Face it, wind generation is not a good fit with the legacy power grid, and the entrepreneurial wind industry is not a natural culture match with electric utilities. But that has not stopped the power industry from consistently taking the initiative to resolve technical roadblocks, either through cooperative funding or the efforts of individual utilities. Over time, wind advocates, grid operators and regulators have developed an effective, though somewhat wary, partnership. The results of that cooperation go far beyond the dreams of the early wind pioneers.

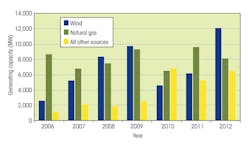

The world’s first wind farm, Crotched Mountain, was built in 1980, in southern New Hampshire. Although initially pretty much unnoticed, it was the beginning of U.S. leadership in harnessing the wind to serve complex electric networks. In little more than three decades, wind generation has grown from nothing to about 6% of total U.S. generation capacity. Last year, the record was broken for new wind installations — 12,000 MW nationwide — a 25% increase that exceeded capacity additions from any other fuel source.

Now the Alta Wind Energy Center in Southern California, a refined grandchild of Crotched Mountain, is one of the world’s largest wind energy projects. With legislated markets created by state renewable portfolio standards, as well as both state and federal financial incentives, installed wind generation is expected to continue its exponential rise.

Sometimes Not Enough

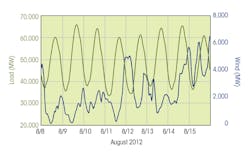

As installed wind generation capacity inches toward 6% or more of system nameplate generation capacity, system impacts have emerged, the biggest being that wind availability generally does not correlate well with the peaks and valleys of the diurnal demand curve.

Having wind resources from across a large and diverse geography does not necessarily smooth out the variability. PJM Interconnection is the largest power grid in North America and the largest electricity market in the world, covering all or part of 13 states and the District of Columbia. As Terry Boston, CEO of PJM, pointed out, “At PJM, we only count on 13% of our total wind capacity to contribute during peak because, on the hottest and coldest days, the wind has a habit of not blowing. Thirteen percent is high compared to some other system operators, and that’s because of PJM’s diversity and big footprint.”

Timing Is Everything

An example of radical wind variability of a different sort happens occasionally in Northern California. Usually on warm summer days, the rising heated air in the Central Valley causes cool ocean air to flow through the coastal passes, including where the Altamont wind farm is sited just east of the San Francisco Bay. The resulting afternoon breezes generate power that is somewhat coincidental with early evening air-conditioning loads. However, the hottest days, and therefore the highest air-conditioning loads, occur when hot easterly winds cancel out the onshore winds, and wind generation goes to zero just when it is needed most.

Even within a 24-hour cycle, wind can vary widely over a few minutes or even seconds. Overly optimistic analyses of potential stability issues simply plug in the more available hourly averages. That is a huge mistake because supply and demand must match on an instantaneous basis, not on an average. And, since the amount of power generated by a wind turbine is proportional to the wind speed cubed, a gust that doubles the wind speed causes the output power to surge by a factor of eight, unless purposely reduced.

Sometimes Too Much

Wind generation has at least two unfair advantages that sometimes cause problems with the optimal economic dispatch process, putting wind in front of the line:

- Federal renewable electricity production tax credit (PTC): This 2.3 cents/kWh tax credit is for electricity generated by a qualified wind energy resource and sold to the grid. PTCs, combined with numerous state and local incentives, enable wind generators to sell energy at a negative price, thus sometimes paying the market to take the power while still making a profit.

- Renewable portfolio standards (RPS): As of January 2012, 30 states had mandatory requirements for a specified percentage of electrical energy to be generated from eligible renewable energy sources by a certain date. California, for example, requires 33% by 2020.

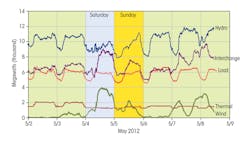

PTC rewards and RPS requirements combine to create some almost bizarre operating scenarios. For example, when the nighttime system load is low and the winds are picking up, as is often the case, wind energy is the least expensive, because the price can even go negative. However, the system operator may not want to turn down thermal plants if the slow-ramping base-load generation is needed for expected rising load.

In most systems, contractual arrangements are made between the purchaser and wind generators, so wind generation can be backed down to play nicely with other grid resources. But in California, legislation in support of the unusually high RPS requires that the California Independent System Operator (CAISO) take all the wind energy offered.

Tim Mason, renewable energy consultant for Black & Veatch, compared CAISO with the New York Independent System Operator (NYISO), which has mostly problem-free experience with wind generators. “CAISO and NYISO are similar in that they both purchase wind energy through individual power purchase agreements, paying a fixed price per megawatt-hour,” Mason said. “However, NYISO can dispatch (lower) the wind generation whereas CAISO cannot since it is under a hard renewable procurement constraint. Wind is a must-take generation and is placed in front of the dispatch curve.”

CAISO’s neighbor, the hydroelectric-rich Bonneville Power Administration (BPA), has a similar situation. As Mason pointed out, “BPA, much like CAISO, has must-take contracts with wind generators. On top of that, BPA has a number of environmental constraints that require a minimum level of hydro. They can’t sell the power and they can’t turn it off, either.”

“There’s another option,” said Rick Miller, senior vice president of renewable energy services at HDR Engineering. “If you own and operate a must-run station because of grid reliability requirements or environmental factors, and you have too much wind or solar, or any must-take energy resource that is over-generating, then you have to pay an off-taker to accept your energy. BPA’s in a tight squeeze because it really doesn’t have a revenue source to use for paying someone to take it. It’s the law of unintended consequences.”

At present, these issues are of more concern to the Western Interconnection than to the rest of the country, but that is changing. “So far, the biggest impact has been the increased complexities in dispatch,” said Nivad Navid, consultant engineer at Midcontinent Independent Transmission System Operator (MISO). “But, what’s going to hit us hard as the levels of wind generation increase is the loss of system flexibility. Keep in mind that MISO generation is 65% coal, so the biggest challenge will be having enough rampable capacity to fill in for wind variability.”

When demand exceeds generation, system frequency drops. When generation exceeds demand, the frequency increases. Either condition can lead to catastrophic system shutdown. The challenge for controllable resources in a system with significant wind generation is to provide reliable net load — system demand minus wind generation — a stochastic variable if there ever was one. To provide the near-instantaneous variations in net load, a minimum level of fast-response regulation resources (for example, gas turbines, storage and demand management) must be available for short-term dispatch.

“If you have to add traditional reserves, then you are often increasing the system production cost, negating the value of adding renewables,” Navid said.

If traditional resources are not the entire answer,a more attractive market for new and innovative regulation technologies may help. Recognizing this need, Federal Energy Regulatory Commission (FERC) Order 755 (issued Oct. 20, 2011) established rules to compensate regulation resources according to their speed and accuracy in response to dispatch signals. This was a loud and clear call to duty for the storage industry.

Storage—The Panacea?

In the past, storage technologies have been priced primarily by the difference between on-peak and off-peak energy prices (arbitrage). However, wind has boosted the value of regulation services and new pay-for-performance rulings are expected to recharge the industry. Sited and sized properly, large storage or aggregated smaller storage can offer benefits beyond arbitrage, such as firm capacity, ramping, spinning reserve, frequency regulation and black-start capability.

“Right now, renewables account for a very small percentage of the electric supply, so integrating renewable generation is working fairly well,” said Dan Girard, director of renewable energy and energy storage business development at S&C Electric Co. “However, as renewables become more popular and comprise a larger percentage of our energy mix, utilities will need more control over these naturally intermittent sources.

“Gas turbines and other fast-dispatch generation will play a role in mitigating the impact of renewables on power systems, but energy storage will be absolutely critical to manage renewables,” Girard continued. “A lot of that storage could be distributed. For example, rather than just feeding it back through the meter, energy from rooftop solar panels could be stored on-site for peak demand or ancillary services.”

Larger battery installations can provide both peak shaving and significant system frequency regulation. There have been a number of utility-scale battery installations in the United States. The two largest are PJM Interconnection’s 32-MW battery farm (lithium ion) on Laurel Mountain in West Virginia and the 36-MW (advanced lead acid) system at Notrees Windpower project in Texas, dispatched by the Electric Reliability Council of Texas (ERCOT). Battery advancements have been mostly due to the electric vehicle market, and, so far, the economics and manufacturing issues do not work out for very large utility-scale applications.

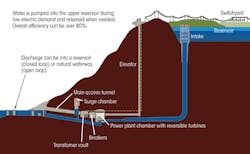

Less expensive per megawatt than batteries and having many times more energy capacity, pumped hydroelectric storage can store energy during periods of low demand and provide capacity during times of high demand. In addition, with ramping rates that can exceed hundreds of megawatts per minute, pumped storage can fill in for rapid wind variations and provide frequency regulation for other contingencies. The United States has 24 licensed pumped storage plants totaling about 16,000 MW, and the largest plant in the world, the 3,000-MW Bath County pumped storage station, is in Virginia.

Existing pumped storage plants were placed at grid locations to partner with base load coal and nuclear plants. Now, primarily because of increasing intermittent generation, the FERC has more than 60 applications for new pumped storage projects. An innovative example is the 1,300-MW Eagle Mountain project in Southern California, which proposes to use two abandoned mines as reservoirs in conjunction with a nearby wind farm.

Pumped storage using conventional reservoirs takes about a decade to build. Fortunately, the mountainous, western United States has several existing waterways, potable water and even snow-making infrastructures where smaller pumped storage projects make sense, depending on permitting issues. Some of these, such as the 320-MW Cabin Creek pumped storage project, just east of Denver, are already developed. Other sites may require modification or an addition to existing reservoirs and installation of pumps and a powerhouse.

Compressed air energy storage (CAES) takes about half the construction time of larger pumped storage. But an underground salt dome or some other cavern is needed. Above-ground, smaller storage may be feasible. The low price of natural gas also is creating new interest in CAES because, in the most common CAES thermodynamic cycle, natural gas is burned with the exiting air in a combustion turbine. The 110-MW gas-burning CAES plant in McIntosh, Alabama, has been operated by PowerSouth since 1991.

More Transmission Coming

As with wind farms, new large storage requires new transmission construction, often over large distances. The North American Electric Reliability Corp. estimates about 25% of new transmission is specifically linked to the integration of renewable resources.

Until recently, major wind-related transmission projects, such as the US$3 billion, 700-mile (1,127-km) high-voltage direct-current TransWest Express project in west Texas, were meant to bring wind-generated power to load centers from distant windy areas. Now, because of the growing need for more transmission to disperse, decongest and balance energy supply and demand throughout each interconnected region, about $15.1 billion is being invested in new transmission projects in 2013, a 36% increase over 2011.

But, what about maximizing the operating value of existing transmission?

“I have sometimes wondered why more transmission-owning companies haven’t been more proactive in opening up the capacity of existing transmission with fairly simple improvements, particularly when the transmission system itself generates revenue through tariffs,” said Scott Feuerborn, department manager, electric system planning at Burns & McDonnell. “Fortunately, things are starting to change. For example, there’s going to be a lot more interest in dynamic thermal rating technologies, many of which have been around for years.”

With a little irony, Feuerborn added, “We’ve got wind to thank for pushing us to more fully use the transmission assets we already have.”

Demand Management

“I spent a lot of my career making generation serve a fluctuating load,” PJM’s Boston said. “Now I have to figure out how to make the load fit some variable generation.”

The ability to directly control significant amounts of customer demand offers some intriguing opportunities to mitigate the grid impacts of wind and other intermittent resources. Smart grid technologies can conceivably link wind farms, control centers and end users, reducing or cycling aggregated loads, such as heating, ventilation and air conditioning (HVAC), water heaters and some commercial lighting during sudden wind power lulls and peaks.

An innovative use of demand management is PJM’s pilot project using electric cars from GM and BMW. The GM

OnStar system provides the project’s Chevy Volts with a dashboard graphic that displays both instantaneous wind power and forecasted power for every five minutes, updated hourly. The driver can then choose to plug in when wind power is most available.

Smarter Wind Generators

Many of the early problems with wind integration were due to the grid unfriendliness of the turbine control designs.

“The last thing you want is to have generators tripping offline,” said Bryan Uhlmansiek, manager of wind energy services at Black & Veatch. “During the early days of the industry, machines would trip during low-voltage or zero-voltage events, but now there are hardware and software improvements to allow them to keep operating during many situations when previous designs would have tripped.

“Even more recent product improvements address the problem of machines going into pause mode for 10 minutes if a gust comes along when the turbine is at full load,” Uhlmansiek continued. “To prevent this from occurring, some manufacturers are now installing software that feathers the blades and protects the drivetrain until the wind dies down.”

The latest inverter designs and even on-site battery storage enable wind machines to provide some level of smoothing and volt/VAR services. Of course, the ultimate goal would be for aggregated machines to provide their own grid impact mitigation.

Where to Go from Here

Is there a limit to how much wind generation any particular system can handle without major mitigation? Yes, almost certainly. But are there any absolute show-stoppers that enough money, time and innovation could not overcome? No, probably not.

Lloyd Cibulka, research coordinator, electric grid research at the California Institute for Energy & Environment at the University of California, has this take on things: “At the technical level, it should be possible to handle just about any penetration level. Just add enough combustion turbines, storage and other technologies that can handle the required ramp rates and intermittency, along with accurate forecasting.”

“However,” Cibulka continued, “do we have enough time to do these things before we start having big problems? And what about the economics? How will this work within the regulatory and market constraints that exist today?”

At this point, the answers to Cibulka’s question are not at all clear. Challenges will continue to pop up, issues will be met and problems will be solved.

As with the wind itself, the power industry just cannot forecast the details.