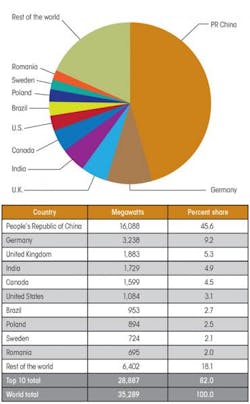

Solar advocates point out PV levels exceed the IEEE recommended amount of 15% substantially in many parts of the world. In Germany, for example, the grid has up to five times that amount in some areas and has been operating with no problems.

Utility groups, on the other hand, are conservative. They have to be because outages are so devastating socially and economically. Therefore, they are taking a stand to slow down the installations until detailed studies can be completed before moving forward into this uncharted sea.

Adding Technology to the Grid

The U.S. Department of Energy (DOE) is funding several solar projects to develop new countermeasures for the grid to overcome PV-induced issues. DOE is investigating power electronics in the form of flexible ac transmission systems (FACTS) controllers to improve the distribution network. DOE also is working to develop smarter, more interactive systems and components to integrate more solar into the grid through its Solar Energy Grid Integration-Advanced Concepts (SEGIS-AC) program. Companies such as GE, Advanced Energy, Alencon and SolarBridge are taking part in the DOE SEGIS-AC program.

One such DOE SEGIS-AC project is the development of smarter inverters for the rooftop PV. The inverter is the brains of the solar array. The advanced version has a digital architecture with bidirectional communications ability and software to smooth out the intermittent power flow so common in rooftop installations. Experts agree that today’s inverters are technically able to perform the smart functions.

ABB, working with Kyocera and Autonomous Energy, installed 400 modules of PV rooftop arrays on its Moorebank facility in New South Wales. The installation is made more efficient by the ABB PVS800 central inverter, which is a smart device that converts the dc generated by the PV modules into high-quality ac and feeds it into the distribution network.

FACTS Sized for Distribution

Another promising technology can be found in FACTS controllers. They have proven attractive for distribution circuits because of their fast response times, smooth control and cyclic (repeated) operation. Many FACTS controllers have been adapted to the distribution grid with the advent of voltage source converter (VSC) technology. Devices such as static volt-ampere-reactive (VAR) compensators (SVCs) and static synchronous compensators (STATCOMs) have become small enough to work on the distribution network.

These devices offer dynamic voltage control, dampen power oscillations, improve stability when transients are impacting the feeders and control reactive power. ABB, Alstom Grid, AMSC, S&C Electric, Siemens and Mitsubishi are supplying these devices to utilities around the world.

There are many volt/VAR optimization schemes being applied to the distribution network to address the balance of reactive power to active power using power electronics. S&C has developed some unique SVC/STATCOM applications combined with two-way communications and voltage sensors on the feeders along with intelligent controls for capacitors, load-tap changers and voltage regulators. This approach uses real-time conditions, which allow for optimization of the volt/VAR response needed by the network.

Where to Next?

A few years ago, rooftop solar was an interesting footnote to the spread of renewable energy. Who would have guessed small-scale PV would have impacted utilities much less the distribution feeder so dramatically? Governments have encouraged such deployments by offering tax credits and other incentives. Regulators have passed laws to encourage net metering. Developers have seen profits to be made and jumped in with both feet. Utilities have been left to make it all work.

Once again, utilities are turning to new technologies to address the issues and problems brought about by other new technologies. The transistorized SVC and STATCOM technology are taming the wild voltage fluctuations one distribution network at a time. One thing is certain, there is no going back to the unidirectional grid of yesterday. More distributed renewables are coming on-line every day. It is vital to ensure the distribution network can handle the megawatts of PV being installed on the rooftops. Who would have guessed?

About the Author

Gene Wolf

Technical Editor

Gene Wolf has been designing and building substations and other high technology facilities for over 32 years. He received his BSEE from Wichita State University. He received his MSEE from New Mexico State University. He is a registered professional engineer in the states of California and New Mexico. He started his career as a substation engineer for Kansas Gas and Electric, retired as the Principal Engineer of Stations for Public Service Company of New Mexico recently, and founded Lone Wolf Engineering, LLC an engineering consulting company.

Gene is widely recognized as a technical leader in the electric power industry. Gene is a fellow of the IEEE. He is the former Chairman of the IEEE PES T&D Committee. He has held the position of the Chairman of the HVDC & FACTS Subcommittee and membership in many T&D working groups. Gene is also active in renewable energy. He sponsored the formation of the “Integration of Renewable Energy into the Transmission & Distribution Grids” subcommittee and the “Intelligent Grid Transmission and Distribution” subcommittee within the Transmission and Distribution committee.