As electric utilities work hard to get the most out of every dollar they spend, they have a hard time justifying the addition of online monitoring equipment when the cost of maintenance and/or monitor replacement can be significant. For this reason, they need to be strategic about what monitoring is installed. They need a clear understanding of the lifetime costs of the monitoring versus the anticipated life of the asset, an understanding of the benefits the monitoring provides, and a knowledge of the accounting issues involved.

Research has shown that online monitoring can significantly extend the life of existing assets by alerting users to minor problems before they become major problems. In that sense, key parameters should be measured on every major asset to ensure proper operation. Think of this as a warning light in a car's dashboard — if the light comes on, it's important to understand why the light is on and what needs to be done to correct the issue.

Transformer Monitoring Solutions

Over the last 100 years, transformer owners have come to rely heavily on the data received from manual oil samples taken annually. By looking at dielectric strength, color, moisture content, gases in the oil, and other properties, these tests offer a snapshot of the transformer's health at the time the sample was taken. This is much like a doctor asking a patient to get a routine blood panel during an annual physical. The doctor uses this data to recommend corrective actions. In the same way, engineers use transformer oil sample data to let them know if the transformer has an issue that needs to be addressed.

Ideally, transformer owners would have real-time access to all the critical parameters that can be monitored on their transformers. Unfortunately, the costs and complexity of those monitoring solutions are typically hard to justify because of the high reliability of transformers versus the cost of the monitoring. Many transformer owners feel that because the failure rate of transformers is typically only 1% to 3% per year, there are better places to allocate budget. This ideology works well until a transformer failure causes major disruption and expense.

Historically, utilities think of power transformers as a 30-year asset. While that assumption may have been true in the past, it is not clear that utilities can continue to expect that kind of performance going forward. This is because newer transformers are significantly smaller, yet have the same or higher power ratings than previous transformer generations. This begs the question of how a transformer that is half the size can have the same or higher rating as the one that was just replaced after 40 years?

Transformer Designs

In order to understand this, let's explore how transformers are designed today versus 40 years ago. Improvements in computer modeling, better materials, and another 40 years of experience have allowed transformer designers to significantly reduce the size of transformers. Although these factors have contributed to more efficient designs, global competition has been the real driving factor forcing manufacturers to drive out costs to become more competitive to stay in business.

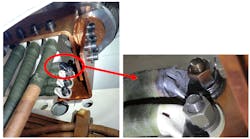

In order to compete, transformer manufacturers need to reduce costs. This means reducing the amount of materials like copper, steel, paper, oil, and components such as temperature gauges and pressure relief devices. It also means that manufacturers must pay significantly more detail to how each transformer is built. A small issue like a nick in a conductor, torn paper, or a loose connection may not have caused a problem 50 years ago because there was much more margin built into each transformer. Today, those minor problems can cause major issues such as overheating, partial discharge, and so forth.

Utility Transformer Management

Utility asset managers have slowly adopted certain monitoring over time. When almost every transformer has temperature gauges and oil level indicators, it is easy to see why the first electronic monitors provided the ability for utilities to monitor those items remotely with their supervisory control and data acquisition (SCADA) systems. While this data is important, it does not necessarily warn the owner of an imminent failure.

As monitoring systems evolved, online dissolved gas analyzers (DGA) became commonplace 10 to 20 years ago, with most utilities placing DGA monitors on critical transformers. As more DGA monitors became available, there was much excitement in the industry about the idea that transformer owners could monitor all the critical gases in real time. While this capability provides valuable information, it comes at a cost. The installed cost of most online 8 to 10 gas monitors is in the US$60,000 to US$80,000 range.

Most of those monitors will require significant maintenance within four to eight years after installation and every four to eight years after that. Therefore, the maintenance costs of multi-gas monitors have become a major issue for utilities who want the data, but do not have the maintenance budget available to keep the monitors running. For utilities with large transformer fleets, they have had to significantly limit the number of installations because of the high installation and maintenance costs.

Because of the high cost of multi-gas monitoring, it is reasonable to speculate that less than 1% of utility power transformers have working multi-gas monitors installed. Since maintenance budget is limited, many utilities simply do not have the maintenance budgets to maintain their multi-gas monitors. This begs the question, "If a utility is only monitoring 1% of its transformers and the transformer failure rate is between 1% and 3% per year, what is the likelihood a utility will catch a transformer failure with an online monitor?"

Benefits of Hydrogen Monitoring

For asset managers, the big question is: "If I'm managing a fleet of power transformers, what's the best way to accurately predict which ones will be next to fail?" Since most transformer experts agree that DGA analysis is the best answer, how can utilities effectively monitor real-time DGA on a fleet of hundreds or thousands of transformers? The short answer is hydrogen monitors.

Hydrogen is a key gas that is generated when significant issues like overheating, partial discharge, and arcing occur in transformers. While some of these issues might persist for weeks, months, or years, these issues can also lead to failure in minutes, hours, or days. Annual oil samples are not frequent enough to catch fast-evolving transformer faults.

Hydrogen monitors have proven to be effective in warning transformer owners of significant issues for more than 30 years. These monitors typically update every hour to every second. The good news is that today there are maintenance-free hydrogen monitors available that use solid-state sensors with no need for maintenance or calibration for more than 10 years. The other great benefit of these monitors is that they typically cost between US$5000 to US$8000 for base models.

Utility Accounting

As solid-state components drive down monitoring costs, it is easier to justify adding monitors to smaller and smaller transformers. Most utilities have standardized on certain hydrogen monitors for certain classes of new transformers. On new transformers, the cost of the monitor is included as part of the transformer, so it is easy to justify. Installing large-scale retrofits on an existing transformer fleet is a much more difficult proposition.

In general, utilities are incented to spend capital because they earn a rate of return on their capital investment. On the other hand, they typically do not earn a rate of return on maintenance dollars spent, so dollars spent on maintenance simply reduces their earnings per share. Various accounting rules have not previously allowed utilities to earn a rate of return on low-cost asset monitors.

Since these rules have detracted from overall electric reliability, progressive utilities have changed their practices to allow online monitors to be a separate item of property. This not only allows utilities to capitalize the initial cost of online monitor installations, it also allows them to account for this equipment as a capital expense when they purchase replacement monitors when old monitors fail. Therefore, they are able to continually monitor their most critical assets over the complete asset life without spending significant maintenance dollars that detract from their earnings per share.

Since accounting rules for low-cost online monitors are changing, utilities can pursue wide-scale use of these monitors. Instead of installing 5 to 10 multi-gas monitors per year, they can spend the same amount of money and prioritize the transformers in their fleet to determine the best candidates for deployment of 50 to 100 hydrogen monitors per year. With this strategy, they are much more likely to start improving their reliability numbers by proactively maintaining or replacing transformers that are experiencing significant problems. This works well in condition-based monitoring programs where limited resources can focus on the assets that are most likely to cause problems in the near future.

Today, utility asset managers have the benefit of low-cost online hydrogen monitors that can warn of significant transformer issues. As monitor prices come down and accounting rules allow for cost recovery of these solutions, asset managers now have the tools they need to look at how long it will take to monitor their entire fleet of transformers. In addition, maintenance engineers can have peace of mind knowing that these monitors will require little to no maintenance over the life of the monitor. Solid-state hydrogen monitors can be a significant tool to help asset managers improve overall electric system reliability.