Wired for Growth: Unveiling Opportunities Amid Challenges in the US

- The United States is the leading distribution transformer market in the North American region, whereas globally, it is one of the largest markets.

- The recent bottleneck in the distribution transformer market can be attributed to the widespread deployment of renewable energy and investments in the replacement of aging electrical infrastructure.

- Keeping significant profit margin in mind many transformer OEMs have moved to not only expand but also install new transformer manufacturing facilities in the country.

Distribution transformers are installed globally to reduce the voltage in the distribution lines to a level that is acceptable for the consumer. The United States is the leading distribution transformer market in the North American region, whereas globally, it is one of the largest markets. Currently, the U.S. is unable to meet the consistently growing demand for distribution transformers due to supply chain constraints.

Historically, supply chain bottlenecks have affected the power transformer market more frequently than the distribution transformer market. The recent bottleneck in the distribution transformer market can be attributed to the widespread deployment of renewable energy and investments in the replacement of aging electrical infrastructure.

Rising pressure on the transformer supply chain due to increasing demand has become a matter of great concern for the stakeholders in the industry, which needs to be addressed.

U.S. Distribution Transformer Market Landscape

According to the Department of Energy, there are more than 60 million distribution transformers installed in the US grid, whereas the annual market indicates a stable trend with almost 1 million units to be added as a consequence of capacity additions and replacements in 2024. PTR estimates that the distribution transformer market in the US was valued at more than USD 5 billion in 2023.

Distribution Transformer Supply Chain: Pre- and Post-Covid

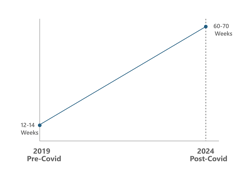

Around 2018, the majority of the distribution transformer customers, including utilities, were comfortable with the supply chain as they just had to issue a purchase order and were able to receive the transformer at their doorstep within 12-14 weeks. The OEMs (original equipment manufacturers) were able to cater to the demand even if the utility ordered a few hundred transformers.

As economies began to recover post-COVID, demand rose quicker than the US manufacturing base could meet. Soon, the country's manufacturing base reached its maximum output, but demand kept on rising. This not only increased lead times but also made them undependable.

Utilities didn’t realize that they were supposed to place orders in advance after assessing their future demand, whereas OEMs expected the demand to be short-lived, which is the reason why they didn’t expand the manufacturing base as required. At present, lead times have increased 5-6 times from 12-14 weeks to 60-70 weeks and, in some cases, up to two years.

New Production Facilities and Expansions in 2023

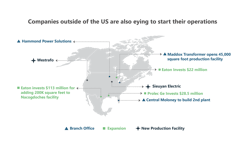

In 2023, OEMs have moved to build and expand transformer production facilities in the US. Maddox Transformer has opened a 45,000-square-foot transformer production facility. Hammond Power Solutions plans to open a transformer production facility, whereas Central Moloney plans to build its second plant in the US. Eaton and ProlecGE have invested nearly USD 165 million to enhance transformer production in the country. On the other hand, Westrafo and Sieuyan Electric have opened branch offices.

New production facilities and expansions in 2023

Looking Ahead

According to PTR, the prices of distribution transformers in the US have increased almost 4-5 times for the same product compared to other regions. This indicates a considerable profit margin for suppliers covering the US distribution transformer market. Keeping this in mind, many transformer OEMs have moved to not only expand but also install new transformer manufacturing facilities in the country.

Initially, the OEMs were skeptical that the rising demand for distribution transformers would not be able to sustain in the long run, but the recent developments on the supply side indicate that the OEMs have reached a conclusion that the demand will sustain itself.

About the Author

Azhar Fayyaz

Azhar Fayyaz

Senior Analyst - PTR Inc.

Azhar Fayyaz is a Market Analyst at PTR Inc. He is involved in projects on the power grid topics at Power Technology Research gathering data on the network structure of distribution utilities, estimating the installed base of T&D equipment, and analyzing the information to predict future market trends. As a market analyst at PTR, he performs competitive analyses of different companies operating in a region and determines their market share for a specific product. He also has more than 5 years of experience working as a senior shift engineer at Chashma Power Generation Station. Azhar comes from a technical background and has an M.Sc. in Power Engineering.