KEPCO Plans Extensive Asset Replacement Work

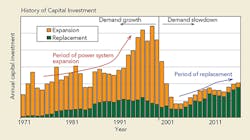

During the second half of the 20th century, electricity demand in Japan increased in line with its high economic growth. The country made a huge investment in extending its power system, but then the economy collapsed in the 1990s. Since then, the increase in power demand has slumped and the number of aged facilities has increased year over year.

Now the Kansai Electric Power Co. (KEPCO) is facing an enormous volume of asset replacement work. The utility has introduced an efficient way to optimize its long-term asset replacement plan through a controlled capital investment.

Asset Management Methodology

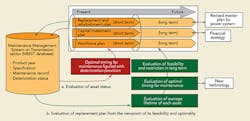

KEPCO introduced a new methodology for asset management into its maintenance operation in 2000. The methodology manages the status of aged assets and maintenance work to optimize the program of replacement and refurbishment work with a long-term view, formulating the most effective strategy for mid- and long-term capital investment.

This asset management scheme aims to accomplish three key objectives:

- Establish a replacement plan before the degradation level of aged facilities becomes fatal by managing their status of deterioration. This will ensure system reliability is maintained.

- Ensure the planned outages and the availability of skilled workers are compatible and satisfy the requirements for executing the long-term annual plan of replacement and refurbishment work. This planned mass replacement and refurbishment of assets provides an opportunity to rationalize the entire transmission system from the perspective of supply reliability, investment efficiency and ease of maintenance.

- Control the level of capital investment spent over the long-term planned replacement of aged assets. This is required to prevent the need for rearranging the annual investment, which has an influence on transmission tariffs.

The Right System

To realize the asset management objectives, the utility needed to develop an efficient system to provide asset status data. However, in view of the large number of transmission system assets, KEPCO identified several conventional practices that had a negative impact on its efficiency:

- There was a lack of data sharing among its power system facilities.

- Multiple manual procedures were required to link different kinds of data or deal with affiliate companies.

- Layout drawings and design documents were retained in paper files.

To solve these problems, KEPCO developed an information technology system known as the Maintenance Management System on Transmission sector (MMST) in 2004. All information related to asset management is entered in MMST with the following features:

- Enables the digitization of all maintenance information and unifies its management in the system

- Ability to complete a plan-do-check-action cycle of maintenance management in a single system

- Provides a data connection with KEPCO’s affiliated maintenance company

- Designed to minimize additional tasks

- Facilitates multidimensional analysis and evaluation of the utility’s maintenance data recorded in the system.

MMST has resolved almost all of the problems related to workload management, and the system makes it possible to complete the plan-do-check-action cycle for short-term asset management in one system.

The long-term planning process considers asset management in two cycles. Firstly, the timing of replacement and refurbishment work for each aged asset is optimized by analyzing various data stored in MMST. This results in the creation of an optimal short-term plan for replacement work and capital investment. Secondly, the average lifetime and optimal timing for maintenance of each kind of asset can be evaluated statistically by analyzing the large quantity of data stored in MMST.

Subsequently, the amount of replacement work required annually can be foreseen by considering the average lifetime of each asset. The long-range capital investment also can be determined from the average cost of replacement and refurbishment work as well as the volume of work to be executed. Given these results, as well as the other restrictions linked to the planned outage and shortage of skilled workers, a long-range plan for replacement can be established. The long-range capital investment plan then can be optimized by revising these plans. With this asset management methodology, KEPCO revises its long-term plan for capital investment on an annual basis. Overall, since the introduction of MMST, the utility has experienced dramatic improvements in asset management efficiencies.

The Process and Results

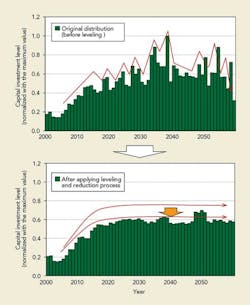

The long-term capital investment distribution can be predetermined by applying the average asset replacement cost for each type of asset. As the age distribution of assets is not linear, the annual capital investment will vary in future years depending on the assumed average lives.

Next, the leveling off process is applied by considering the total volume of assets coupled with any other restrictions. To realize a flat workload and investment distribution, the annual volume of replacement work can be reallocated. This means some facilities are expected to be used beyond their average lifetime. The actual replacement of an asset is determined by analyzing the condition of the asset to ensure it is replaced before the deterioration level becomes critical.

A Few Examples

The average lifetime of an asset can be revised by applying knowledge obtained from the analysis of deteriorating properties of aged assets that have been removed. For example, the average lifetime of a 154/77-kV transformer in KEPCO’s long-term investment plan has been revised from 45 years to 60 years after analyzing the extent of deterioration identified in transformers removed from the system.

The average cost of replacement and refurbishment work is determined based on the track record of similar work executed. Also, the cost is reviewed from the perspective of feasible minimum cost. For example, the average replacement cost of a 77/6.6-kV transformer was reduced by US$40,000 per unit, and that of transmission line protection relay results in the reduction of $200,000 per year. (Costs are estimated based on the exchange rate of 100 Japanese Yen per U.S. dollar.)

By applying this reduction process, the average level of annual investment has been reduced by about 2.5%. Furthermore, the long-term depreciation cost shows the gradual decrease and leveling off produce a soft landing, removing the likelihood of revising transmission tariffs in the future.

Application of the Methodology

The application of the asset management methodology results in the optimization of each replacement project the utility completes. Transmission system configuration can be optimized from the perspective of supply reliability, investment efficiency and the ease of maintenance. For example, by considering the long-term plan for transformer replacement, the number and capacity of transformers are rationed across a wide area when refurbishment is deemed necessary. This has resulted in improved supply reliability and a reduction in substation maintenance with minimal cost.

Underground cable replacement can be optimized from the perspective of effective use of underground conduits. By establishing a long-term replacement plan for the underground cables in a specific area, the replacement and reinforcement plan for underground conduit also is optimized to consider the most effective way to use existing conduits. This results in lower costs for new conduits. This process also is useful when considering the undergrounding of overhead transmission lines in urban areas.

The large-scale overhead transmission line replacement plan can be optimized with the objective of leveling the workforce requirements and the annual investment required to accomplish the plan. By deciding on the replacement priority for each transmission tower, the need for replacing the complete transmission line can be identified and the replacement can be conducted in a timely manner. This process levels out the workload for the well-skilled workforce and the annual investment for the duration of the replacement plan.

Controlled Investment

As the increase in peak system demand declines, KEPCO’s transmission system facilities continue to age year over year, increasing the need for refurbishment work to be performed annually. Given this situation, KEPCO anticipated the degradation of system reliability, difficulty in dealing with the massive volumes of replacement work and additional funding would be needed for refurbishment and replacement.

To prevent these problems, KEPCO implemented a new methodology for asset management into its maintenance operation. The utility’s entire maintenance program is managed to optimize the volume of replacement and refurbishment work by taking a long-term view as well as formulating the most effective strategy for mid- and long-term capital investment. To conduct this new methodology successfully, KEPCO introduced MMST.

Coordinating all the available asset management information in a single system has provided the utility a long-term capital investment level forecast, which can be leveled off based on certain perspectives. Furthermore, the average level of annual investment is reduced by analyzing the deterioration of removed assets.

With this asset management methodology, long-term investment is successfully controlled to prevent an increase in transmission tariffs in the future. In the era of mass replacement, KEPCO’s experience can serve as a reference for other utilities facing a similar large volume of replacement work in the future.

Naoto Fujioka has worked for Kansai Electric Power Co. for 23 years, mainly with regard to power system planning. He is temporarily assigned to work for the Organization for Cross-regional Coordination of Transmission Operators in Japan as a head manager of system planning. He holds a MSEE degree from Kyoto University, and is a member of the Institute of Electrical Engineers of Japan and CIGRE.

Akiji Matsuda is the general manager, Kyoto area power system office in Kansai Electric Power Co. He has worked for KEPCO for 17 years. He holds a MSEE degree from Nagoya University and is a member of the Institute of Electrical Engineers of Japan and CIGRE.

Yoshio Ogama is the assistant manager of a maintenance service office in Kansai Electric Power Co. He has 10 years of experience in the planning of transmission and bulk supply power systems. He holds a MSEE degree from Kyoto University and is a member of the CIGRE.