PG&E Diversifies Vegetation Management

With an expansive and varied service area — more than half of which is designated by the state of California as having an elevated wildfire risk — Pacific Gas and Electric Co. (PG&E) is in the process of confronting one of the most significant vegetation management challenges in the U.S. The utility inspects approximately 100,000 miles (160,934 km) of overhead power lines every year, with some locations patrolled multiple times a year. It also prunes or removes more than 1 million trees annually to maintain clearance from power lines. While PG&E currently deploys massive field teams to keep utility assets clear of vegetation, brute force is not sufficient to scalably address the threat of vegetation-caused outages and fire ignitions.

PG&E has determined that innovation in its vegetation management practices is a key pathway to continue to reduce the likelihood and severity of wildfires. The utility has built a diversified portfolio of initiatives to pilot and deploy technology to clear its lines, harden its assets and protect its customers.

Innovation Investment Philosophy

Traditionally, the results of a person-hour of vegetation management effort are relatively well-known, with X miles of line cleared in Z hours depending on the terrain. While PG&E continues its expanded and enhanced vegetation safety work to address vegetation that poses a higher potential for wildfire risk in high fire-threat areas, it also continues to explore ways to increase the risk-adjusted efficiency of spend. If commercialized and deployed at scale, which technologies could have a significantly higher return on investment, even if those technologies are not yet fully proven?

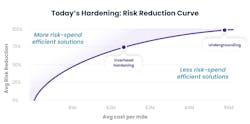

PG&E uses a metric of risk-spend efficiency to evaluate a project’s investment worthiness throughout its business. The goal is to reduce the most amount of risk (in this case, wildfire-related risk) relative to the cost of the program. Risk-spend efficiency is technically calculated as: (the Net Present Value of Pre-Mitigation Risk Scores less the Net Present Value of Post-Mitigation Risk Scores) over the Net Present Value of Program Costs. If you think of this as a 2x2 of risk reduction vs. spend, the goal — which perhaps seems obvious — is to work toward a world of low spend and high-risk reduction, which would enable the system to be protected at the lowest cost to customers.

But, in innovation, there is a third important dimension: certainty. Particularly for technologies with an earlier technology readiness level (TRL) or commercial readiness level, risk reduction and cost cannot always be calculated with the same precision used to evaluate well-understood utility assets or projects. Moonshot, or innovative, projects with potential to meaningfully decrease risk at the lowest long-term cost come with technology risk, execution risk and — particularly in the case of a regulated utility — political risk.

An Innovation Portfolio

Early-stage venture capital (VC) firms can take big risks to find new breakthrough solutions, investing in many higher upside and earlier-stage companies hoping that (at least) one will become a unicorn capable of providing the desired return for the entire fund. Regulated utilities have a different dynamic in seeking meaningful innovation. They cannot accept the frequency of failure of the VC sector, if such failure would in practical terms mean material safety or reliability risk. Utilities also must be able to assure customers and regulators of responsible stewardship of customer funds, in the context where success of a given innovation or technology is not assured.

Yet improvement beyond incremental change requires extension beyond business as usual. For a utility to balance potentially contradictory objectives, it can seek out best opportunities from disparate channels that could both provide upside exposure and allow for downside risk mitigation. The process of building this diversified innovation portfolio must be disciplined to ensure the responsible use of regulated funds.

PG&E has pursued different innovation pathways to find the right mix of upside exposure, downside mitigation and potential for disciplined innovation. Considered as a portfolio, the goal is to position the utility for a future in which the cost of reducing wildfire risk is significantly lower than it is today. Following are three examples from PG&E’s diverse wildfire mitigation portfolio. The first example focuses on direct vegetation management (for example, trimming trees and removing small-diameter wood). However, it will still be impossible to prevent an extreme wind gust from blowing a tree branch into a set of wires. The other two examples highlight supporting technologies that can reduce the risk of wildfire ignition when best efforts at tree trimming cannot prevent contact between vegetation and utility infrastructure.

Direct Vegetation Management

Because commercially available solutions had not yet solved critical vegetation management challenges for PG&E, the utility partnered with ADL Ventures, an energy and innovation consultancy, to launch a Woody Biomass Challenge to solicit solutions from the entrepreneurial community. Rather than evaluating the existing start-ups that happened to cross its desk, PG&E began with the problem statement.

PG&E and ADL defined three key challenges that, if solved, could meaningfully decrease the likelihood and severity of wildfires. Given that 15 million acres (6 million hectares) of California forest require some degree of restoration, the nurturing of market forces to cost-effectively clear small-diameter wood from the forest could prove pivotal, not just for PG&E but for the entire state of California. The following three challenges were posted to ADL’s U.S. Department of Energy-funded open innovation platform, ProblemSpace:

- Next-generation biomass collection technologies

- Next-generation densification and transportation technologies

- Market expansions for woody biomass projects.

While PG&E showed leadership in putting the Woody Biomass Challenge forward, it recognized this was a systems problem that would require multiple stakeholders to work collaboratively. Project leaders gathered dozens of thought leaders with diverse perspectives to collaborate on this challenge. Participants included multiple client utility divisions, the U.S. Forest Service, the U.S. Endowment, Center for the Study of Force Majeure, American Forest Foundation, Joint Institute for Wood Products Innovation and the UC Davis California Biomass Collaborative.

After a down-selection process from more than 100 submissions to eight finalists, seven finalists were asked to move forward with pilot research and development projects, market validation tests or customer discovery. Some of the companies emerging from the challenge with potential for PG&E testing, demonstration or other support were as follows:

Takachar, a start-up out of MIT that employs a process known as oxygen-lean torrefaction to enable small-scale, portable biomass conversion to multiple products, such as biochar. Uniquely, Takachar can decrease transportation and logistics costs by converting fuel closer to the forest without fire risk.

Forest Concepts, a company established by seasoned entrepreneurs that creates a product for biomass baling that minimizes labor and transportation cost relative to traditional chipping and grinding methods.

Allotrope Partners and its partner Axens are working together to convert a retired sawmill to convert non-merchantable wood into higher-value products such as 2G ethanol and renewable natural gas. The partnership with PG&E could yield a virtuous cycle by converting non-commercial wood from the utility’s vegetation management activities into products such as renewable natural gas that could be used to cleanly heat the homes of PG&E’s gas customers.

Asset Management Software

Investments in new capabilities that can accelerate the learning benefits of existing procedures or enable managing more vegetation with the same human resources essentially act as compound interest investments as opposed to simple dividend payments. In other words, investments in productivity increases give exponential returns, whereas traditional investments in simple labor deployment give simple linear dividends. Some examples of these compound interest investments are field mobility management software, autonomous vegetation equipment and inspection solutions — or any technology that enables the utility to use existing labor resources to manage more line-miles or actively prevent, rather than react to, vegetation encroachment.

PG&E’s electric accounts span a uniquely complex territory that poses serious challenges for record keeping and maintenance. Vegetation management is critical to ensuring the safety of PG&E’s customers, but so, too, is the inspection and repair of all PG&E T&D assets.

Around 2016, the utility embarked on an effort to digitize its field operations with three primary goals:

- Harden its assets

- Reduce operating expenses

- Improve and simplify regulatory compliance.

An asset management platform, called Asset360, was developed with tens of millions of dollars in R&D investment and has been deployed in the field for five years. After working with ADL Ventures to monetize innovation that can get stuck, so to speak, within the utility, PG&E’s field mobility software has been expanded to a suite of applications being licensed by FieldNav.

Because the product was designed side by side with users, it has had high user adoption and internal stakeholder support. Assets are tracked in real time, significantly reducing the risk of noncompliance from paper maps and paper records. While this solution has been valuable for ongoing inspection, compliance and repair work, and identifying and correcting vegetation management issues, Asset360’s value to PG&E has been magnified in times of natural disaster recovery, particularly during wildfires.

Field service crews, supervisors and administrators alike can complete and document their field work within one single application with in-app mapping features. It takes only minutes to provision new field crews — including third-party contractors — making it easy to ramp surge capacity when inspection and repair requirements peak.

Ignition Prevention

The work to reduce the likelihood of wildfires caused by utility infrastructure is ongoing. In addition to vegetation management, PG&E works tirelessly to harden its system such that it is either impossible for it to ignite a wildfire because distribution lines are underground or T&D wires are sufficiently hardened against phase-to-phase contact.

PG&E again leveraged ADL Ventures’ Department of Energy-funded ProblemSpace platform to identify solutions with greater risk-spend efficiency than its current hardening methods, undergrounding and overhead hardening. The Wildfire Ignition Prevention Challenge accepted applications through Q1 of 2021. Announcements may be forthcoming regarding collaborations that can help PG&E to solve many challenges, including better real-time detection of faults and the prevention of arcing and sparking along T&D infrastructure.

How to Innovate And Protect

These are but three examples of PG&E’s innovation portfolio to reduce the likelihood and severity of wildfires. While not every single innovation measure will yield clear success, the diversification could improve the utility’s ability to reduce wildfire risk at the lower cost to customers.

In PG&E’s context, innovation is not a nice to have but a must have. Even if existing vegetation management and hardening practices were leveraging the best technology the future has to offer, it could take years and even decades to clear all vegetation around lines and fully harden the grid.

If utilities can find market-based approaches to clear small-diameter wood from the forest and novel ways to monitor and mitigate the grid for faults, it could make the work of wildfire prevention less Sisyphean.

Kevin Johnson is a principal at PG&E in its Energy Strategy & Innovation division, where he has a particular focus on keeping the carbon in California’s forest sequestered in trees rather than released into the atmosphere. Johnson received his bachelor’s degree in international development and political science from UCLA and an MBA degree from Dartmouth Tuck School of Business.

Chris Richardson is a partner at ADL Ventures and leads its Energy & Utilities practice. A serial entrepreneur, Richardson previously worked in energy and transportation strategy consulting and helped to launch the product marketing function at EnerNOC (now Enel X), where he was responsible for demand response and energy supply procurement. He has an undergraduate degree from Northwestern University and an MBA degree (with honors) from the University of Chicago Booth School of Business.

For More Information

FieldNav | https://fieldnav.io

Takachar | www.takachar.com

Forest Concepts | https://forestconcepts.com

Allotrope Partners | www.allotropepartners.com

ADL Ventures | adlventures.com

ProblemSpace | problemspace.io

About the Author

Kevin Johnson

Kevin Johnson ([email protected]) is a principal at PG&E in its Energy Strategy & Innovation division, where he has a particular focus on keeping the carbon in California’s forest sequestered in trees rather than released into the atmosphere. Johnson received his bachelor’s degree in international development and political science from UCLA and an MBA degree from Dartmouth College.

Chris Richardson

Chris Richardson ([email protected]) wears a CMO hat with ADL Ventures and leads its Energy & Utilities practice. A serial entrepreneur, Richardson previously worked in energy and transportation strategy consulting and helped to launch the product marketing function at EnerNOC (now Enel X), where he was responsible for demand response and energy supply procurement. He has an undergraduate degree from Northwestern University and an MBA degree (with honors) from the University of Chicago Booth School of Business.