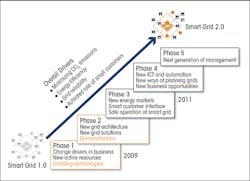

Today’s electricity delivery system is a grid in transition as it shifts from a demand-driven to a bidirectional energy system. New digital technologies are transforming the industry from the traditional analog enterprise to an interconnected flexible structure. New energy sources are making distributed generation a viable alternative to the established large central generation plant. New regulations are becoming more stringent, requiring utilities to be more energy efficient, reduce emissions and provide access to renewable generators to the grid. New technologies are changing the market structure itself as deregulation opens the industry to more competition and new players.

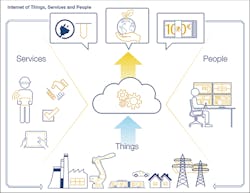

There is also an interconnectivity coming about from the Internet of Things (IoT), and now even services and people dimensions are being added to this evolution. The industry has looked at the convergence of data, sensors, communications and control as the “smart grid” since its introduction many years ago. The smart grid concept was easier to understand than something as nonintuitive as the IoT term seen everywhere today.

Basically, IoT is a technology concept consisting of physical objects — such as appliances, vehicles, systems, buildings and the grid — embedded with electronics, software, sensors and network communications. IoT interconnectivity gives these objects the ability to be sensed and controlled remotely across an existing infrastructure such as the Internet. It integrates real-world objects into computer-based systems.

IoT and IoTSP

In its simplest form, IoT has been referred to as “the nerve ending of intelligent sensing.” The basic technology is based on machine-to-machine (M2M) networking. M2M uses direct communications between devices to enable the devices to exchange information and perform actions without human interaction, which is exactly what the smart grid and its interoperability standards achieve.

One group calls the smart grid the “IoT in action,” which says a lot. Others have taken it a step further with the integration of the services and people dimensions into the concept, which introduces the element of the Internet of Things,

Services and People (IoTSP).

The influx of digital technology and powerful communications systems are forcing utilities to reevaluate their old-school architecture of independent generation plants, separate transmission control centers, individual distribution operations and stand-alone customer relations to meet the new requirements. Microgrid technology is shaking up things a bit, too, as it forces coordination between microgrids and the utility macrogrid.

Many consider these to be disruptive technologies that are accelerating the restructuring of the marketplace. One of the most challenging aspects of the microgrid shift is the phenomena of multidirectional power exchanges (see “Microgrids Go Mainstream,” T&D World, November 2015).

The Prosumer Concept

Microgrids and distributed renewable generation have changed the traditional electricity consumer to a new entity — the prosumer. This includes the residential, commercial and industrial customer. Today, all of these consumer levels are able to generate electric power and feed it to the grid. As a result, utilities no longer have a monopoly on generating power, and the one-way relationship from the utility to the customer has been changed forever. Changes in regulations have created economic incentives for prosumers to own and operate their own power systems.

A report by the U.S. Department of Energy (DOE) and GridWise Alliance titled “The Future of the Grid” stated, “Consumers will use the grid in different ways. More consumers will become prosumers — both consumers and producers of energy. The grid will no longer be just a ‘delivery pipe’ for power. Power will flow both ways, and other ancillary services may also be provided by these new prosumers.”

The prosumer concept goes hand in hand with the transitional changes redefining the power-delivery system, but if that is not enough, the prosumer demands information to flow along with electricity in those multiple directions.

The World Economic Forum reported the Internet revolution has redefined business-to-consumer (B2C) industries. It predicted the impact of the combination of IoT technology with B2C will “dramatically alter manufacturing, energy, agriculture, transportation and other industrial sectors of the economy, which, together, account for nearly two-thirds of the global gross domestic product.”

This IoT-B2C development has been changing business models. In the electricity industry, this innovation is not new. One of the first customer-oriented digital B2C applications came about when the electromechanical electric meter shed its gears to become a solid-state digital facelift.

The venerable mechanical meter came on the scene in 1888 and did not change much in its first 100 years or so of service. Then someone got the bright idea to smarten up this meter. The meter then had the ability to read itself and communicate (one way) directly to the utility with automatic meter reading technology. It did not take long to realize the limitations of one-way communications. Advanced metering infrastructure technology evolved to provide two-way communications, making the meter an energy/communications portal between the grid and customer.

The new smarter digital meter was given the ability to read itself, track customer usage and control the customer’s devices for load balancing. Most importantly, it did all this in real time. It was the classic definition of a disruptive technology in every sense of the term and set the stage for the prosumer movement. The basic technology was not new, but the smart meter application was. It took advantage of M2M networking.

Initially, there was an insufficient population of smart or even semi-smart devices for the utility and the customer to exchange information. In those early days, the devices on both sides of the meter were mostly passive in design.

One Thing Leads to Another

Pilot programs were set up to supply both utilities and customers with smarter devices capable of communicating and reacting to the new technology. The pilot projects were successful and got everyone’s attention. In effect, this provided a new digital awareness in the industry as it moved further in the M2M world.

This is not to say the electricity delivery system was not digitally active until the smart meter technology made its debut. Engineers worldwide were busy integrating digital components into substations, distribution circuits and other areas of the grid. Substation equipment and control systems were undergoing the digital transformation before the smart meter came on the scene, but they did not generate the attention the smart meter did.

Electric apparatus manufacturers were installing digital sensors and monitor gear in their equipment. An ABB survey published in 2015 stated, “More assets, more sensors, more data and more analysis are bringing asset-intensive industries into a new era of asset management, one of unprecedented connection and information.”

Digitally, the stars are aligning. Chips are getting smaller and more powerful while prices are dropping, which places sophisticated computing power directly at the component level. Sensors are capable of addressing multiple applications and have built-in communications capabilities. These improvements mean sensors can be placed where they have never been before, such as directly in substation equipment, conductor, bus work and other components.

Distribution circuits were given intelligence to identify where faults were and the ability to isolate those faults without the intervention of a human operator. Transmission circuits were given the ability of dynamic line ratings that enable the technology to determine the best power loadings for the circuit based on real-time conditions.

How Big Is Big?

Smart meters were thought to be the next big thing, but those thinkers were not thinking big enough. The new meters may have brought awareness of M2M to the industry, but that was not the entire story. The smart grid concept pointed out the traditional business model used by utilities needed to change.

In the IoT architecture, a structure of multiple independent silos does not work. Whether it is called smart grid or IoT, the core elements have the same goal — consolidating network management into one system.

A recent ABB paper summed it up well: “The combination of rich data collection at the edge of the network and powerful analytics at the core deliver unprecedented visibility into network operation, simplifying management, improving operational efficiency and accelerating problem/resolution time. This holistic view enables utility operators to quickly pinpoint and address key health and lifecycle challenges that are major sources of inefficiency and risk.”

The IoT offers an enormous endeavor for businesses, so much so the Industrial Internet of Things (IIoT) has developed, which is specifically an industrial-based network that fits nicely with the IoTSP concept. IIoT is based on the same principles as IoT, but with more emphasis on machine learning and big data using different protocols and architectures.

So much interest has been generated in IIoT that the Industrial Internet Consortium (IIC) was formed with 19 working groups covering seven areas. IIC’s goal is to establish priorities, develop standards and processes, and test equipment. The membership reads like a who’s who of industry such as ABB, GE, AT&T, Cisco, IBM, Intel, Schneider Electric, Siemens, Mitsubishi, Itron, Hitachi, Toshiba and many others.

Accenture Technology published an interesting white paper a couple of years ago, “Driving Unconventional Growth through the Industrial Internet of Things.” The paper stated, “The Industrial Internet of Things is a major trend with significant implications for the global economy. It spans industries representing 62% of gross domestic product among G20 nations, according to Oxford Economics, including manufacturing, mining, agriculture, oil and gas, and utilities.”

That growth is getting a great deal of attention. The World Economic Forum reported, “The Industrial Internet has also attracted increasing levels of venture capital, with an estimated US$1.5 billion in 2014. Unlike in other technology sectors, venture capital funding for the Industrial Internet comes primarily from large corporate venture funds, such as GE Ventures, Siemens Venture Capital, Cisco Investments, Qualcomm Ventures and Intel Capital.”

Utility Internet of Things

Where it really gets interesting for the electric utility industry is in the offshoot of IIoT being referred to as Utility Internet of Things (UIoT). A GE report published in 2015, “Powering the Future,” stated, “The convergence of digital and physical innovations, together with advances in energy technologies, has begun to impact the industry.”

UIoT is being discussed as cross-functional applications layered on top of connected electrical apparatus to manage and deliver electricity. UIoT takes interconnectivity to a different level. Some say it is a bridge between information technology (IT) and operational technology (OT) that links the utility’s control center and back-office systems with the customer’s assets, sort of an asset-management system on steroids.

The industry is caught up in an expanding deployment of connected smart assets that are interacting with the generation, transmission and distribution components of the grid. Also coming into play are distributed generation assets such as solar, wind and electric vehicles. As a result, utilities are forced to deal with asset management of existing and emerging assets.

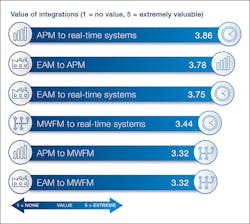

ABB, Microsoft and Zpryme published a study, “Bridging IT and OT for the Connected Asset Lifecycle Management Era,” in which they interviewed 221 utilities from around the world. The breakdown was 63% from North America, 11% from Europe, 11% from Asia-Pacific, 8% from the Middle East and Africa, and 7% from Central and South America. The study had some attention-grabbing findings.

Nearly everyone surveyed said asset management was a priority for them. About 55% of the respondents had seen an increase in the importance of asset management over the past 12 months to their organization. Approximately 45% said IT-OT integration for asset management was extremely valuable. More than 50% said they felt IoT was influential in asset management, but only 22% had an IoT strategy in place at their business. With findings such as these, it is not out of the question to draw the conclusion that UIoT will grow significantly as it is integrated into an interoperable grid.

It Is Happening

This intelligence is not only being talked about, but many organizations are upgrading their facilities and deploying ultramodern UIoT technology as grid modernization unfolds. The European Union (EU) actually began its exploration of grid modernization in 2011, when the European Commission proposed the GRID4EU project, a large-scale demonstration of distribution networks with distributed generation and active customer participation.

Six major European distribution system operators pooled their expertise along with 27 energy suppliers, manufacturers, system integrators, research centers and universities from EU taking part in the project and answered the commission’s proposal. These distribution system operators — CEZ Distribuce (Czech Republic), ENEL Distribuzione (Italy), ERDF (France), Iberdrola Distribucion (Spain), RWE (Germany) and Vattenfall Eldistribution (Sweden) — represent more than 50% of the metered electricity customers in Europe and have an enormous stake in how the grid will develop as more advanced smart grid technology is deployed.

Recently, the EU published the final report for GRID4EU, and the results were very satisfactory. The EU stated, “The scaling up and replication of the results obtained help contribute efficiently to reaching the EU 2030 energy targets.”

Another project with far-reaching results took place in California on the Pacific Gas and Electric Co. (PG&E) system. PG&E has placed three state-of-the-art electric distribution control centers into service to enhance and improve customer service. The first one was the Fresno facility commissioned in late 2014, followed by the Concord facility in mid-2015 and the Rocklin facility in early 2016.

According to PG&E, the centers are equipped with a new distribution management system that “incorporates advanced electronic mapping and SmartMeter data to help operators pinpoint the exact location of an outage. Operators also have the ability to remotely control equipment and work with automated ‘self-healing’ switches.”

PG&E also stated, “These smart switches automatically isolate outages and help reroute the flow of electricity to minimize the number of customers affected by an outage and restore others within minutes. To date, this self-healing technology has helped avoid more than 100 million customer outage minutes and saved more than 1 million customers from a sustained outage.”

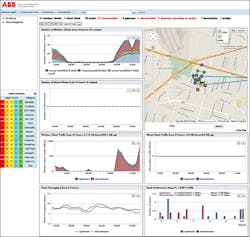

In 2015, CenterPoint Energy and the DOE completed a project designed to improve the reliability of the Houston, Texas, power network by deploying an advanced intelligent grid (IG) system. This system included ABB’s enterprise software solutions — comprising an advanced distribution management system (ADMS) integrated with a mobile workforce management system and an advanced outage analytics package — tying the systems together.

According to a press release from the project, “The IG is designed to improve service to the utility’s 2.3 million metered customers, and includes installation of 31 substations and 771 intelligent grid-switching devices on 188 distribution circuits, making this deployment one of the world’s largest ADMS systems in operation. Leveraging the ADMS software from ABB, this intelligent ‘self-healing’ grid can more quickly identify, isolate and restore power outage locations. Since 2011, it has helped customers avoid more than 100 million outage minutes.”

The Internet of Everything

The grid of the future is a different grid from anything seen before. It is dynamic and ubiquitous, and the seeds of that future were planted several years ago (see “Our Ubiquitous, Dynamic Grid,” T&D World, December 2013). The UIoT is certainly making the smart grid smarter. It is reliable, cleaner, more prosumer friendly, robust and totally changing the B2C environment. There is a convergence of digital technology and the physical world. It may be called M2M, smart grid, IoT or UIoT; it really does not matter what it is called.

The Internet of Everything is shaking up the electricity grid and the power industry. Almost every device in the substation is self-monitoring. Sensors and monitors have been embedded in the transmission lines carrying the power. Distribution circuits have smart components monitoring every function and waiting to isolate any faults to minimize disruption of service. Customers have generation on their side of the smart meter along with their own intelligent devices to improve consumption. Now all that must be done is to make it converge correctly.

About the Author

Gene Wolf

Technical Editor

Gene Wolf has been designing and building substations and other high technology facilities for over 32 years. He received his BSEE from Wichita State University. He received his MSEE from New Mexico State University. He is a registered professional engineer in the states of California and New Mexico. He started his career as a substation engineer for Kansas Gas and Electric, retired as the Principal Engineer of Stations for Public Service Company of New Mexico recently, and founded Lone Wolf Engineering, LLC an engineering consulting company.

Gene is widely recognized as a technical leader in the electric power industry. Gene is a fellow of the IEEE. He is the former Chairman of the IEEE PES T&D Committee. He has held the position of the Chairman of the HVDC & FACTS Subcommittee and membership in many T&D working groups. Gene is also active in renewable energy. He sponsored the formation of the “Integration of Renewable Energy into the Transmission & Distribution Grids” subcommittee and the “Intelligent Grid Transmission and Distribution” subcommittee within the Transmission and Distribution committee.