As extreme weather events increase in frequency and severity, utilities are faced with addressing more power outages. Grid infrastructure upgrades, such as microgrids, provide a needed option for improving resilience. Utilities such as American Electric Power (AEP), and FirstEnergy, two of West Virginia’s largest investor-owned utilities, and the West Virginia Power Association, are looking to microgrids as a means of improving resilience following outages.

“We view microgrids as another potential tool for electric companies to consider when discussing resiliency," said Hannah Catlett with FirstEnergy.

Recently the West Virginia Office of Energy commissioned the Smart Electric Power Alliance (SEPA) to study the potential for microgrids to strengthen resilience in West Virginia.

The comprehensive study explores how electric utility company planners can identify microgrid deployment scenarios, such as front-of-the-meter microgrids and behind-the-meter critical facility microgrids. It also details how electric utility companies can initiate customer-sited generation and storage partnerships and programs.

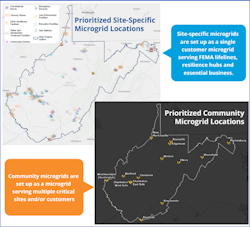

Geospatial analysis and mapping were used to tell the story of West Virginia’s microgrid opportunities within communities with grid resilience and reliability needs. In this context, grid needs are based on factors such as critical infrastructure and natural hazard risks, energy equity and environmental justice, and utility planning and operations.

Prioritize Locations for Resilience Investments (Site Specific Microgrids). We selected the highest scoring critical facilities based on GIS suitability criteria and metrics for scoping and further analysis (e.g., preliminary sizing and cost analysis).

Prioritize Locations for Resilience Investments (Community Microgrids) The team performed a point cluster analysis to determine clusters of at least two prioritized critical facilities (from steps one to six) within a half mile radius that could form a potential community microgrid resilience solution.

Prioritize Locations for Resilience Investments (Census Tracts). Based on the GIS microgrid suitability criteria and metrics, SEPA assigned each census tract to a tier of resilience needs.

Develop Interactive Maps. SEPA compiled and cleaned publicly available GIS data to develop interactive mapping tools and story maps for stakeholders to utilize when planning for resilience. Direct uses may include pulling information to justify investments and grant funding.

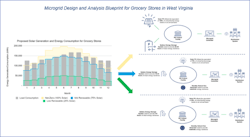

The study not only identifies sites and communities in need of resilience investment, it also provides a project blueprint for electric utility companies and their customers for how to design, size, and cost projects.

Load and reliability data were gathered by engaging with AEP and FirstEnergy who are both exploring resilience solutions, such as company-owned microgrids. Other stakeholders participating in the study’s working group to inform the project blueprints were West Virginia Emergency Management Division, PJM, Sierra Club West Virginia Chapter, Consumer Advocate Division West Virginia, West Virginia Public Service Commission, and the West Virginia Association of Counties.

FirstEnergy's Catlett said, “To determine whether a microgrid may be a viable option in a certain area, it is important for us to understand the needs of that community and start discussions early.”

Resilience Investments, Regulatory Implications and Microgrid Consideration

Resilience investments, such as microgrids, can have affordability, safety, and reliability consequences when not planned and coordinated properly. It is essential to work hand and hand with the electric utilities and key stakeholders to find resilience solutions that support the clean energy transition. While our West Virginia study lays out a microgrid-specific deployment strategy, there are many other tools available for utilities and customers to deploy for grid enhanced resilience that often can provide enhanced benefits at lower costs. These options must be weighed against other resilience investments, such as undergrounding and grid hardening. Leveraging state and federal funds, and seeking regulatory approval for any other required funds can push microgrid plans forward.

Summary and Next Steps

AEP is interested in exploring microgrid concepts to provide customer-level and distribution system benefits. They are still evaluating the study results to better understand and align identified system needs with appropriate solutions.

FirstEnergy continues to research and evaluate microgrids as a tool for consideration and their potential role in future scenarios. FirstEnergy is also supportive of T&D investment opportunities to modernize the grid to support enhanced reliability and resilience efforts.

West Virginia Office of Energy is utilizing the SEPA study as a resource for resilience improvement projects

- U.S. DOE Grid Resilience and Innovation Partnership (GRIP) Topic Area 3: Grid Innovation Programs, “Energy Storage as a Resiliency Asset,”

- State-led activities under the Infrastructure Investment and Jobs Act section 40101 (d)

- West Virginia’s State Energy Security Plan to establish the feasibility of microgrid solutions to mitigate the risk of energy supply disruptions

Based on the experience in West Virginia, authors of the study offers the following recommendations to stakeholders embarking on enhanced grid reliability and resilience planning

- Discuss how resilience, equity, and carbon free energy drivers impact your state or utility emergency preparedness and electricity infrastructure plans.

- Overlay grid infrastructure data with hazard and energy equity data.

- Identify areas and specific facilities that would get the most value from resilience and reliability investments.

- Evaluate microgrids against other resilience solutions to compare the benefits and costs of all potential investments.

- Leverage state and federal funding to support grid and customer investments.

Momentum is building for new microgrid resilience projects due to a variety of funding streams available through Department of Energy grant programs like Renewables Advancing Community Energy Resilience (RACER), Grid Resilience and Innovation Partnership (GRIP), and Energy Improvements in Rural or Remote Areas. There are also bonus tax credits under the Inflation Reduction Act. Stakeholders can follow West Virginia’s lead by using resilience and equity data to successfully deploy resilience investments in the areas where they are needed most

Jared Leader is the senior director of Resilience at Smart Electric Power Alliance. In his role, Leader develops strategic plans for programs, products, and procurement for utility and industry stakeholder members and clients that facilitate the integration of renewable energy onto the modern grid. Prior to joining SEPA, he spent several years working as an environmental engineer and consultant for utility, municipal and commercial clients in the energy and water sectors. Leader has a MS, Energy Policy and Climate from Johns Hopkins University, and a BS in Civil and Environmental Engineering from the University of Virginia. In 2021, he was recognized by PUF's Fortnightly Under Forty list of energy and utility professionals

About the Author

Jared Leader

Jared joined SEPA in 2017. In his role, he develops strategic plans for programs, products, and service offerings for utility and industry stakeholder members and clients that facilitate the integration of distributed energy resources, non-wires alternatives and microgrids onto the modern grid. Jared leads SEPA’s Microgrids Working Group and co-led D.C. Public Service Commission’s grid modernisation working groups. Prior to joining SEPA, he spent several years working as an environmental engineer and consultant for utility, municipal and commercial clients in the energy and water sectors. He has a MS, Energy Policy and Climate from Johns Hopkins University, and a BS in Civil and Environmental Engineering from the University of Virginia. Outside of business hours, Jared enjoys skiing, hiking and spending time in the great outdoors.